Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

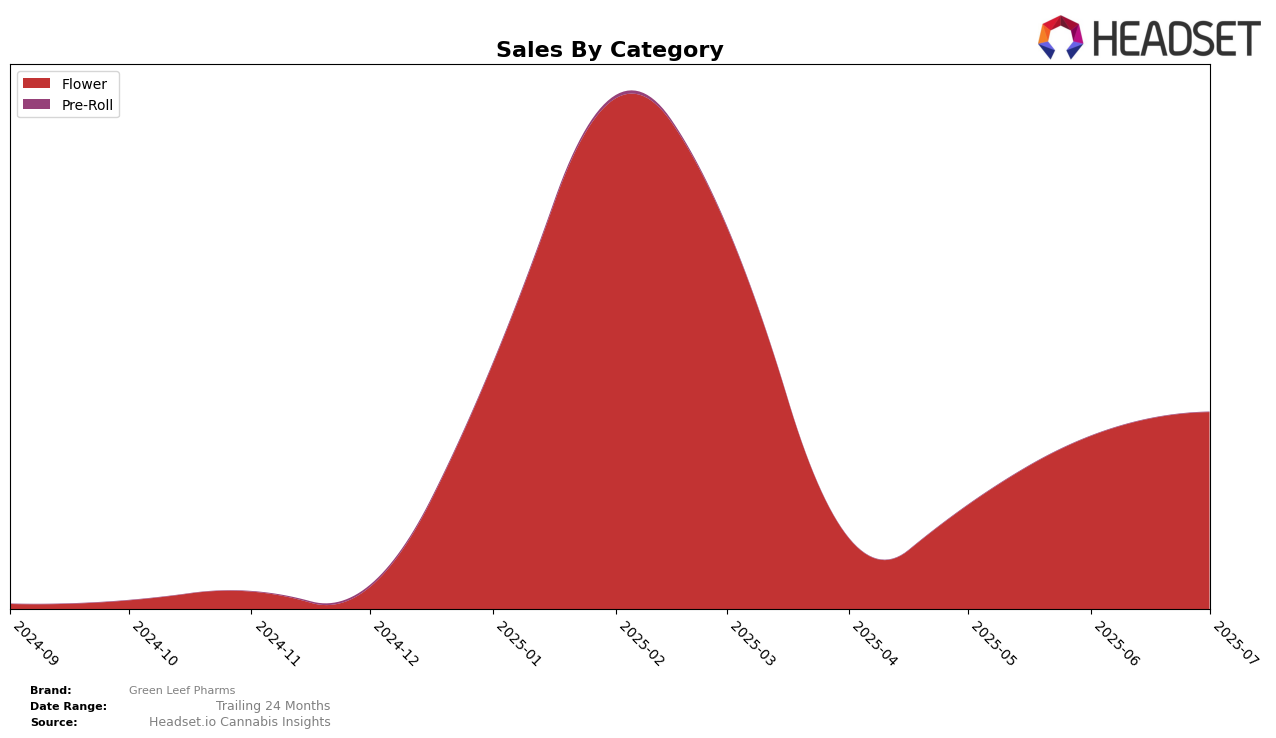

Green Leef Pharms has shown a notable upward trajectory in the Arizona market, particularly within the Flower category. Over the span from April to July 2025, the brand climbed from a rank of 45 to break into the top 30 by July, indicating a significant improvement in its market position. This ascent is underscored by a steady increase in sales, which more than doubled during this period. The ability to move from being outside the top 30 to securing a spot at 29th suggests a strategic strengthening in either product offerings or market penetration strategies.

Despite these gains in Arizona, Green Leef Pharms' absence from the top 30 in other states and categories could point to challenges in replicating this success elsewhere. The lack of presence in additional markets might highlight opportunities for expansion or areas where competitive pressures are more pronounced. This contrast between their performance in Arizona and other regions suggests that while they are making strides, there is still considerable room for growth and diversification across different states and product categories.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Green Leef Pharms has shown a promising upward trajectory in its rankings from April to July 2025. Starting from a rank of 45 in April, it climbed to 29 by July, indicating a significant improvement. This positive trend suggests that Green Leef Pharms is gaining traction in the market, potentially due to strategic marketing efforts or product innovations. In contrast, competitors like 22Red and Daze Off have experienced fluctuations in their rankings, with 22Red moving from 30 to 27 and Daze Off dropping from 27 to 31 over the same period. Meanwhile, TRIP saw a decline from 19 to 28, and Sublime remained relatively stable, albeit with a slight drop from 26 to 30. These shifts highlight a dynamic market where Green Leef Pharms is emerging as a stronger contender, potentially capturing market share from its competitors.

Notable Products

In July 2025, Whiplash #1 (3.5g) maintained its top position for Green Leef Pharms, with sales reaching 12,190 units, marking it as the best-performing product. Glitter Gust (3.5g) held steady at the second rank, indicating consistent consumer demand. Cheetah Piss (3.5g) retained the third rank, showing a slight decline in sales compared to May 2025 but still performing well. Blue Cannonballs (3.5g) entered the rankings at fourth place, reflecting a new interest in this product. Snoop Dog OG (14g) remained in the fifth spot, indicating stable but modest sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.