Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

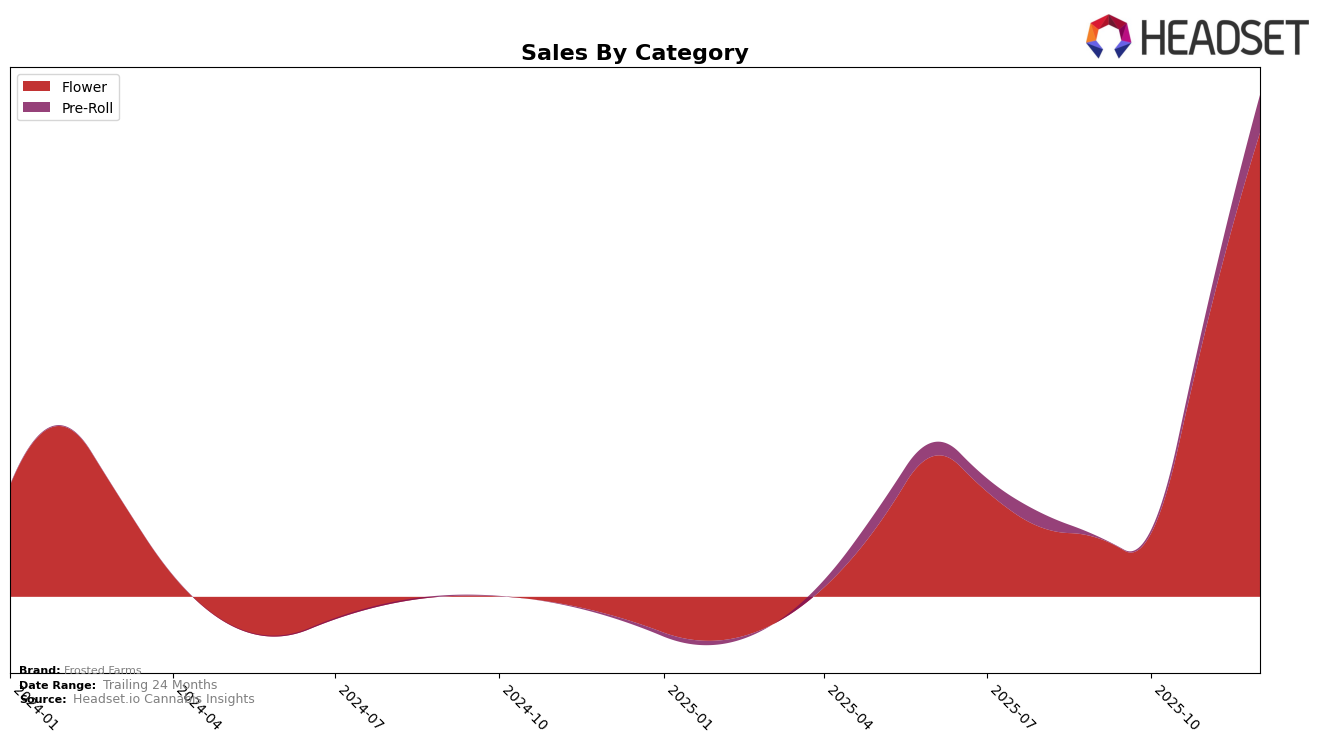

Frosted Farms has shown significant improvement in the Michigan market, particularly in the Flower category. Despite not being in the top 30 brands in September and October 2025, Frosted Farms made an impressive leap to rank 29th in December 2025. This upward movement is indicative of a positive trend in their sales strategy or product appeal within the state. The fact that they were not ranked in the top 30 in the preceding months suggests that they have either introduced new products or improved their market penetration, which is a noteworthy development for stakeholders to monitor.

The performance of Frosted Farms in Michigan highlights an important trajectory in their Flower category sales. The jump to the 29th position in December 2025, from not being ranked in the top 30 previously, suggests a strong finish to the year. This could be attributed to seasonal demand or effective marketing strategies. While specific sales figures for the months leading up to December are not disclosed, the notable increase in rank indicates a successful period for the brand. Observers should keep an eye on whether this momentum can be sustained into the new year, as it could signal Frosted Farms' growing influence in the competitive Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Frosted Farms has shown a remarkable improvement in its market position, climbing from being unranked in September and October 2025 to securing the 53rd rank in November and further advancing to the 29th rank in December. This upward trajectory in rank is indicative of a significant boost in sales, with Frosted Farms achieving a notable increase from approximately $525,885 in November to $903,494 in December. In contrast, Peninsula Cannabis and Garcia Hand Picked have shown fluctuating ranks, with Peninsula Cannabis improving from 39th to 27th and Garcia Hand Picked from 60th to 33rd over the same period. Meanwhile, ILL Exotics and Tru Smoke have experienced varying degrees of rank stability and decline, respectively, with Tru Smoke dropping from 13th in September to 28th in December. These dynamics suggest that Frosted Farms is gaining traction and potentially capturing market share from its competitors, positioning itself as a rising player in the Michigan flower market.

Notable Products

In December 2025, the top-performing product for Frosted Farms was Complex Candy (Bulk) in the Flower category, securing the number 1 rank with impressive sales of 9574 units. This product showed a significant leap from its previous 2nd rank in October 2025. Afghani Supernova (1g) maintained its 2nd position from November to December, though with a reduction in sales figures. Glue Cheese (Bulk) dropped from the 1st position in November to 3rd in December, reflecting a decrease in sales. Summertime (3.5g) consistently held the 4th rank from October through December, indicating stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.