Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

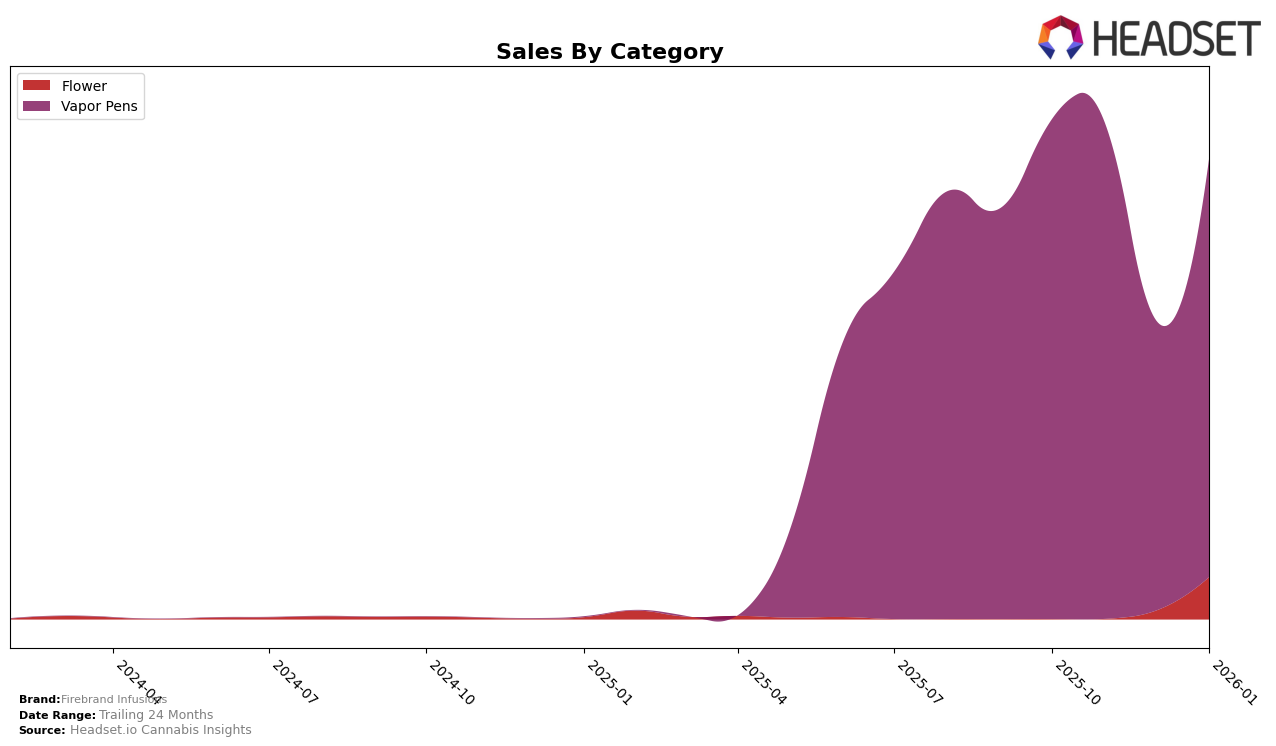

Firebrand Infusions has shown varied performance across different product categories and states. In the state of Ohio, the brand did not make it into the top 30 for the Flower category from October 2025 to January 2026, which suggests a need for strategic improvements in that area. However, the Vapor Pens category tells a different story, where Firebrand Infusions maintained a strong presence. Although they experienced a dip in December 2025, falling to the 26th rank, they managed to recover to the 20th position by January 2026. This indicates a resilient market presence and the potential for further growth in this category.

Overall, Firebrand Infusions' sales trends in Ohio reveal some interesting dynamics. Despite the absence from the top 30 in the Flower category, their Vapor Pens category has been a consistent performer, with sales figures reflecting a recovery towards the end of the period. This suggests that while the brand faces challenges in certain areas, they have a strong foothold in others, particularly in the Vapor Pens market. Such insights could be pivotal for stakeholders looking to understand the brand's strategic positioning and potential areas for growth.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, Firebrand Infusions experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 19th, Firebrand Infusions saw a dip in December 2025, falling out of the top 20, before recovering to 20th place in January 2026. This temporary decline coincided with a significant drop in sales during December, suggesting potential challenges in maintaining market share. Meanwhile, competitors like King City Gardens and Woodward Fine Cannabis maintained a steady upward trajectory, with King City Gardens improving its rank from 20th to 18th and Woodward Fine Cannabis climbing from 22nd to 19th. HillFire also showed volatility, peaking at 17th in December before dropping to 22nd in January. These dynamics highlight the competitive pressures Firebrand Infusions faces, emphasizing the need for strategic adjustments to regain and sustain its market position.

Notable Products

In January 2026, the top-performing product for Firebrand Infusions was the Durban Poison Distillate Cartridge (1g) in the Vapor Pens category, climbing to the number one rank with sales of $2,336. The Tiger's Blood Distillate Cartridge (1g) also performed well, securing the second position, an improvement from the previous month. GG #4 Distillate Cartridge (1g) held the third rank, showing a positive shift from its fifth-place standing in the prior two months. The Blueberry Banana Pancakes Distillate Cartridge (1g) made its debut in the rankings, capturing the fourth position. Meanwhile, the Pink Guava Distillate Cartridge (1g) dropped to fifth place after leading in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.