Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

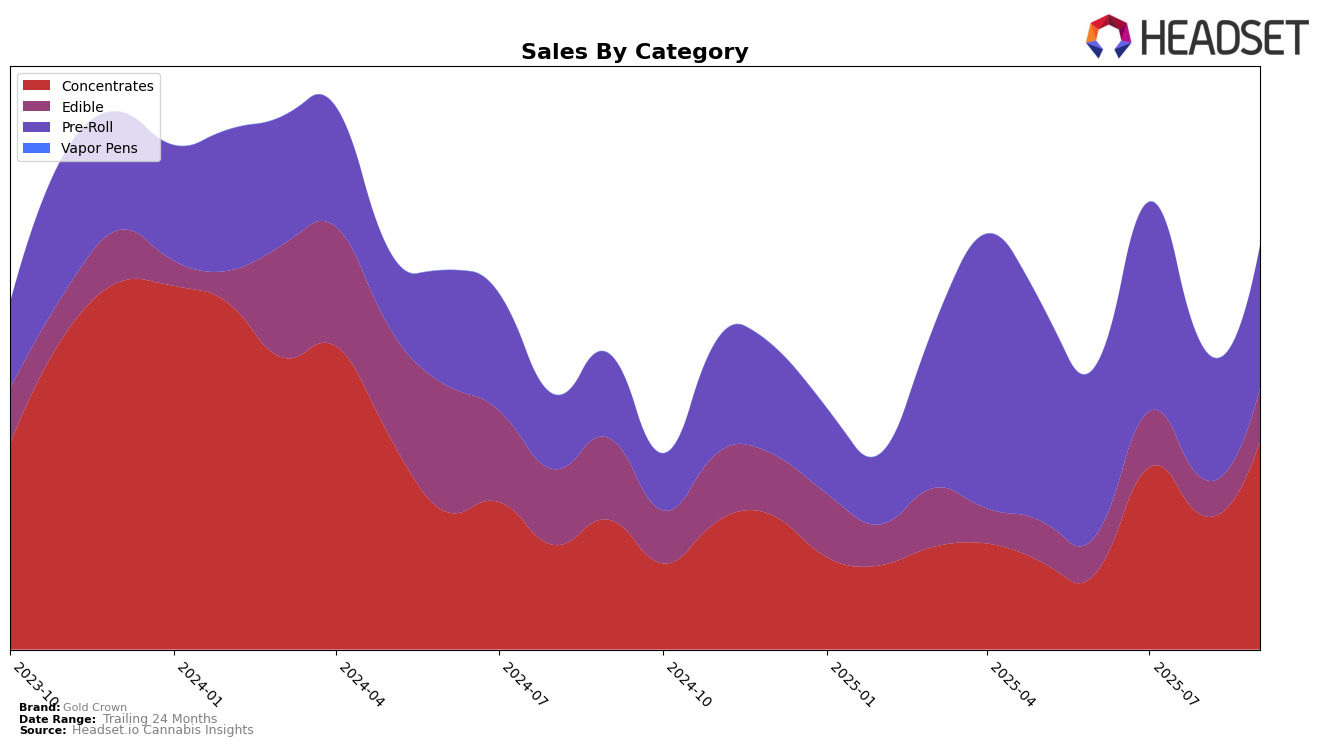

Gold Crown has demonstrated notable performance fluctuations across different product categories in Michigan. In the Concentrates category, the brand made significant strides, moving from a rank of 65 in June 2025 to breaking into the top 30 by July, then experiencing a minor dip in August before climbing back to 26th place by September. This upward trajectory is indicative of a strengthening presence in the Concentrates market, which is further supported by a consistent increase in sales figures over the months. Conversely, the Edible category shows a more modest improvement with Gold Crown hovering around the 70s in rankings, suggesting a need for strategic adjustments to enhance its competitive edge in this segment.

The Pre-Roll category presents a mixed picture for Gold Crown in Michigan. While the brand started at a rank of 74 in June, it experienced a dip in August, falling out of the top 90, before recovering slightly to 85th place by September. This fluctuation highlights potential volatility or competitive challenges within this category. Despite these challenges, the sales figures for Pre-Rolls suggest that there is a loyal customer base, yet there is room for improvement in terms of market positioning. The absence of Gold Crown in the top 30 across any category in some months indicates areas where the brand could focus efforts to enhance visibility and market share.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Gold Crown has shown a notable upward trajectory in its rankings over the summer months of 2025. Starting from a rank of 65 in June, Gold Crown made a significant leap to rank 30 in July, although it slightly dipped to 42 in August before recovering to 26 in September. This improvement in rank suggests a positive reception and growing market presence, especially when compared to competitors like Cloud Cover (C3), which experienced a decline from rank 16 in June to 24 in September. Meanwhile, Grimas consistently improved its position, reaching rank 25 in September, slightly ahead of Gold Crown. The sales figures indicate that while Gold Crown's sales are lower than some of its competitors, its growth trend is promising, especially as it competes closely with brands like Oceana Gardens, which also saw an upward trend, moving from rank 63 in June to 28 in September. As Gold Crown continues to climb the ranks, it positions itself as a formidable player in the Michigan concentrates market.

Notable Products

In September 2025, Gold Crown's top-performing product was Pink Passion Fruit Crumble (1g) in the Concentrates category, securing the number one position with sales figures reaching 2206 units. Following closely, Blueberry Runtz Budder (1g) held the second spot, while Category #5 Budder (1g) ranked third. Notably, Jesters - Sour Diesel Live Resin Infused Pre-Roll (1.5g) came in fourth, maintaining its rank from previous months. Meanwhile, Jesters - Northern Lights Infused Pre-Roll (1.5g) saw an improvement, climbing from fourth in August to fifth in September. These shifts highlight a strong performance in Concentrates and Pre-Roll categories for Gold Crown this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.