Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

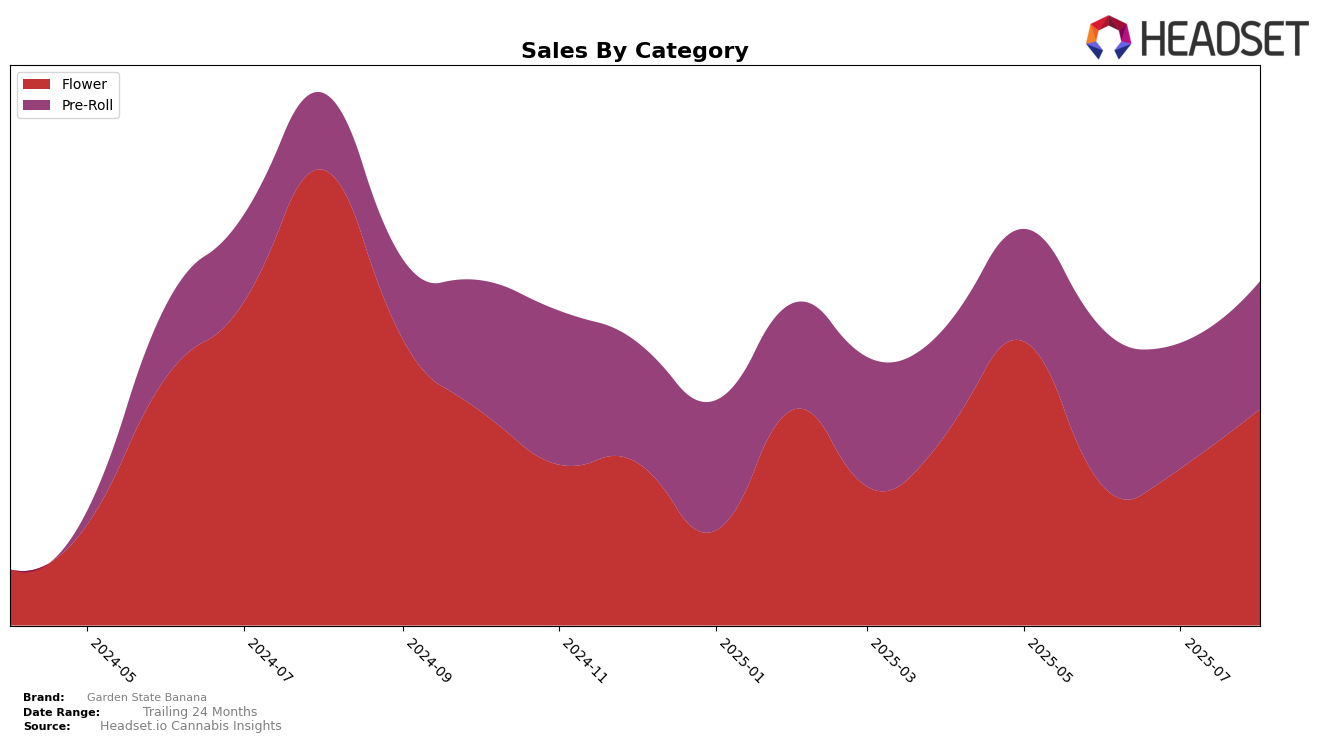

Garden State Banana's performance in the New Jersey market reveals some interesting trends across different product categories. In the Flower category, the brand has been struggling to break into the top 30, with rankings consistently hovering in the 40s since May 2025. Despite this, there was a noticeable increase in sales from July to August, suggesting a potential upward trend. This could be indicative of a growing customer base or improved product offerings that are beginning to resonate with consumers. The lack of a top 30 ranking, however, highlights the competitive nature of the Flower category in New Jersey, and suggests that Garden State Banana may need to implement strategic changes to improve its positioning.

Conversely, Garden State Banana's performance in the Pre-Roll category presents a slightly more optimistic picture. The brand maintained a position within the top 30 throughout the summer months, despite a slight dip in July. This stability in rankings, coupled with relatively steady sales figures, suggests that the Pre-Roll category could be a strong area of growth for the brand. The ability to remain in the top 30 indicates a solid market presence and consumer demand in this segment. However, the brand's drop to 30th place in August might signal the need for renewed efforts to maintain its competitive edge and prevent further slippage in rankings.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Garden State Banana has experienced fluctuating ranks from May to August 2025, with its position ranging from 34th to 44th. This volatility is indicative of a competitive market environment. Notably, Kynd Cannabis Company has shown a stronger performance, consistently ranking higher than Garden State Banana, despite a dip in August. Meanwhile, URBNJ has demonstrated a slight upward trend, surpassing Garden State Banana in August. On the other hand, Hillview Farms and The Growfather have maintained lower rankings, suggesting less competitive pressure from these brands. The sales trajectory for Garden State Banana shows a recovery in August, aligning with its improved rank, yet it remains crucial for the brand to strategize effectively to combat the competitive advances of Kynd Cannabis Company and URBNJ.

Notable Products

In August 2025, the top-performing product for Garden State Banana was the Banana Mochi Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from July, despite a slight decrease in sales to 3075 units. The Rainbow Fizz Pre-Roll (1g) rose to the second position with notable sales of 1592 units, climbing from fourth place in July. Banana Sundae (3.5g) made a strong entry into the rankings, securing the third position in the Flower category. Meanwhile, Banana Mochi (3.5g) dropped to fourth place in the Flower category, despite being the top product in May. Blueberry Runtz Pre-Roll (1g) re-entered the rankings at fifth place, showing an increase in sales compared to previous months where it was unranked.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.