Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

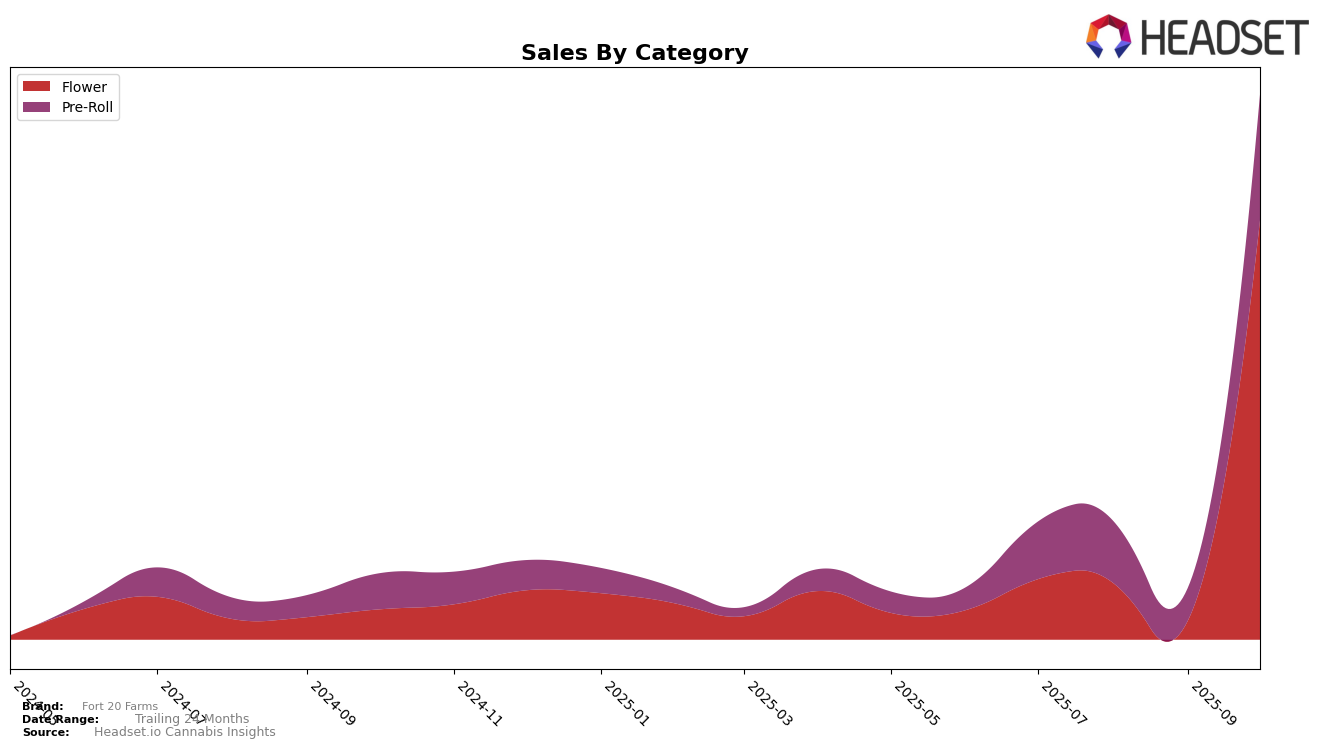

Fort 20 Farms has shown a notable performance improvement in the British Columbia market, especially in the Flower category. In October 2025, the brand made a significant leap to rank 28th, a remarkable climb from its previous position of 96th in September. This upward trajectory is underscored by a substantial increase in sales, indicating a growing consumer preference and market penetration. The dramatic shift from being outside the top 30 to securing a spot within it highlights Fort 20 Farms' strategic success in this category, marking a positive trend that stakeholders should watch closely.

In contrast, Fort 20 Farms' performance in the Pre-Roll category within British Columbia presents a mixed picture. The brand was not ranked in the top 30 in September, which could signal challenges in maintaining consistent visibility or market share in this segment. However, by October, Fort 20 Farms re-entered the rankings, achieving a 67th position. While this is an improvement, it still suggests that there is room for growth and potential strategies that could further enhance their standing. Observers and potential investors may find it worthwhile to delve deeper into the factors contributing to these fluctuations in the Pre-Roll category.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Fort 20 Farms has demonstrated a remarkable turnaround in its market position. Initially ranked 82nd in both July and August 2025, Fort 20 Farms experienced a dip to 96th in September, indicating a challenging period. However, by October 2025, the brand surged to 28th place, showcasing a significant improvement in its competitive standing. This upward trajectory is notable when compared to competitors like Tweed, which fell from 16th in July to 26th in October, and Magi Cannabis, which maintained a relatively stable rank around the mid-20s. Meanwhile, Greenade and Sitka Weedworks both showed volatility, with Sitka Weedworks making a notable leap from 84th in September to 29th in October. Fort 20 Farms' impressive climb in rank suggests a strategic pivot or successful marketing initiative that has resonated well with consumers, positioning it as a rising contender in the market.

Notable Products

In October 2025, the top-performing product from Fort 20 Farms was BC Key Moh Kush Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking from September with a significant sales figure of 3503 units. Bubba Kush Pre-Roll (1g) emerged as a new contender, securing the second position, previously unranked in prior months. BC Kemo Pre-Roll (1g) consistently held its position, ranking third for both September and October. Indica Smalls (7g) made an impressive entry into the rankings at fourth place. Meanwhile, Bubba Kush Pre-Roll 3-Pack (1.5g) dropped from its initial top spot in July to fifth in October, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.