Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

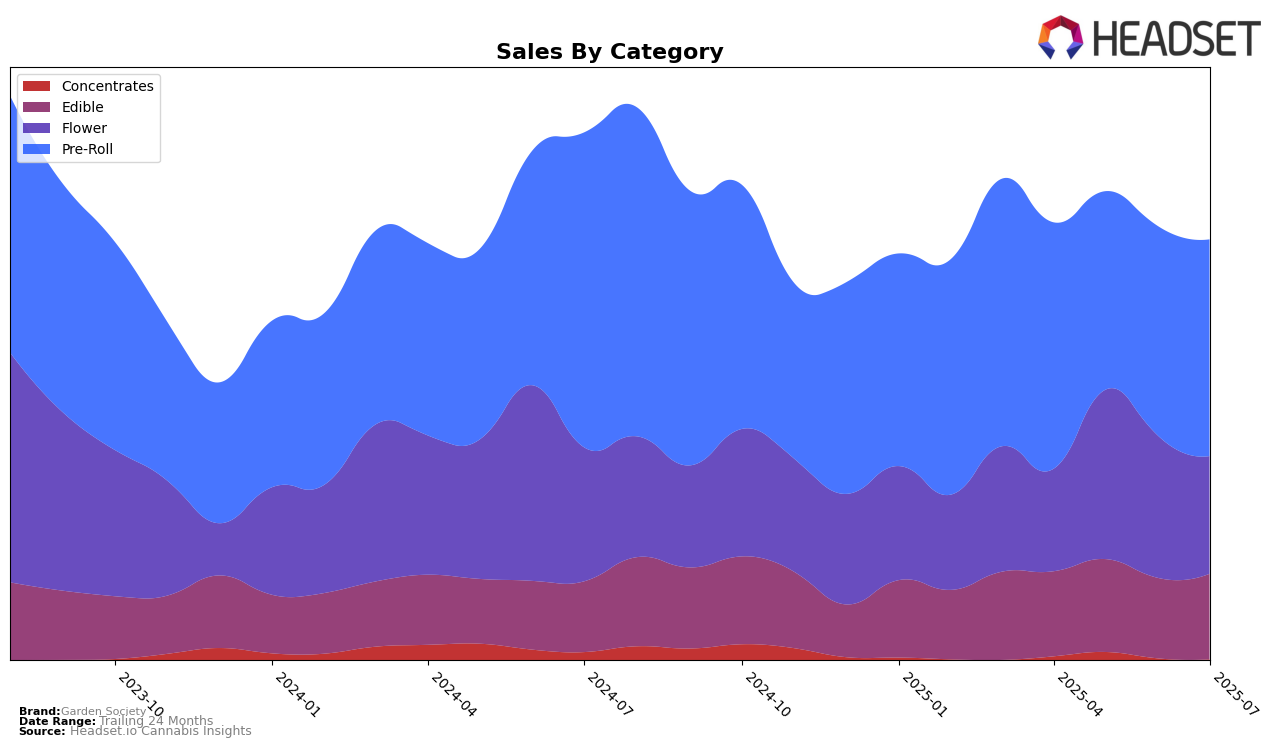

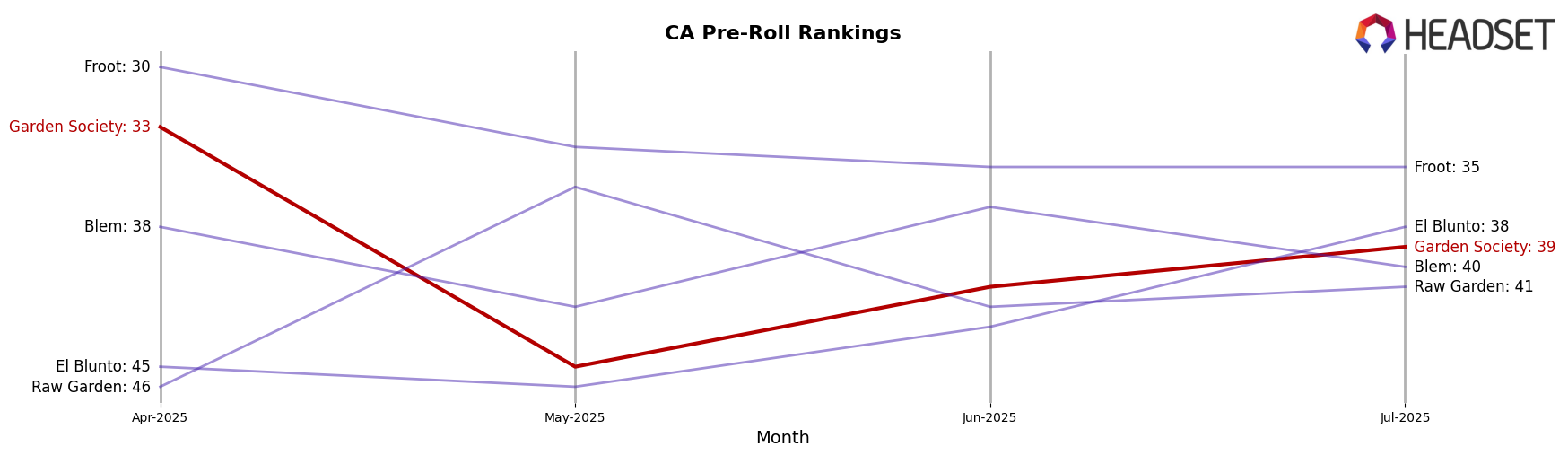

Garden Society's performance in the California market shows notable trends across different product categories. In the Edible category, the brand has demonstrated a steady climb, entering the top 30 by July 2025, after hovering just outside it in previous months. This upward movement is a positive indicator of their growing presence and consumer acceptance in California's competitive edible market. Meanwhile, their Pre-Roll category has seen a more fluctuating journey, with rankings varying from 33rd in April to 39th by July. Despite these fluctuations, the brand's sales figures in the Pre-Roll category have shown resilience, suggesting a potential for stabilization and future growth.

In contrast, Garden Society's presence in Ohio is less pronounced, particularly in the Edible category, where they did not make it into the top 30 rankings until July 2025, debuting at 51st. This indicates that while there is some traction, the brand faces challenges in gaining a significant foothold in Ohio's edible market. The absence of rankings in prior months suggests that there is considerable room for improvement and potential strategies to increase market penetration. These dynamics highlight the varying competitive landscapes Garden Society navigates across states, offering insights into where their strategic focus might be directed for future growth.

Competitive Landscape

In the competitive landscape of the California Pre-Roll market, Garden Society has experienced fluctuations in its ranking over the months from April to July 2025. Starting at a rank of 33 in April, Garden Society saw a decline to 45 in May, followed by a slight improvement to 41 in June and 39 in July. Despite these changes, Garden Society's sales showed a recovery from a low in May, with a gradual increase in June and July. In comparison, Raw Garden and El Blunto have shown varied performance, with Raw Garden improving its rank from 46 in April to 36 in May, while El Blunto ended July at a rank of 38, slightly ahead of Garden Society. Meanwhile, Blem maintained a relatively stable position, and Froot consistently outperformed Garden Society, maintaining a rank in the 30s throughout the period. These dynamics suggest that while Garden Society is making strides in recovering sales, it faces stiff competition from brands like Froot and Blem, which have maintained stronger sales and rankings.

Notable Products

In July 2025, the top-performing product from Garden Society was the Blissful Rest - THC/CBN/CBD 1:1:1 Snoozeberry Gummies 20-Pack, maintaining its number one rank for four consecutive months, despite a slight sales dip to 1401 units. The Brighter Day - Peach Nectar Gummies 10-Pack debuted strongly at the second position with sales of 1379 units. The Pink Boost Goddess THCV Reserve Rosettes Infused Pre-Roll 10-Pack moved up to the third position from second in June, showing consistent performance with sales at 1331 units. Joyful And Present - THC/THCV 1:1 Kiwi Lime Sauvignon Blanc Gummies 20-Pack dropped one spot to fourth, maintaining steady sales figures. Lastly, Brighter Day - Peach Prosecco Gummies 20-Pack entered the top five in July, ranking fifth with a slight decrease in sales compared to May.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.