Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

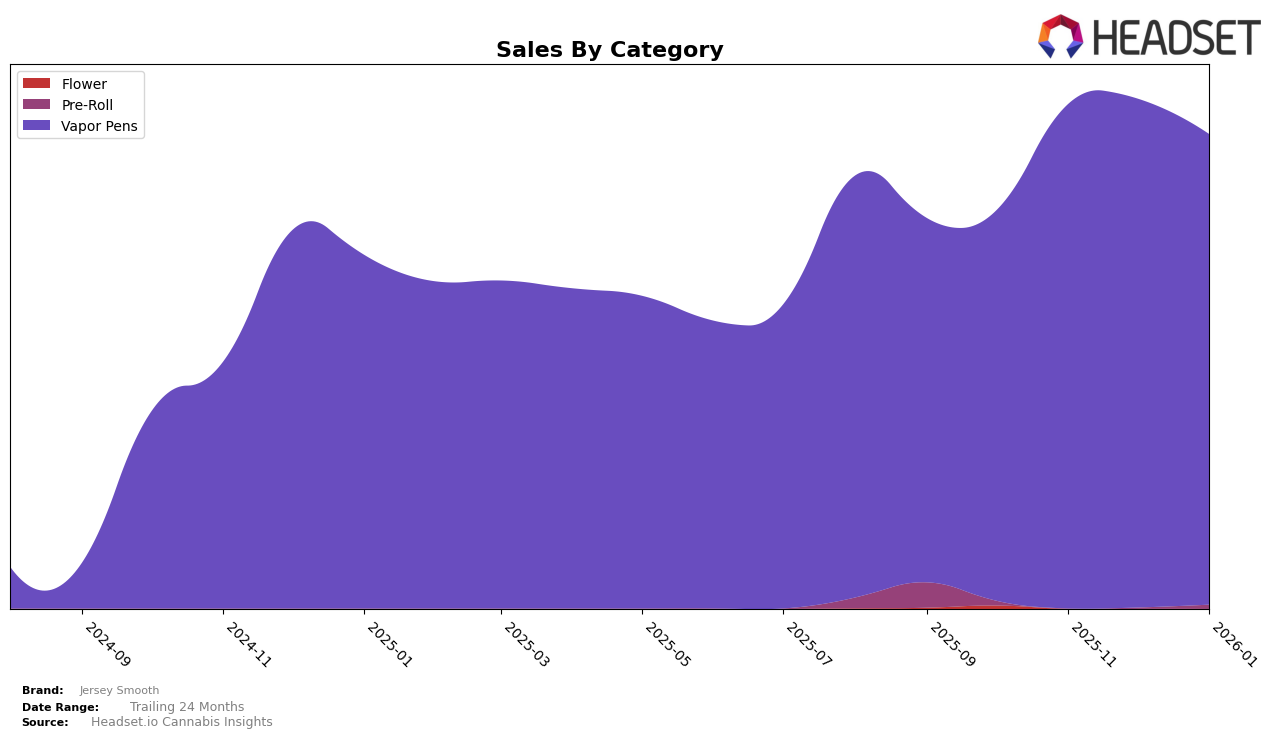

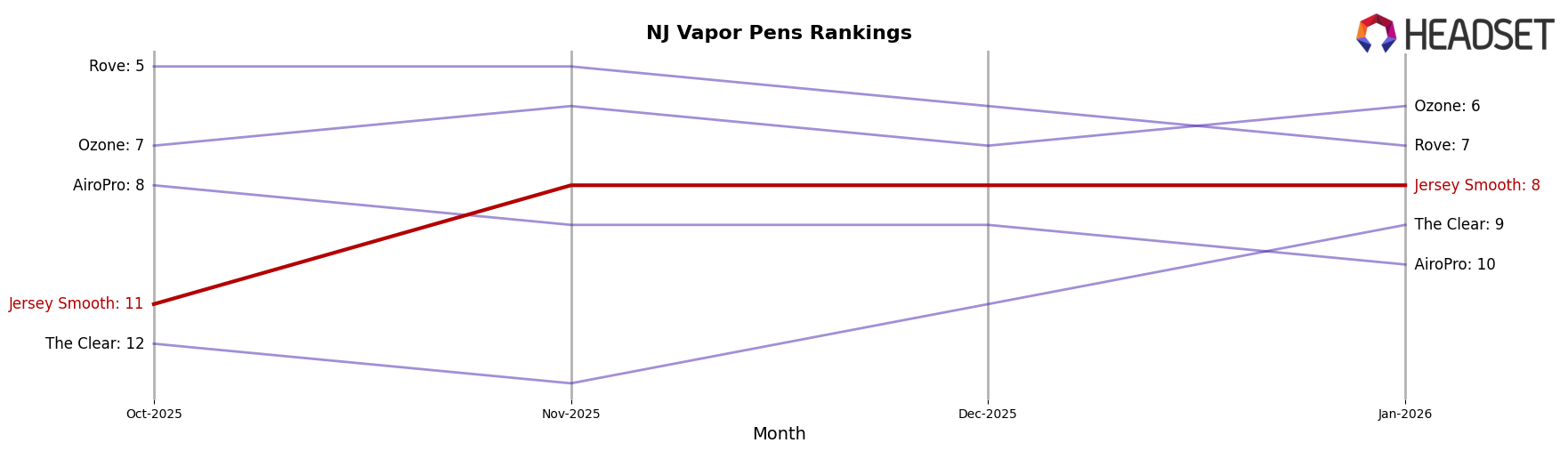

Jersey Smooth has shown consistent performance in the Vapor Pens category in New Jersey, maintaining a steady presence in the top 10 rankings. From October 2025 to January 2026, the brand improved its ranking from 11th to 8th and held that position for three consecutive months. This stability suggests a strong foothold in the New Jersey market, with sales peaking in November 2025. Despite a slight decrease in January 2026, the brand managed to retain its ranking, indicating resilience in a competitive market.

While Jersey Smooth has made notable strides in New Jersey, its absence from the top 30 in other states and categories could be interpreted as a gap in market penetration or a strategic focus on specific areas. This absence in other regions might highlight opportunities for growth or a need for targeted expansion strategies. The brand's consistent performance in New Jersey's Vapor Pens category, however, underscores its potential to replicate this success in other markets if it chooses to expand its geographical reach.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Jersey Smooth has demonstrated a notable upward trajectory in brand ranking and sales performance. From October 2025 to January 2026, Jersey Smooth improved its rank from 11th to 8th, maintaining this position consistently through December and January. This rise in rank is complemented by a significant increase in sales from October to November, positioning Jersey Smooth ahead of The Clear, which fluctuated between 9th and 13th place during the same period. However, Jersey Smooth still trails behind Rove, which consistently held a top position, despite a slight decline from 5th to 7th place by January 2026. The steady performance of Ozone, which maintained a rank between 6th and 7th, also presents a competitive challenge for Jersey Smooth. Meanwhile, AiroPro experienced a decline in sales and rank, dropping to 10th by January, which could provide an opportunity for Jersey Smooth to further consolidate its position in the market.

Notable Products

In January 2026, the top-performing product from Jersey Smooth was the Baja Blast Distillate Disposable (1g) in the Vapor Pens category, maintaining its first-place ranking consistently from October 2025 with sales of 1715 units. The newly introduced Mangonada Liquid Diamonds Distillate Disposable (1g) debuted impressively at the second position, indicating strong market acceptance. The Baja Blast Distillate Disposable (2g) held steady in the third spot, showing consistent demand since December 2025. Full Service Gas Distillate Disposable (1g) experienced a drop to fourth place from its second-place ranking in November and December 2025. Beach Day Lemonade Distillate Disposable (1g) rounded out the top five, slipping from its previous fourth place in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.