Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

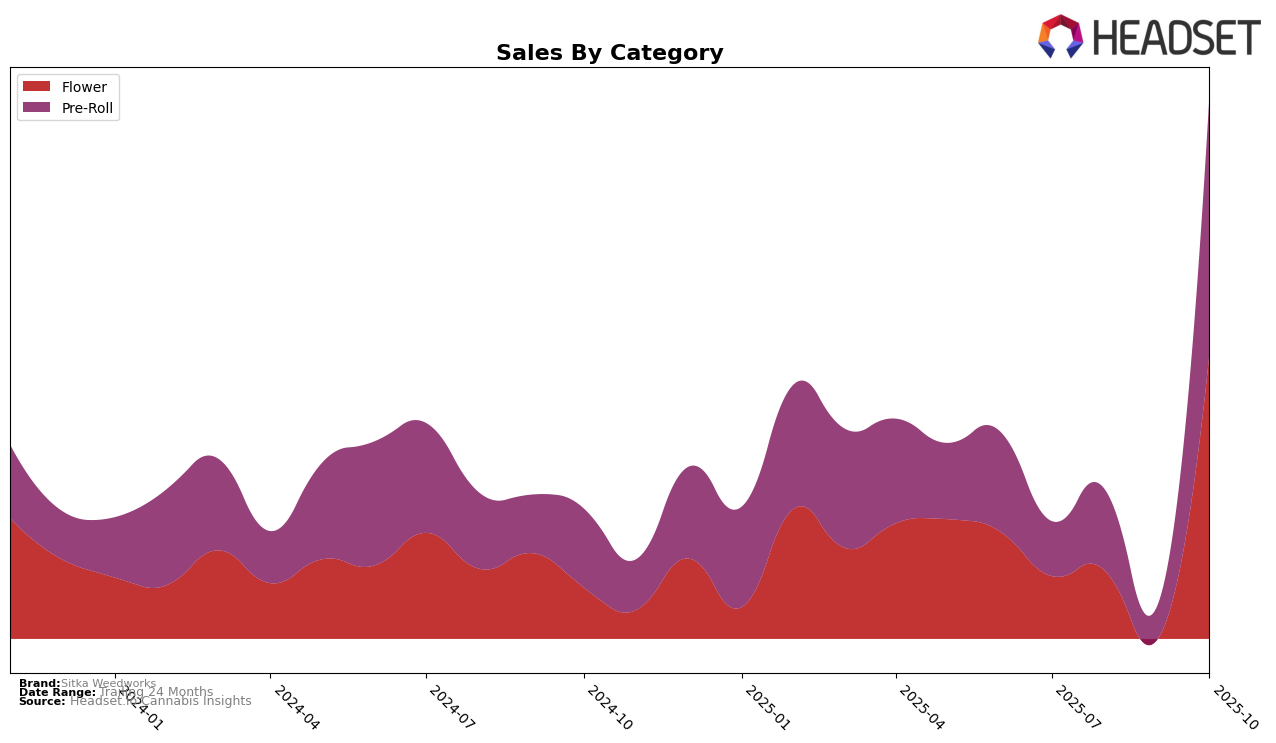

Sitka Weedworks has shown varied performance across different categories and regions. In the Alberta market, their presence in the Flower category has seen a decline, with rankings dropping from 71st in July 2025 to 85th by October 2025. This downward trend is reflected in their sales figures, which have decreased consistently over the months. However, in the Pre-Roll category within the same region, Sitka Weedworks has maintained a relatively stable position, albeit outside the top 30, with rankings fluctuating slightly from 74th to 89th over the same period. This suggests a need for strategic adjustments to improve their standing in Alberta's competitive market.

Conversely, the brand has experienced significant positive movement in British Columbia, particularly in the Flower category. Sitka Weedworks made a remarkable leap from 84th place in September 2025 to 29th in October 2025, indicating a successful strategy or product launch that resonated well with consumers. This surge is underscored by a substantial increase in sales, reflecting a strong market reception. In the Pre-Roll category, while they started off at a lower rank, by October 2025, they had climbed to 33rd place, showing promising growth potential. Despite these improvements, the brand's absence from the top 30 in some months highlights areas for potential growth and market penetration in British Columbia.

Competitive Landscape

In the competitive landscape of the flower category in British Columbia, Sitka Weedworks has shown a remarkable turnaround in its ranking and sales performance over the past few months. After experiencing a dip in rank to 84th place in September 2025, Sitka Weedworks made a significant leap to 29th place by October 2025, indicating a strong recovery and growth in market presence. This upward trend in rank is mirrored by a substantial increase in sales, positioning Sitka Weedworks ahead of brands like Greenade and Jonny Chronic, which saw a decline in their rankings to 30th and 32nd, respectively, in October. Meanwhile, Magi Cannabis maintained a stable position, slightly ahead at 27th, but Sitka Weedworks' rapid ascent suggests a competitive edge that could potentially challenge even more established brands. Fort 20 Farms also saw a dramatic improvement, moving from 96th to 28th, indicating a dynamic market where Sitka Weedworks' strategic advancements could continue to drive its success.

Notable Products

In October 2025, Sitka Weedworks' top-performing product was the Legends - Cherry Chatter Pre-Roll 5-Pack (2.5g), maintaining its number one rank from September with a notable sales figure of 6793 units. The Fade to Black Pre-Roll 5-Pack (2.5g) debuted strongly at the second position. Legends - Purple Octane (7g) held steady at the third rank, consistent with its September position. The Animal Tsunami Pre-Roll (1g) entered the rankings at fourth place, while Legends - Fade to Black (14g) completed the top five, marking its first appearance in the rankings. These shifts highlight a dynamic month for Sitka Weedworks, with new entries shaking up the leaderboard and established products maintaining strong sales performance.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.