Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

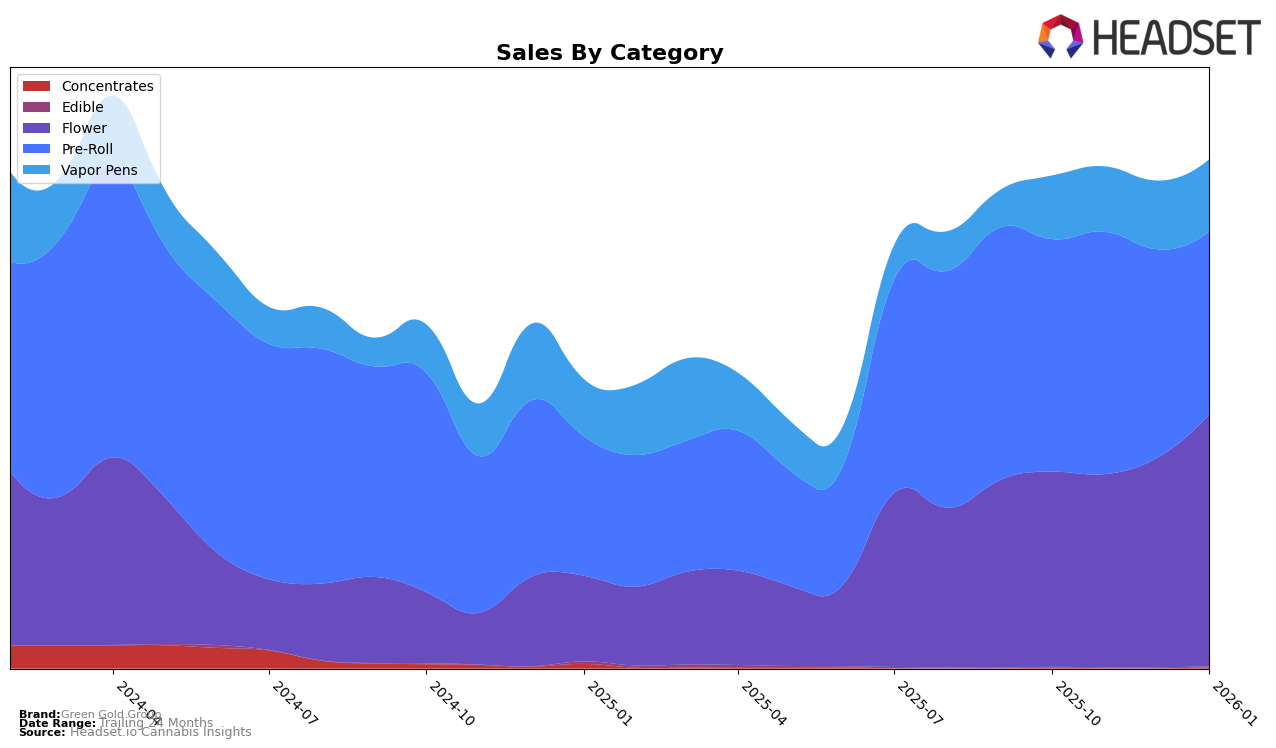

Green Gold Group has shown varying performance across different categories and states. In Massachusetts, the brand has made notable progress in the Flower category, where it climbed from a rank of 44 in December 2025 to 37 by January 2026. This upward movement indicates a growing consumer preference or successful marketing strategies in this category. However, in Alberta, the brand did not make it into the top 30 in the Flower category, as evidenced by the absence of a ranking, which could suggest challenges in market penetration or competition in that region.

In the Pre-Roll category within Massachusetts, Green Gold Group experienced fluctuations, dropping from the 20th rank in November 2025 to 23rd in January 2026, possibly indicating increased competition or shifting consumer preferences. Meanwhile, the Vapor Pens category showed a steady improvement in Massachusetts, with the brand moving up from 54th place in October 2025 to 47th by January 2026, suggesting a positive reception or increased brand visibility in this segment. These movements highlight the brand's varying success across categories and regions, offering insights into potential areas for strategic focus.

Competitive Landscape

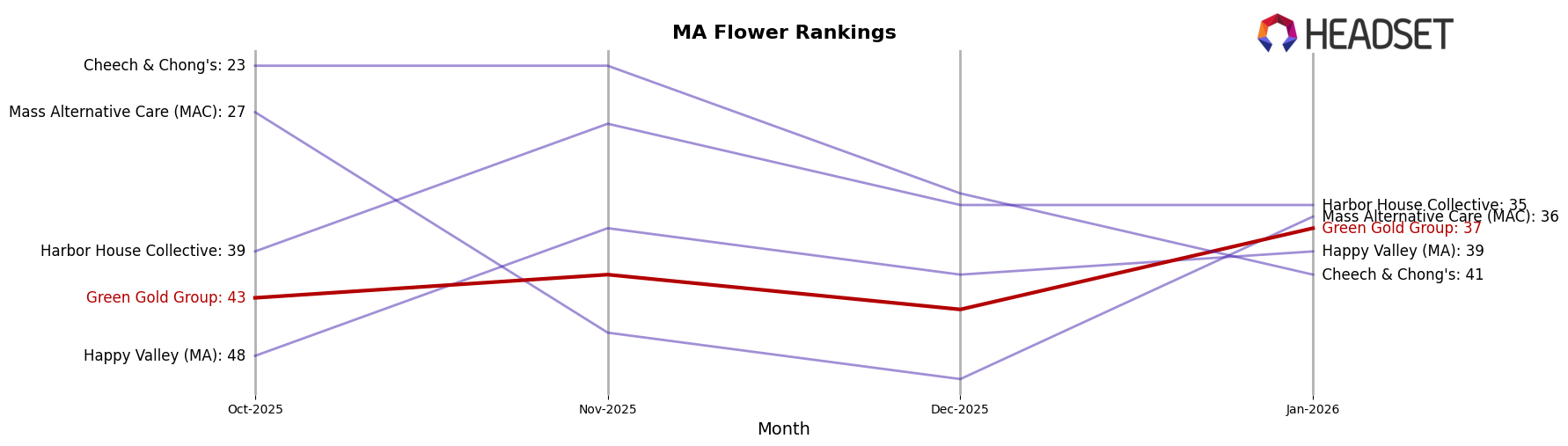

In the Massachusetts flower category, Green Gold Group has shown a steady improvement in its ranking from October 2025 to January 2026, moving from 43rd to 37th place. This upward trend in rank is accompanied by a consistent increase in sales, indicating a strengthening market presence. In contrast, Mass Alternative Care (MAC) experienced fluctuations, with its rank dropping significantly from 27th in October to 36th in January, reflecting a volatile sales performance. Meanwhile, Happy Valley (MA) and Harbor House Collective maintained relatively stable rankings, with Happy Valley showing a slight decline and Harbor House Collective holding steady. Notably, Cheech & Chong's saw a decline from 23rd to 41st, suggesting a significant drop in sales during this period. These dynamics highlight Green Gold Group's competitive edge in the Massachusetts flower market, as it continues to climb the ranks amidst varying performances from its competitors.

```

Notable Products

In January 2026, the top-performing product from Green Gold Group was Space Center Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from the previous month with sales of 6,814 units. The Mac n' Cheese Pre-Roll (1g) climbed to the second position, showing a notable improvement from its absence in December 2025 rankings, with sales reaching 4,143 units. Glazed Ice Pre-Roll (1g) dropped to third place from its top rank in November 2025, reflecting a decrease in sales momentum. Rainbow MAC Pre-Roll (1g) secured the fourth spot, consistent with its December 2025 ranking. Additionally, Rainbow MAC (3.5g) emerged in the rankings at fifth place, highlighting its entry into the top five products for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.