Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

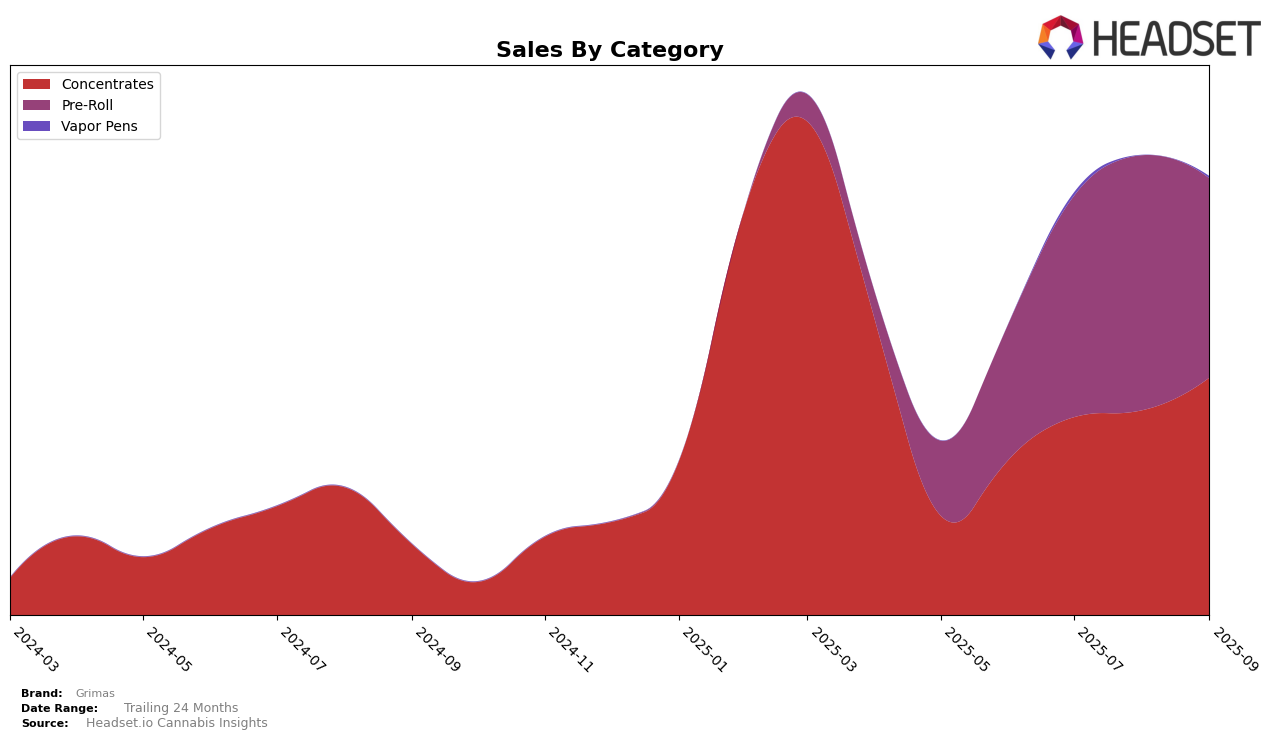

Grimas has shown notable performance improvements in the Concentrates category in Michigan. Over the summer months of 2025, Grimas climbed from a rank of 40 in June to an impressive 25 by September. This upward trajectory suggests a growing consumer preference for Grimas' Concentrates, as evidenced by a steady increase in sales from June to September. However, it's important to note that Grimas did not break into the top 30 brands in Michigan for the Pre-Roll category during this period, indicating potential challenges or competitive pressures in this segment.

In the Pre-Roll category, Grimas experienced fluctuating rankings, starting at 91 in June, peaking at 65 in August, but then dropping to 78 by September in Michigan. Despite this volatility, the brand did see a significant sales boost in July and August, suggesting periods of strong consumer engagement. The decline in September might point to seasonal shifts or increasing competition. The absence of a top 30 ranking in this category suggests that while there are moments of success, Grimas may need to strategize further to secure a more consistent standing in the Pre-Roll market.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Grimas has shown a notable upward trajectory in its rankings, moving from 40th place in June 2025 to 25th place by September 2025. This improvement in rank is indicative of a positive sales trend, as Grimas's sales figures have consistently increased over this period. In contrast, Cloud Cover (C3) experienced a decline in rank, dropping from 16th to 24th, with a corresponding decrease in sales from July to September. Similarly, Mac Pharms saw a drop in rank from 12th to 23rd, which aligns with a downward sales trend. Meanwhile, Gold Crown showed a significant improvement, climbing from 65th in June to 26th in September, suggesting a competitive threat to Grimas's recent gains. These shifts highlight Grimas's growing presence in the market, but also underscore the competitive pressures from brands like Gold Crown that are rapidly gaining ground.

Notable Products

In September 2025, Grimas saw Pink Starburst Infused Pre-Roll (1.5g) maintain its top position in the Pre-Roll category with sales of 2703 units. Juice Man Infused Pre-Roll (1.5g) climbed to second place, despite a decrease in sales from the previous month. Berry Runtz Infused Pre-Roll (1.5g) made its debut in the rankings, securing the third spot. Lemon Cherry Gelato and Blue Milk Infused Pre-Rolls followed closely, ranking fourth and fifth respectively. Notably, Pink Starburst has consistently held the number one spot since June, showing a strong market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.