Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

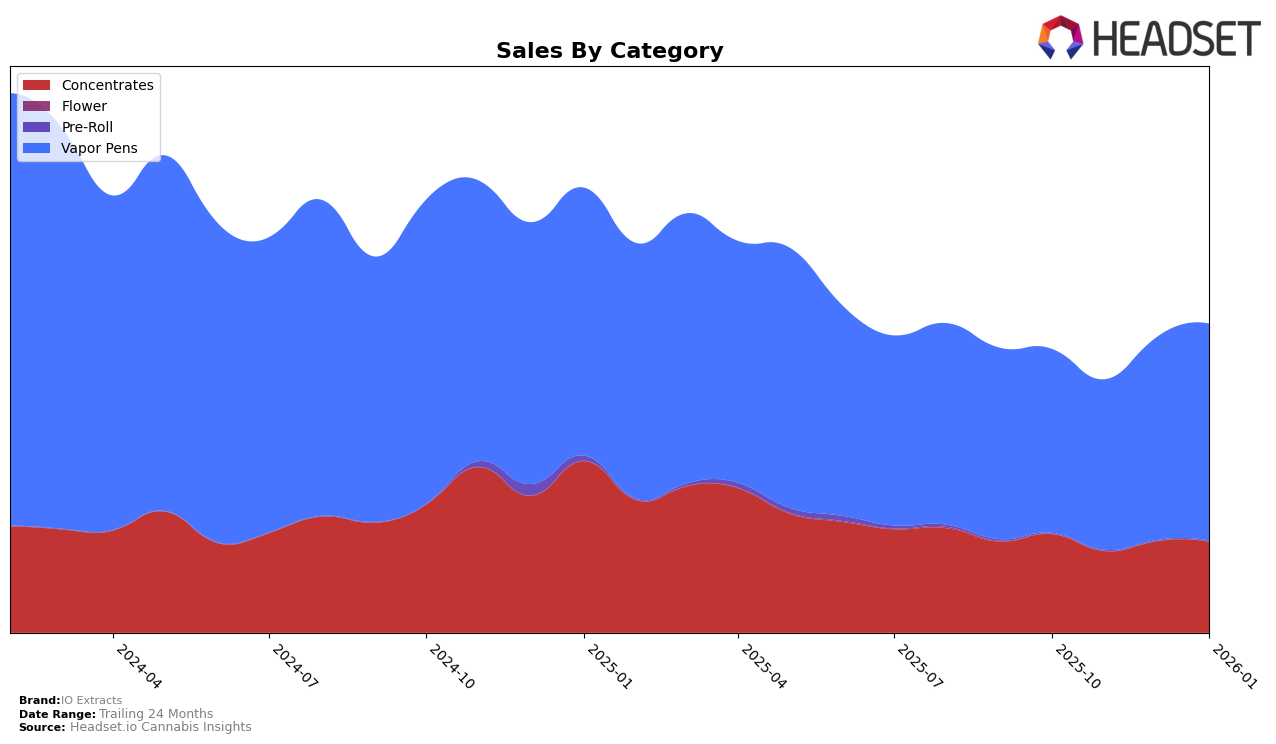

In the Arizona market, IO Extracts has shown varied performance across different product categories. Specifically, in the Concentrates category, the brand maintained a stable presence, with rankings fluctuating slightly from 6th in October 2025 to 7th by January 2026. This slight dip in ranking could be attributed to the competitive nature of the concentrates market, though the brand's sales figures remained relatively stable, indicating consistent consumer demand. On the other hand, in the Vapor Pens category, IO Extracts experienced a minor drop from 15th to 16th place over the same period. Despite the drop in rankings, the sales figures for Vapor Pens showed a positive trend, with a notable increase from November to January, suggesting strengthening consumer interest in this category.

It is important to note that IO Extracts was consistently present in the top 30 brands for both Concentrates and Vapor Pens in Arizona, highlighting the brand's strong foothold in these categories. The absence of rankings outside the top 30 indicates that IO Extracts may not have a significant presence in other categories or states, which could be a potential area for growth or concern. The brand's ability to maintain its position in a competitive market like Arizona suggests a robust strategy, yet there is room for improvement and expansion into new markets and categories to diversify its portfolio and enhance market penetration.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, IO Extracts has experienced fluctuations in its market rank, indicating a dynamic competitive environment. From October 2025 to January 2026, IO Extracts' rank shifted from 15th to 16th, with a dip to 17th in December before recovering slightly. This pattern suggests a competitive pressure from brands like Grow Sciences and Brown Bag, which consistently maintained higher ranks. Notably, Grow Sciences held a steady position around 13th to 15th, and Brown Bag remained at 13th to 14th, indicating stronger sales performance. Meanwhile, Big Bud Farms showed a positive trend, climbing from 29th to 18th, which may have contributed to the competitive pressure on IO Extracts. Despite these challenges, IO Extracts demonstrated resilience with an upward sales trend from November to January, suggesting potential for future growth if strategic adjustments are made to enhance market positioning.

Notable Products

In January 2026, the top-performing product from IO Extracts was the Granddaddy Purple Distillate Cartridge (1g) in the Vapor Pens category, which rose from third place in October 2025 to first place with sales reaching 1265 units. Following closely was the Tropical Cookies Distillate Disposable (1g), which climbed to second place from fifth in November 2025. The Lemon Haze Distillate Disposable (1g) moved up to third place, showing a consistent upward trend from its fifth-place ranking in December 2025. The Fruit Cocktail Distillate Disposable (1g) secured the fourth spot, maintaining its presence in the top five. Lastly, Black Amber Shatter (1g) in the Concentrates category dropped from first place in December 2025 to fifth place in January 2026, indicating a notable decline in its sales rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.