Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

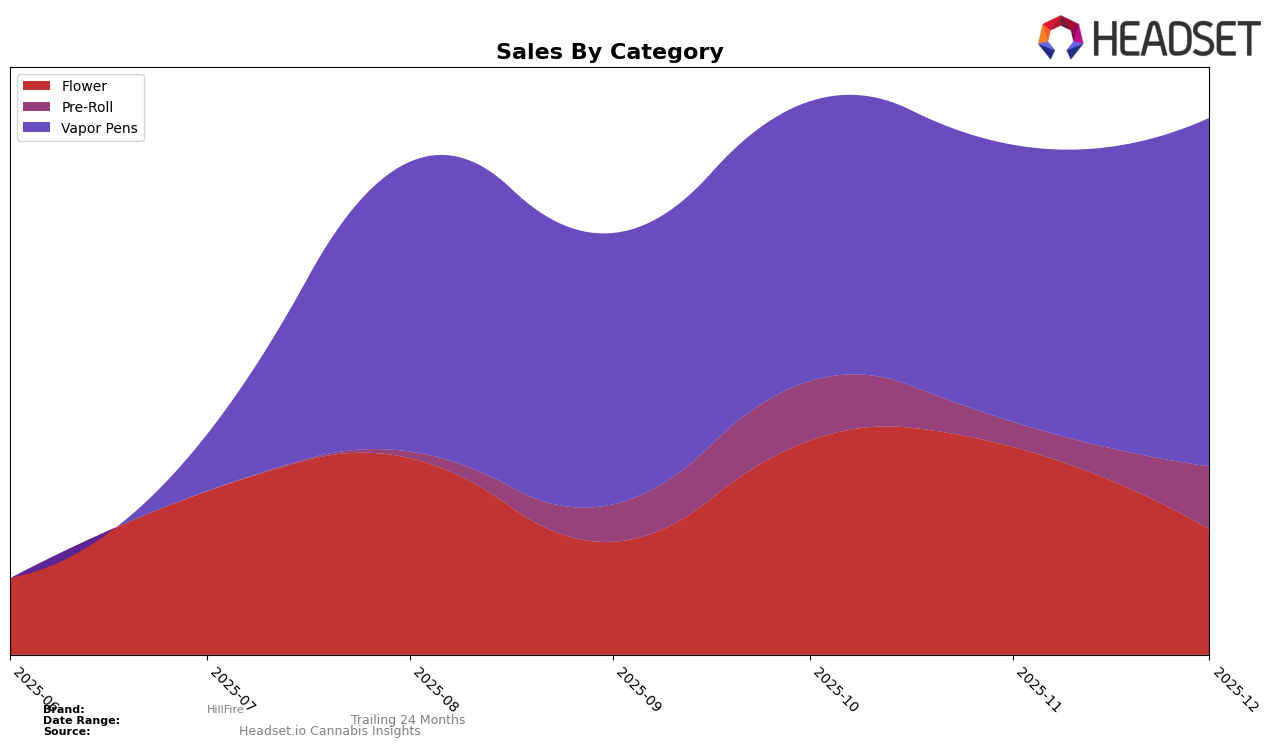

In the state of Ohio, HillFire's performance across various cannabis categories shows a dynamic landscape. In the Flower category, HillFire was unable to break into the top 30, as indicated by their rankings which remained outside the top 30 throughout the last four months of 2025. This suggests that while there was some fluctuation in their rank, with a slight improvement in November, the brand still faces significant competition in this category. Meanwhile, in the Pre-Roll category, HillFire maintained a relatively stable presence, consistently appearing in the top 30, with a notable dip in November before rebounding in December. This indicates a strong foothold in the Pre-Roll market, although the dip in November suggests potential challenges that were quickly addressed.

In the Vapor Pens category, HillFire demonstrated a steady presence, maintaining a top 30 rank with a notable improvement by December. This upward trend in December suggests that HillFire might be gaining traction or implementing successful strategies in this category. The consistent presence in the top 30 for Vapor Pens contrasts with the Flower category, highlighting HillFire's varying performance across different product lines. Overall, while HillFire shows strength in certain categories like Pre-Rolls and Vapor Pens, the Flower category remains a challenge, underscoring the competitive nature of the cannabis market in Ohio.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, HillFire experienced a notable fluctuation in its market rank from September to December 2025. Initially ranked 18th in September, HillFire dropped out of the top 20 in October and November, before making a comeback to 16th place in December. This rebound in rank coincides with a significant increase in sales during December, suggesting a positive market response to any strategic changes HillFire may have implemented. In contrast, The Botanist showed a consistent upward trajectory, climbing from 20th to 14th place over the same period, indicating a strong competitive presence with steadily increasing sales. Meanwhile, Main Street Health maintained a stable position, only slightly fluctuating between 14th and 15th place, while Timeless and Eden's Trees experienced more variability in their rankings. These dynamics highlight the competitive pressures HillFire faces, emphasizing the importance of strategic initiatives to maintain and improve its market position in Ohio's vapor pen category.

Notable Products

In December 2025, HillFire's top-performing product was the Space Jelly Pre-Roll (1g) in the Pre-Roll category, achieving the highest rank with sales of 5065 units. The Maui Wowie Distillate Cartridge (1g) maintained its consistent performance, holding the second position for two consecutive months with a notable increase in sales to 2762 units. The Maui Wowie Distillate Disposable (1g) climbed to the third position, showing a positive shift from its previous absence in November's top ranks. Buried in Blue Distillate Cartridge (1g) experienced a drop to fourth place after leading in November, indicating a competitive shift in the Vapor Pens category. Meanwhile, the Buried in Blue Distillate Disposable (1g) entered the ranks at fifth place, marking its debut in the top five for December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.