Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

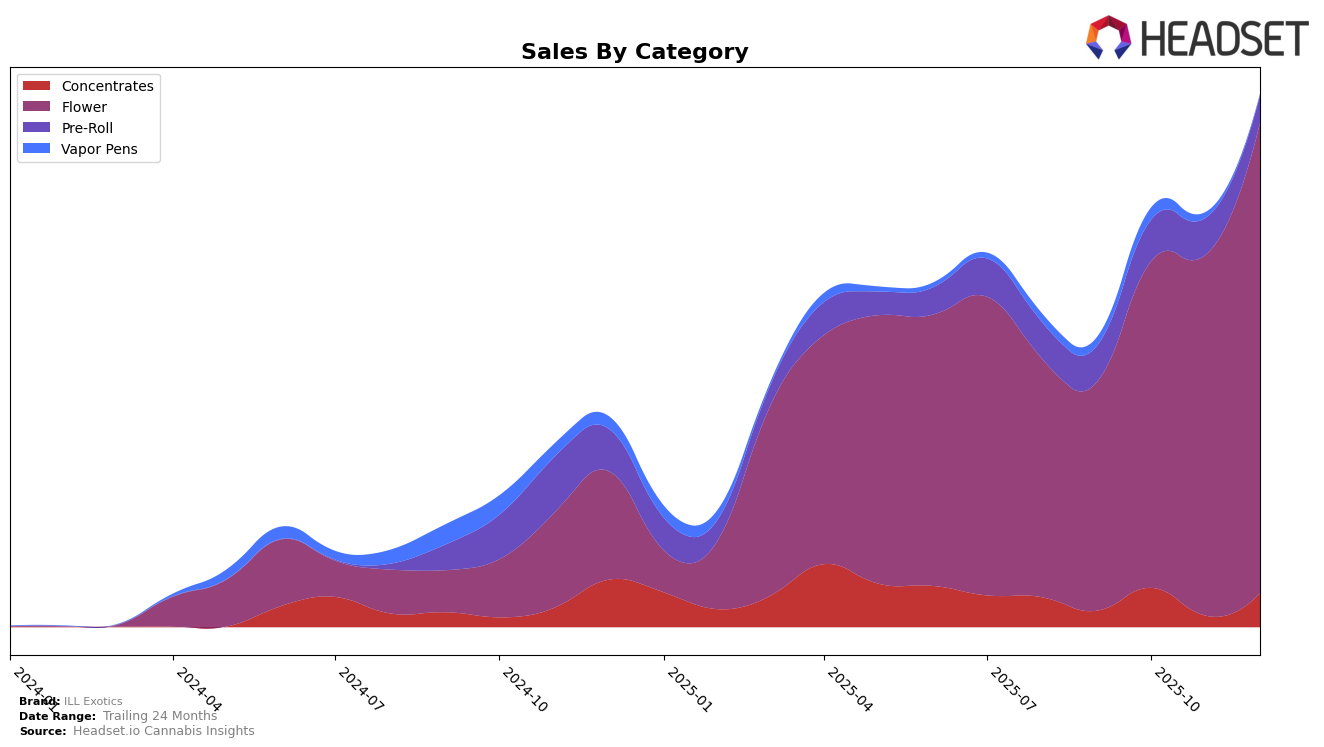

Market Insights Snapshot

In the state of Michigan, ILL Exotics has shown a notable upward trajectory in the Flower category over the last few months of 2025. Starting from a rank of 56 in September, the brand climbed to an impressive 30th place by December. This consistent rise in rankings suggests a growing consumer preference for their Flower products, which is further supported by a steady increase in sales figures. On the other hand, the Concentrates category presents a more fluctuating performance. While ILL Exotics improved their ranking from 83 in September to 44 in October, they fell out of the top 30 in November, only to re-enter at 52 in December. This inconsistency might indicate challenges in maintaining a strong foothold in the Concentrates market.

While the Flower category in Michigan has been a highlight for ILL Exotics, their performance in the Concentrates category reveals potential areas for strategic improvement. Notably, the absence from the top 30 in November suggests a competitive landscape or possibly a shift in consumer preferences during that period. Despite this, the brand's ability to bounce back in December indicates resilience and adaptability. These movements across categories and timeframes provide valuable insights into the brand's market dynamics, highlighting both opportunities and challenges that ILL Exotics faces in expanding its presence in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Michigan flower category, ILL Exotics has shown a promising upward trajectory in the latter months of 2025. Starting from a rank of 56 in September, ILL Exotics climbed to the 30th position by December, indicating a significant improvement in market presence and consumer preference. This positive shift is underscored by a steady increase in sales, positioning ILL Exotics closer to competitors like Garcia Hand Picked, which also improved its rank from 46 to 33 during the same period. Meanwhile, Frosted Farms made a notable entry into the top 20 by December, ranking at 29, suggesting a competitive edge in sales performance. The Fresh Canna experienced fluctuations, ending December with a rank of 35, while Tru Smoke saw a decline from 13 to 28. These dynamics highlight the competitive intensity in the Michigan flower market, where ILL Exotics' consistent rise suggests effective strategies and growing consumer appeal.

Notable Products

In December 2025, the top-performing product for ILL Exotics was P41 (Bulk) in the Flower category, maintaining its number 1 rank from November with sales of 4,428 units. Designer Runtz (Bulk), also in the Flower category, climbed from the 5th position in November to 2nd in December, showcasing a significant increase in sales. Red Panda #2 (Bulk) followed closely, moving up from 4th to 3rd place. Frozen Lemon (1g) experienced a slight drop, descending from 3rd to 4th position. Black Cherry Gelato (Bulk), which was previously unranked in November, entered the top 5, securing the 5th spot in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.