Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

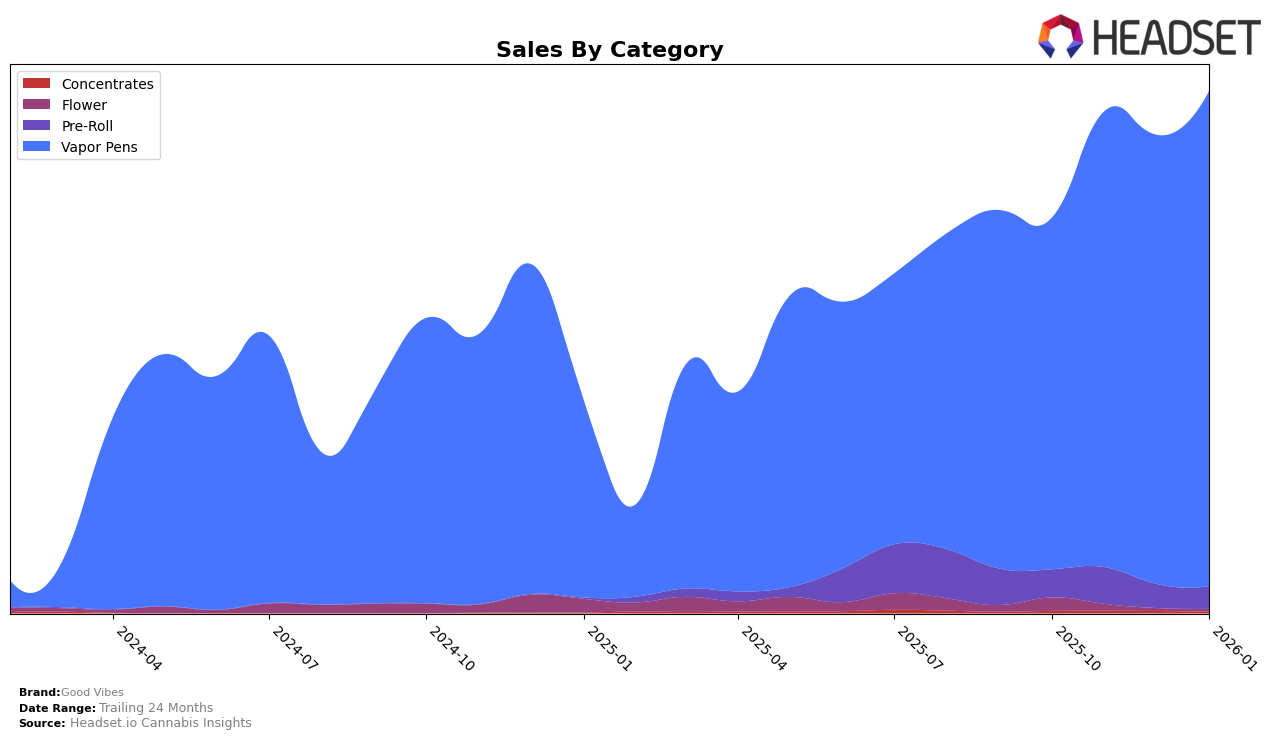

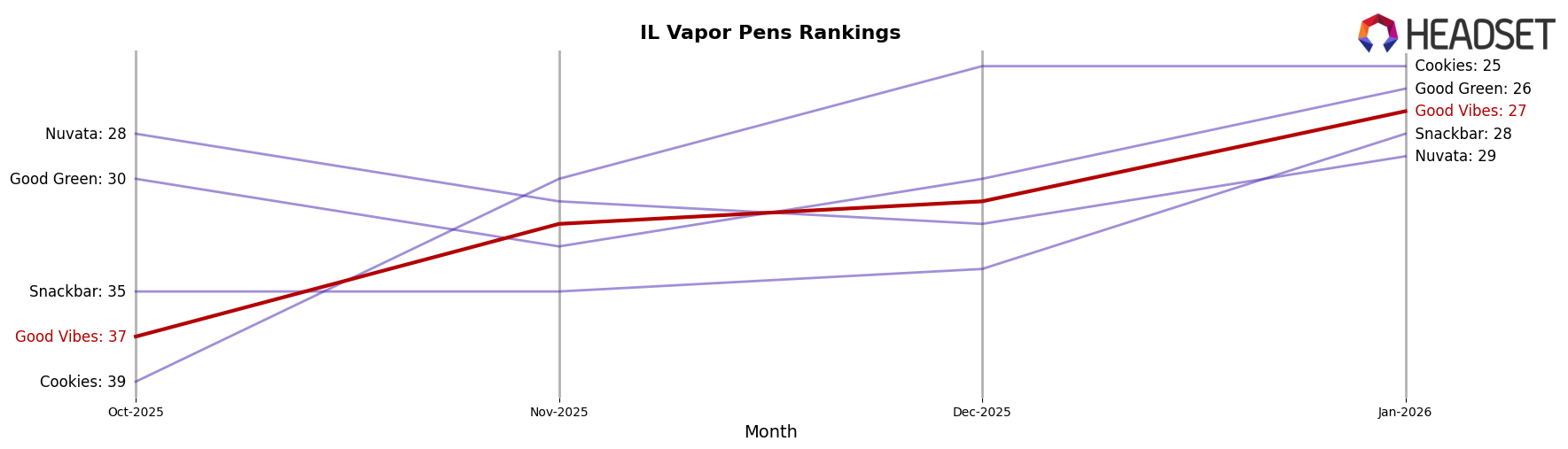

Good Vibes has shown a promising upward trajectory in the Vapor Pens category within Illinois. Starting from October 2025, the brand was ranked 37th, but by January 2026, it had climbed to the 27th position. This notable improvement suggests a strengthening market presence and increased consumer preference for their products in this category. The sales figures reflect this positive trend, as there was a steady increase from $201,826 in October to $284,307 by January, indicating a robust growth trajectory in Illinois. However, it's important to note that the brand's absence from the top 30 in October highlights the competitive nature of the market and the brand's efforts to secure a stronger foothold.

Across other states and categories, Good Vibes' performance appears varied, with some areas showing potential for growth while others remain challenging. The lack of ranking in certain states and categories suggests that the brand is still working to establish itself more firmly in those markets. This could indicate either a nascent stage of market entry or challenges in gaining traction against established competitors. The upward movement in Illinois, however, provides a blueprint for potential strategies that could be replicated in other regions. As the brand continues to navigate these diverse markets, it will be crucial to monitor how they leverage their strengths in Vapor Pens to potentially improve their standings in other categories and states.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Good Vibes has demonstrated a positive trajectory in both rank and sales over the past few months. Starting from a rank of 37 in October 2025, Good Vibes improved to 27 by January 2026, indicating a steady climb within the top 30 brands. This upward movement is significant when compared to competitors like Cookies, which maintained a consistent rank of 25 from December 2025 to January 2026, and Nuvata, which fluctuated slightly but remained around the 30th position. Meanwhile, Snackbar and Good Green showed less dramatic changes, with Snackbar moving from 35 to 28 and Good Green from 30 to 26 over the same period. Good Vibes' sales growth aligns with its rank improvement, suggesting effective market strategies and growing consumer preference. This trend positions Good Vibes as a rising contender in the Illinois vapor pen market, potentially poised to challenge higher-ranked brands if the momentum continues.

Notable Products

In January 2026, Good Vibes' top-performing product was the Jelli Rancher Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its leading position from the previous months with sales of 481 units. The White Runts Live Resin Disposable (2g) rose to the second position, up from third in November 2025, indicating a strong upward trend. The Banana Cream Live Resin Cartridge (1g) experienced a slight drop, moving from first place in December 2025 to third in January 2026. Meanwhile, the Banana Cream Live Resin Cartridge (2g) and Jelli Rancher Live Resin Disposable (2g) both held steady in third and fourth positions, respectively, since December 2025. This data reflects a consistent demand for the Jelli Rancher and Banana Cream product lines within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.