Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

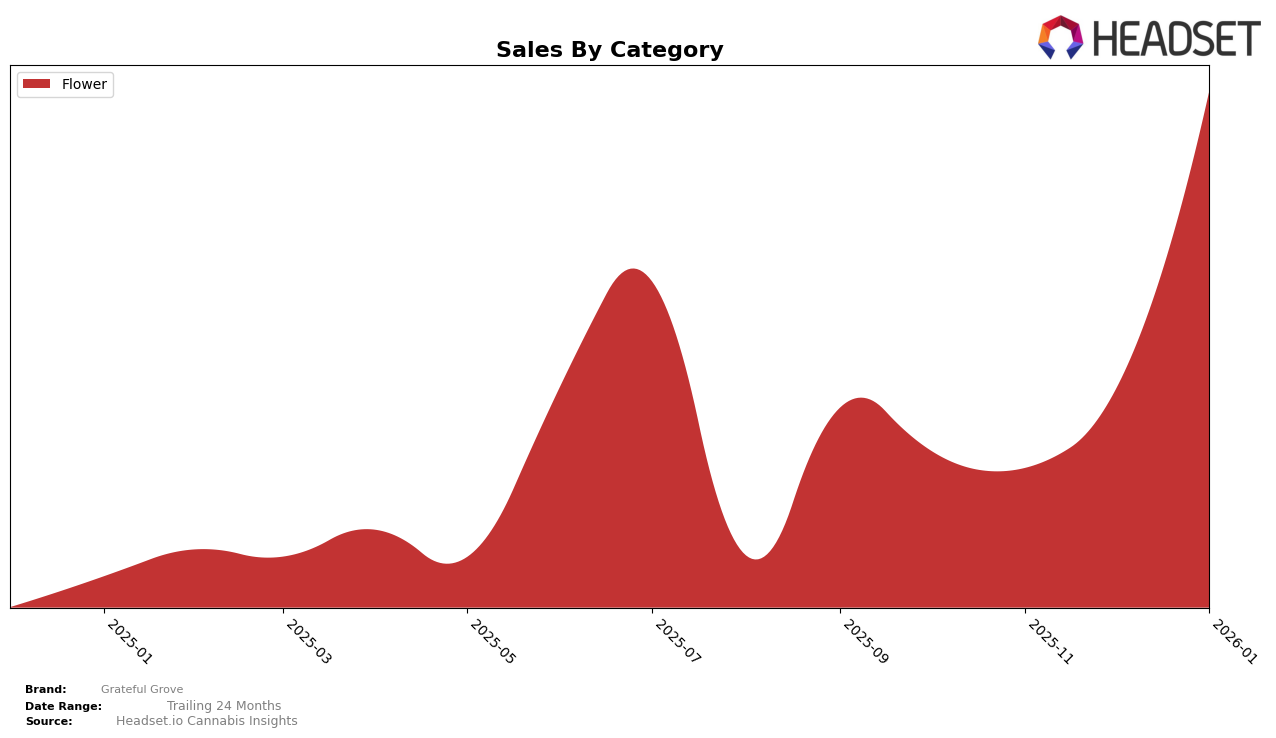

Grateful Grove has shown a noteworthy upward trajectory in the Colorado market, particularly within the Flower category. Starting from a position outside the top 30 in October 2025, the brand made significant strides to secure the 22nd rank by January 2026. This progression highlights a robust growth pattern, especially considering the substantial sales increase from October to January. While Grateful Grove was not initially in the top 30, their rise to the 22nd spot indicates a successful strategy in capturing market share in a competitive landscape.

Despite the positive developments in Colorado, Grateful Grove's absence from the top 30 rankings in other states and categories suggests room for improvement and expansion opportunities. The brand's concentrated success in one state may point to a focused regional strategy, but it also highlights potential untapped markets elsewhere. This performance disparity across states and categories could be an area for strategic growth, as their current momentum in Colorado suggests they have the potential to replicate this success in other markets.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Grateful Grove has demonstrated a remarkable upward trajectory in recent months. Starting from a rank of 67 in October 2025, Grateful Grove surged to an impressive rank of 22 by January 2026, indicating a significant improvement in market positioning. This ascent is particularly notable when compared to competitors like Bonsai Cultivation, which saw a decline from rank 13 to 20 over the same period, and Boulder Built, which fluctuated but ended at rank 21. Meanwhile, Host and Pot Zero maintained relatively stable positions, with Host ending at rank 24 and Pot Zero improving to rank 23. Grateful Grove's sales growth trajectory aligns with its improved ranking, suggesting effective market strategies that have resonated well with consumers, positioning it as a rising contender in the Colorado Flower market.

Notable Products

In January 2026, Grateful Grove's top-performing product was Melted Strawberries (Bulk) in the Flower category, securing the first position with sales of 1292 units. White Burgundy (Bulk) followed closely in second place with 1185 units sold. Dr Who (Bulk) was third, with Bananaconda (Bulk) and Strawberry Adhesive (3.5g) tying for fourth place, each selling 895 units. Notably, Bananaconda (Bulk) rose from its previous rank of third in October 2025 to fourth in January 2026, indicating a slight decrease in its relative performance despite increased sales. The consistent top rankings of these products highlight their strong market presence and consumer preference within the Grateful Grove lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.