Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

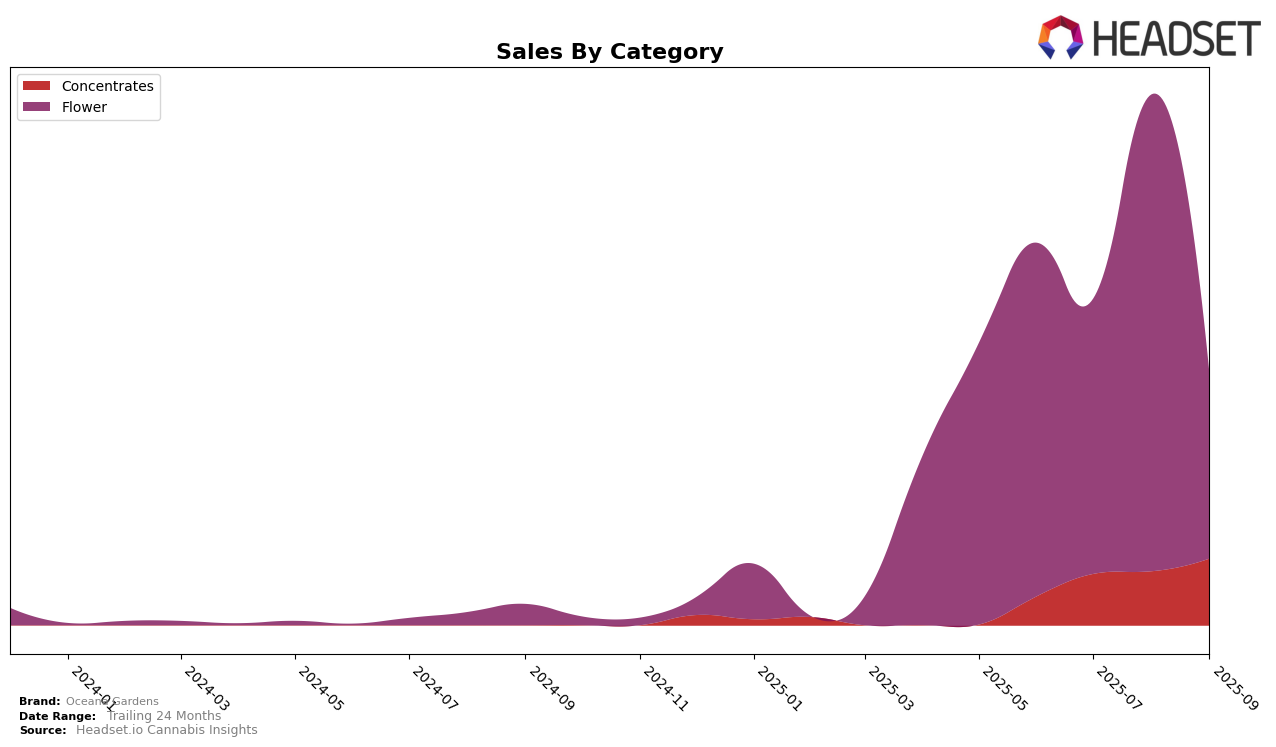

Oceana Gardens has shown a notable upward trajectory in the Concentrates category in Michigan. Starting from a rank of 63 in June 2025, the brand has climbed to 28 by September 2025. This ascent into the top 30 is indicative of a strong performance, especially considering their sales increase from $55,080 in June to $126,054 in September. The upward movement suggests a growing consumer preference or effective market strategies in this category, positioning Oceana Gardens as a brand to watch in Michigan's concentrates market.

In contrast, the Flower category tells a different story for Oceana Gardens in Michigan. The brand's ranking fluctuated significantly, starting at 41 in June, dropping to 52 in July, then rising to 31 in August, and finally plummeting to 65 in September. This volatility, coupled with a decrease in sales from $667,287 in June to $349,399 in September, indicates challenges in maintaining a stable market position within this category. The drop out of the top 30 in September highlights potential areas for improvement or shifts in consumer preferences that the brand may need to address.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Oceana Gardens experienced notable fluctuations in its rank and sales performance from June to September 2025. Initially ranked 41st in June, Oceana Gardens saw a dip to 52nd place in July, before making a significant leap to 31st in August. However, by September, the brand's rank fell to 65th, indicating a volatile market presence. This fluctuation contrasts with competitors like Strane, which showed a steady improvement from 69th to 54th over the same period, and Rkive Cannabis, which re-entered the top 100 in August and climbed to 57th by September. Meanwhile, Cheech & Chong's and The 8th by White Boy Rick demonstrated less dramatic changes, maintaining relatively stable positions. Despite Oceana Gardens' impressive sales spike in August, the subsequent decline in September suggests challenges in sustaining momentum, highlighting the competitive pressures and dynamic nature of the Michigan flower market.

Notable Products

In September 2025, Oceana Gardens saw Orange Cream Pop (3.5g) take the top spot in sales, marking it as the leading product for the month. Garlic Budder (3.5g) followed closely as the second-best performer, showcasing strong demand in the Flower category. Orange Cream Pop (14g) held the third position, despite a slight drop from its second-place ranking in June and July. Garlic Budder (14g) and Squirt (Bulk) maintained their positions at fourth and fifth respectively, indicating consistent performance over the months. Notably, Orange Cream Pop (3.5g) achieved remarkable sales figures, reaching $10,001 in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.