Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

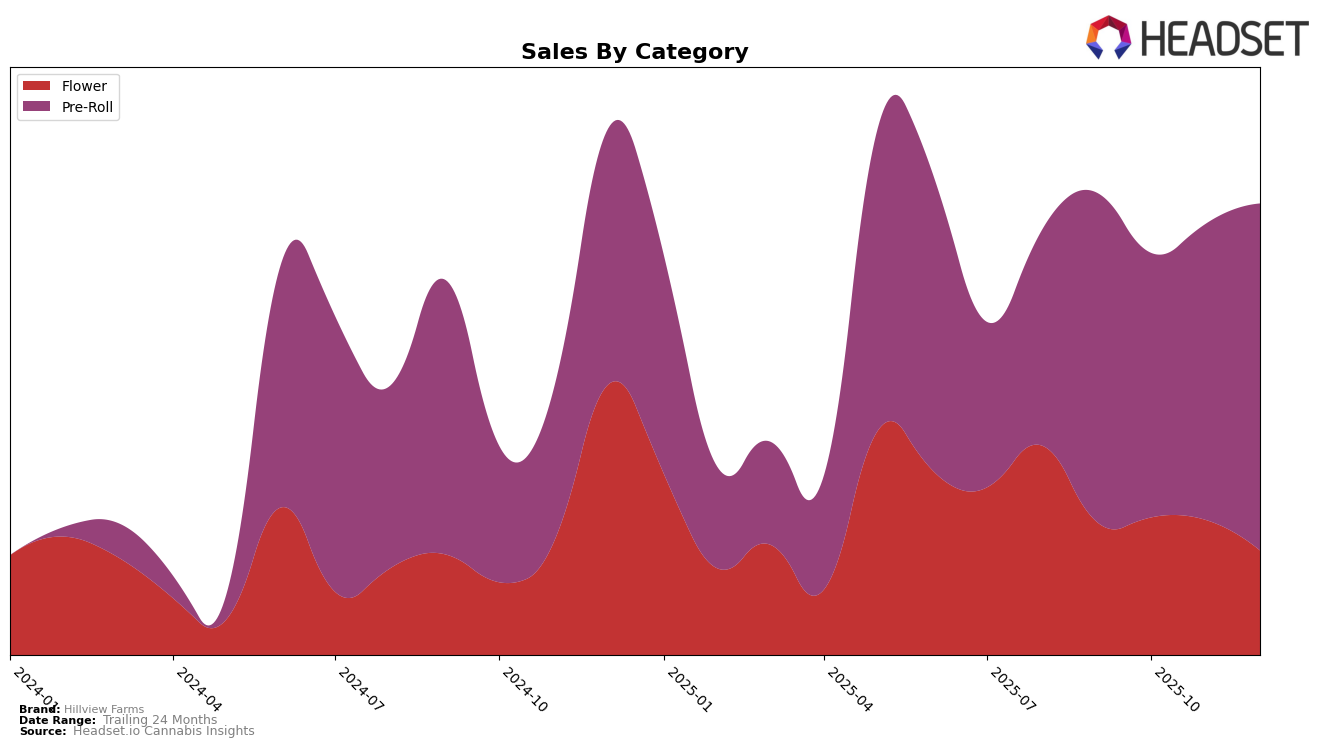

Hillview Farms has shown a varied performance across different product categories and states in recent months. In the New Jersey market, the brand's Flower category has not managed to break into the top 30 brands, with rankings hovering in the 50s. This suggests that while they are making some sales, they are facing stiff competition from other brands in this category. Interestingly, despite not being a top contender in Flower, Hillview Farms has seen a consistent sales volume, albeit with a noticeable drop in December. This could indicate either a seasonal fluctuation or a shift in consumer preference, something that would warrant closer examination for anyone tracking market trends.

In stark contrast, the Pre-Roll category presents a more favorable picture for Hillview Farms in New Jersey. Here, the brand has consistently maintained a position within the top 20, with rankings fluctuating between 15th and 20th over the months. This stability and relatively high ranking suggest a strong foothold in this category, which is further corroborated by the upward sales trend observed in December. This performance in Pre-Rolls could be attributed to effective marketing strategies or product quality that resonates well with consumers, making it a category worth watching for potential growth opportunities.

Competitive Landscape

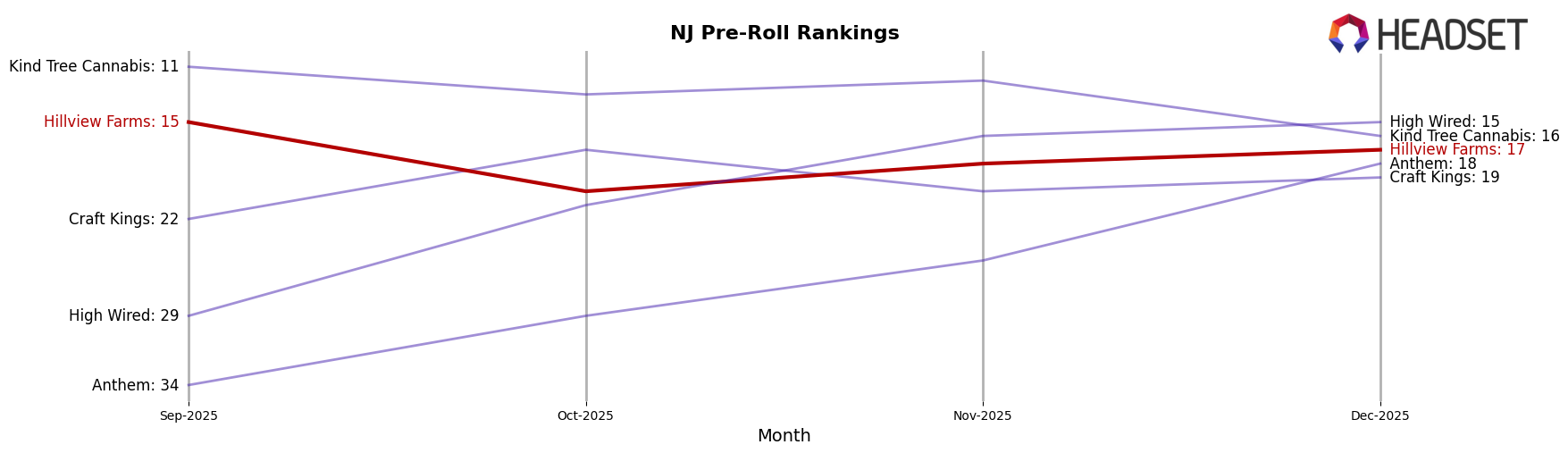

In the competitive landscape of the New Jersey pre-roll category, Hillview Farms has shown a promising upward trajectory in the latter months of 2025. Despite starting at the 15th rank in September, Hillview Farms experienced a dip to 20th in October but rebounded to 17th by December, indicating a positive trend in its market positioning. This recovery is notable when compared to Kind Tree Cannabis, which saw a decline from 11th to 16th over the same period, and Craft Kings, which fluctuated but remained outside the top 15. Meanwhile, High Wired has been a strong competitor, climbing from 29th to 15th, surpassing Hillview Farms in December. Additionally, Anthem made significant strides, moving from 34th to 18th, closely trailing Hillview Farms. These dynamics suggest that while Hillview Farms is gaining momentum, it faces stiff competition from brands like High Wired and Anthem, which are rapidly improving their market positions.

Notable Products

In December 2025, the top-performing product from Hillview Farms was the Headband Pre-Roll 2-Pack (1g) in the Pre-Roll category, reclaiming its number one rank from October after a slight dip to second place in November, with sales hitting 1,014 units. The Strawberry Mango Haze Pre-Roll 5-Pack (2.5g) ranked second, showing a significant rebound from its fourth-place position in November. Orange Sunshine Pre-Roll 2-Pack (1g) made its debut in the rankings at third place, indicating strong market entry. Cereal Milk Pre-Roll 2-Pack (1g) climbed to fourth place from a previous absence in the November rankings. Finally, Strawberry Mango Haze Pre-Roll 2-Pack (1g) secured the fifth spot, marking its first appearance in the sales rankings for December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.