Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

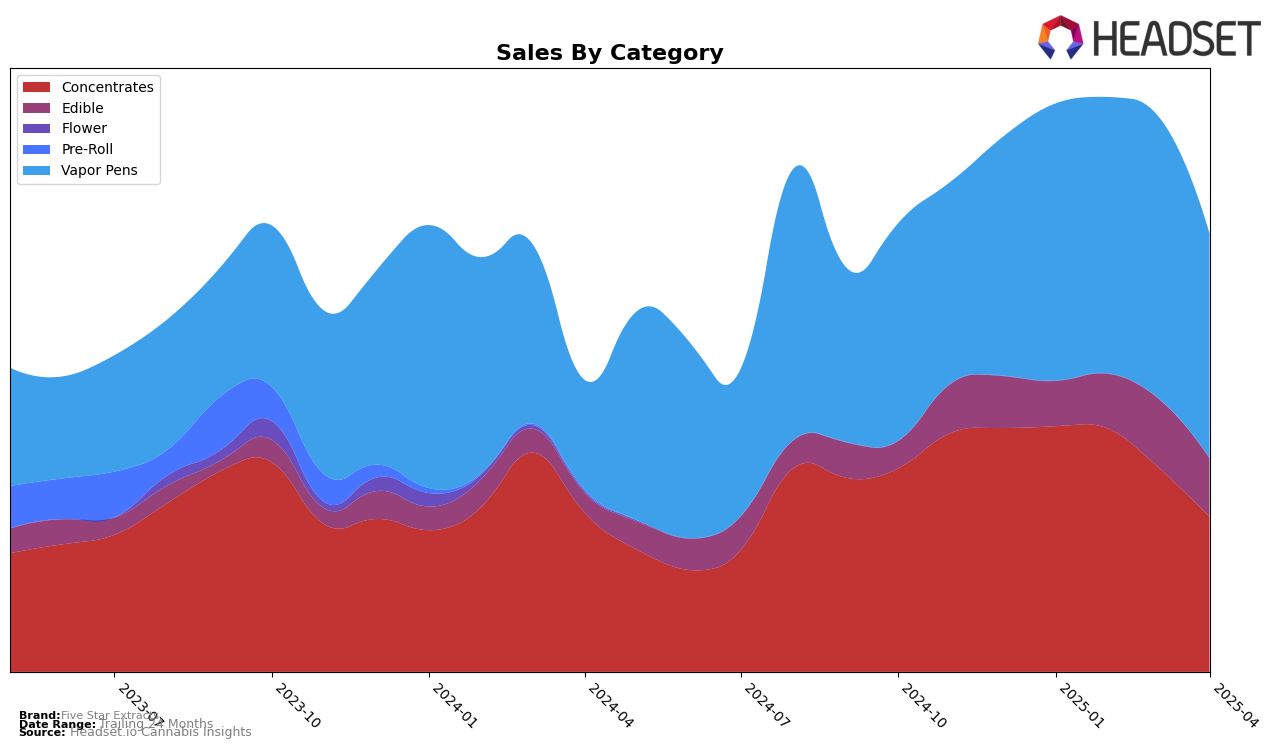

Five Star Extracts has shown varied performance across different categories in the state of Michigan. In the Concentrates category, the brand experienced a downward trend in rankings, moving from 16th place in January 2025 to 28th by April 2025. This decline in ranking is accompanied by a decrease in sales, indicating potential challenges in maintaining their market position. On the other hand, their performance in the Edible category, while not in the top 30, showed consistency in the 60s range throughout the months, which suggests a stable, albeit less dominant, presence in that segment.

In the Vapor Pens category, Five Star Extracts started the year at 35th place in Michigan and fell to 44th by April 2025. This drop in ranking might be indicative of increasing competition or shifts in consumer preferences within the state. Despite this, the brand maintained a relatively stable sales volume in the Vapor Pens category until March, before experiencing a dip in April. Overall, while Five Star Extracts has faced some challenges in maintaining its rankings across categories, their consistent presence in the market suggests potential areas for strategic improvement and opportunities for growth in the future.

Competitive Landscape

In the Michigan vapor pens category, Five Star Extracts has experienced a notable decline in its ranking from January to April 2025, starting at 35th and dropping to 44th. This downward trend in rank is mirrored by a decrease in sales, particularly in April, where sales fell significantly compared to previous months. In contrast, Cloud Cover (C3) has shown a positive trajectory, improving its rank from 60th in January to 42nd in April, with a corresponding increase in sales. Similarly, Cannalicious Labs saw a strong performance in February and March, although it too faced a decline in April. Meanwhile, Wojo Co maintained a relatively stable position, slightly improving its rank and sales over the months. The competitive landscape suggests that Five Star Extracts needs to address its declining market position amid the rising performance of competitors like Cloud Cover (C3) and Wojo Co to regain its footing in the Michigan vapor pens market.

Notable Products

In April 2025, the top-performing product for Five Star Extracts was Blueberry Lemon Haze Badder Infused Gummies 4-Pack (200mg) in the Edible category, maintaining its leading position from March 2025 with a sales figure of 3441 units. Cherry Limeade One Hitter Gummies 4-Pack (200mg) held the second spot consistently from February to April 2025, showing strong sales performance. Sour GMO Bananas Nug Run Sugar Sauce Cartridge (0.5g) emerged as a new entrant in the rankings, debuting at the third position in the Vapor Pens category. Traverse City Cherry Full Spectrum Gummies 4-Pack (200mg) saw a slight drop to fourth place in April, after previously being ranked third in March. Finally, Glitter Bomb Nug Run Sugar Sauce Cartridge (0.5g) entered the rankings at fifth place in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.