Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

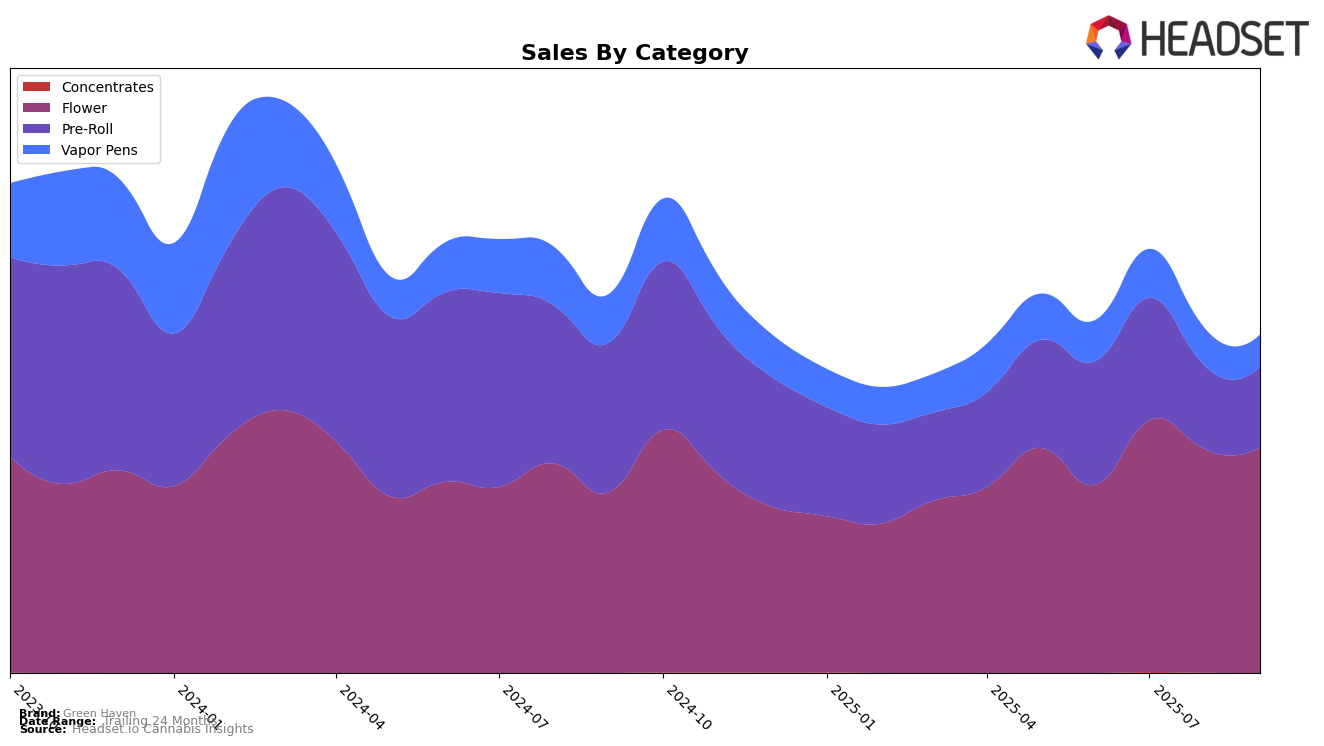

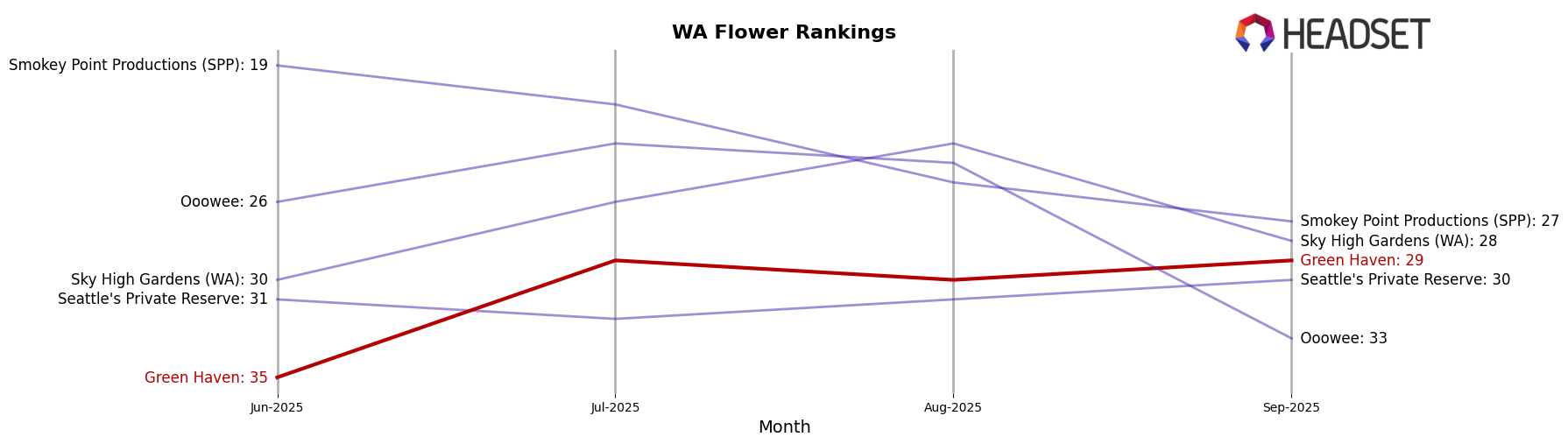

Green Haven's performance in the Washington cannabis market has shown varied results across different product categories. In the Flower category, Green Haven managed to break into the top 30 by July 2025, improving from a rank of 35 in June to 29 in September. This upward trend suggests a positive reception and growing consumer interest in their flower offerings. On the other hand, their presence in the Pre-Roll category has been less stable, with rankings fluctuating and failing to enter the top 30, peaking at 35 in June and descending to 47 by September. Such fluctuations indicate potential challenges in maintaining a consistent market share in this category.

The Vapor Pens category presents a different narrative for Green Haven in Washington. Here, the brand has not managed to gain significant traction, as evidenced by rankings that have remained outside the top 80 since June. Despite a slight improvement from 86 in June to 80 in July, the subsequent decline to 98 by September highlights a competitive struggle in this segment. It's noteworthy that while the Flower category shows promise, the brand's vapor pen sales are not following the same positive trajectory. This divergence in performance across categories underscores the varying levels of consumer engagement with Green Haven's product offerings in the state.

Competitive Landscape

In the Washington flower category, Green Haven has shown a notable improvement in its ranking over the summer months of 2025, climbing from 35th in June to 29th in July, maintaining a steady position through August and September. This upward trend indicates a positive reception in the market, despite not breaking into the top 20. In comparison, Sky High Gardens (WA) and Ooowee have experienced fluctuations, with Sky High Gardens peaking at 23rd in August before dropping to 28th in September, and Ooowee falling from 24th in August to 33rd in September. Meanwhile, Smokey Point Productions (SPP) has seen a decline from 19th in June to 27th in September, suggesting potential challenges in maintaining their market position. Green Haven's consistent improvement in rank, despite not reaching the top 20, suggests a growing brand presence and potential for further market penetration, especially as competitors face volatility.

Notable Products

In September 2025, the top-performing product for Green Haven was Where's My Bike ? (3.5g) in the Flower category, which climbed to the number one spot with sales of 1558 units. Thai Stick Infused Pre-Roll (1g), previously holding the top rank, shifted to second place. Gelato Cake (3.5g) remained steady at third place in the Flower category, showing a slight decrease in sales compared to August. The Thai Stick Infused Pre-Roll 2-Pack (1g) maintained its fourth position in the Pre-Roll category. Notably, Where's My Bike Pre-Roll 12-Pack (7.2g) retained its fifth position since its debut in August, indicating consistent demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.