Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

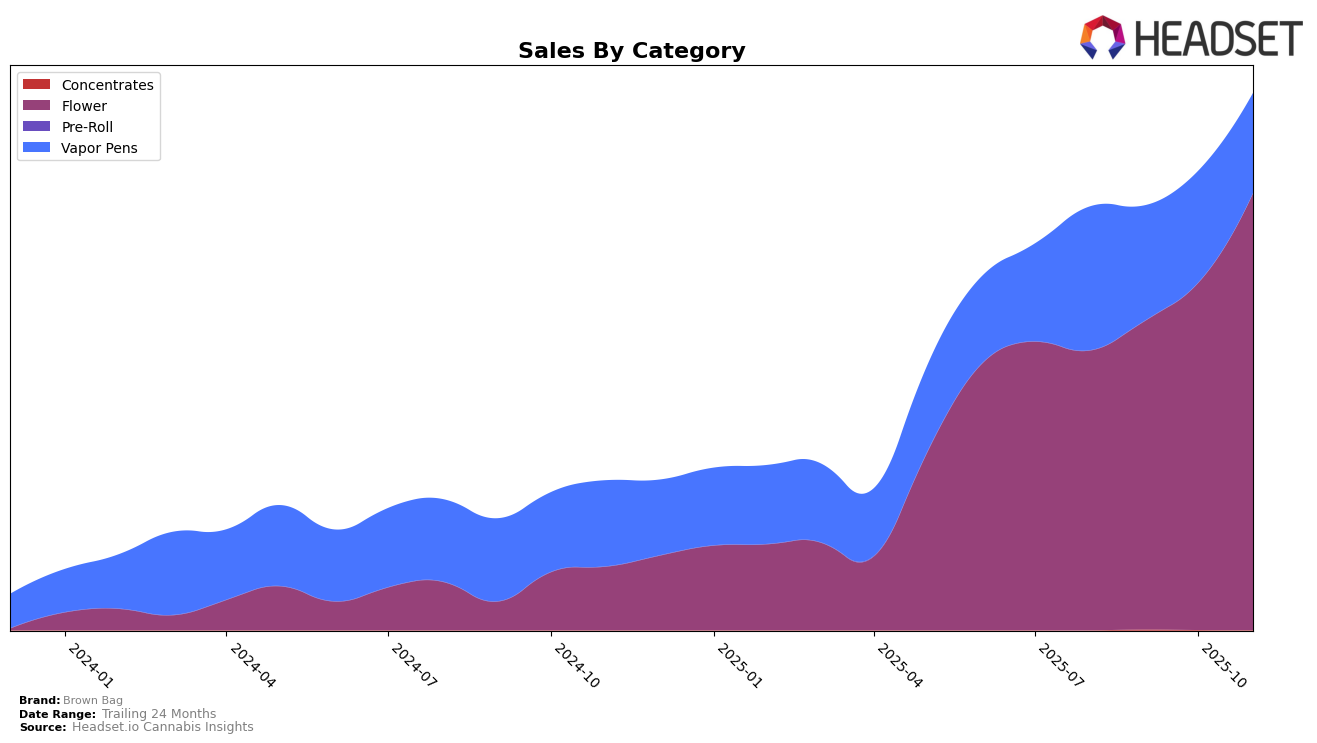

Brown Bag has demonstrated a strong performance in the Flower category within Arizona, maintaining a consistent ranking at the 4th position from September to November 2025. This stability in ranking suggests a solid market presence and consumer preference within this category. The brand's sales in this category have shown an upward trend, with a notable increase from September to November, indicating growing consumer demand. However, in the Vapor Pens category, Brown Bag's ranking has seen a decline, slipping from 10th place in August to 14th place by November. This downward movement could imply increased competition or a shift in consumer preferences away from Brown Bag's Vapor Pens offerings in the Arizona market.

Interestingly, while Brown Bag has maintained its top 5 position in the Flower category in Arizona, the brand does not appear in the top 30 rankings for other categories in the state, which could suggest a narrower product focus or less competitive offerings in other segments. The absence from the top 30 in additional categories might be a point of concern for the brand, as it highlights areas where Brown Bag could potentially expand or improve its market strategy. The significant increase in Flower sales, however, underscores the brand's strength in this particular category, providing a foundation for potential growth and expansion strategies.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Brown Bag has maintained a steady position, ranking 4th from September to November 2025, after climbing from 5th in August. This consistent ranking highlights its resilience and growing market presence, especially as competitors like Shango improved their rank from 9th to 5th during the same period. Despite Mohave Cannabis Co. and Find. holding the top two spots consistently, Brown Bag's sales trajectory is noteworthy, with a significant increase from August to November, suggesting a robust demand and effective market strategies. Meanwhile, Dr. Greenthumb's showed a slight improvement in rank, moving from 8th in September to 6th in November, yet their sales figures remain lower compared to Brown Bag. This data underscores Brown Bag's competitive edge and potential for further growth in the Arizona Flower market.

Notable Products

In November 2025, Grease Monkey (3.5g) from Brown Bag emerged as the top-performing product, securing the number one rank in the Flower category with sales reaching 2028 units. Blackberry Jam Distillate Cartridge (1g) climbed to the second position in Vapor Pens, improving from the third rank in October 2025, with sales of 1950 units. Pressure (3.5g) debuted in the rankings at the third spot in the Flower category, showing strong initial sales. Clementine OG (14g) and Midnight Sherb (14g) followed closely, ranking fourth and fifth respectively, both making their first appearance in the rankings. These shifts highlight a dynamic change in consumer preferences within Brown Bag's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.