Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

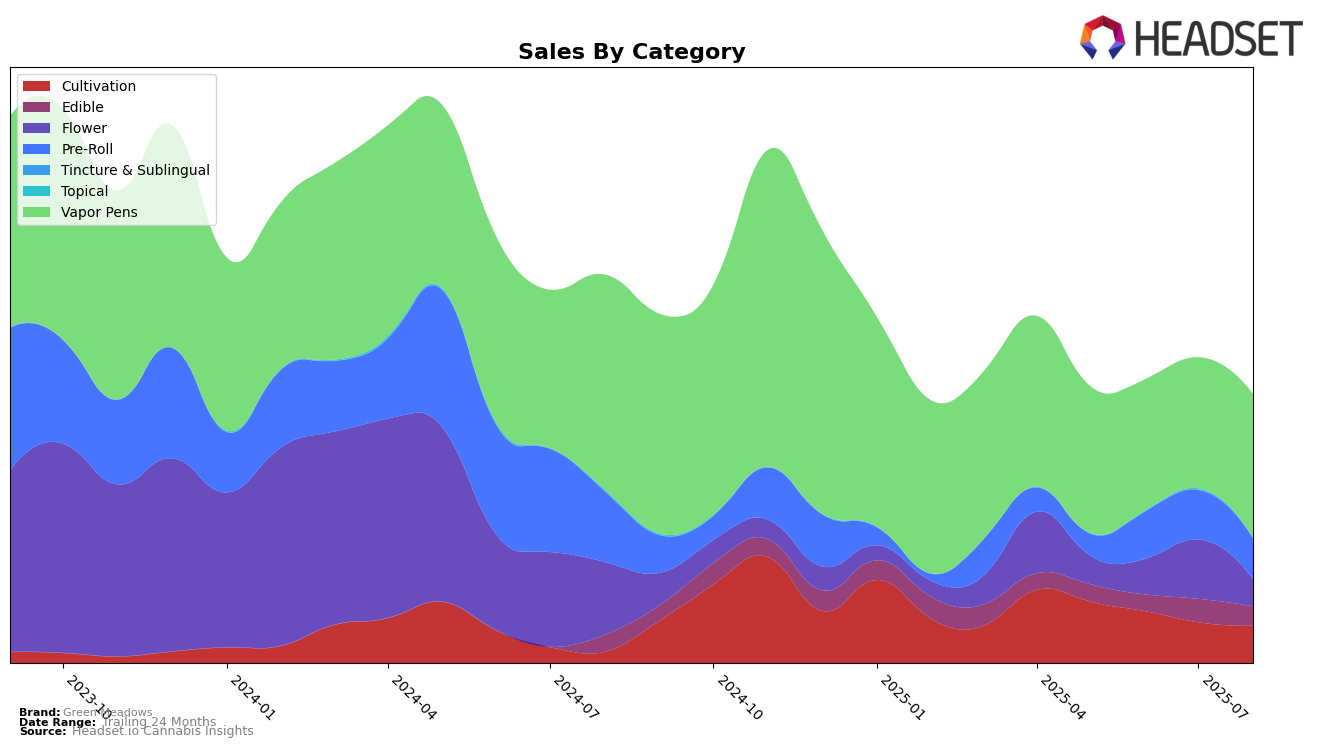

Green Meadows has shown varied performance across different product categories in Massachusetts. In the Edible category, the brand has struggled to break into the top 30, with rankings fluctuating from 54th in May and June to 45th in July, before dropping slightly to 49th in August. Despite not making it to the top 30, there was a notable spike in sales in July, suggesting a temporary increase in consumer interest. Conversely, in the Vapor Pens category, Green Meadows has maintained a more stable presence, with rankings hovering around the mid-40s. This consistency, coupled with a recent uptick in sales in August, could indicate a strengthening position in this segment.

The performance of Green Meadows across these categories highlights their varying market penetration and consumer appeal. While the Edible category remains a challenge, the brand's steady rankings in Vapor Pens suggest a more established foothold. The lack of top 30 rankings in Edibles could be seen as a potential area for growth and improvement. Meanwhile, the slight improvement in Vapor Pen sales in August might hint at effective marketing strategies or product offerings that resonate well with consumers. These movements underscore the dynamic nature of the cannabis market in Massachusetts and the need for brands like Green Meadows to continuously adapt and innovate to capture market share.

Competitive Landscape

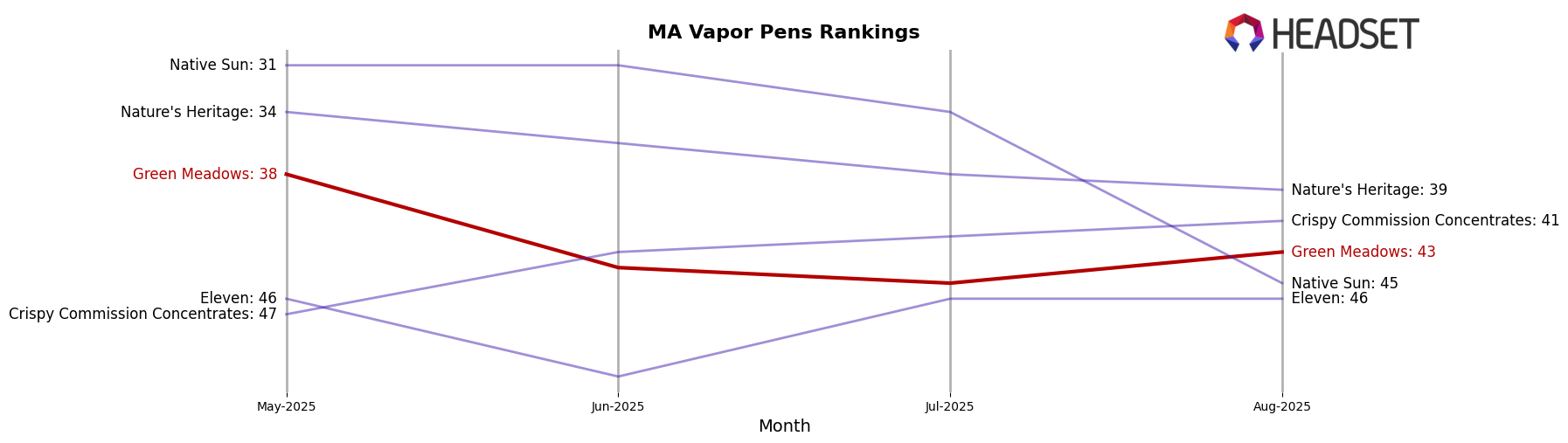

In the Massachusetts vapor pen category, Green Meadows has experienced fluctuations in its competitive positioning, with its rank slipping from 38th in May 2025 to 43rd by August 2025. This decline in rank corresponds with a notable decrease in sales, although there was a slight recovery in August. In contrast, Nature's Heritage maintained a relatively stable rank, hovering around the mid-30s, while Crispy Commission Concentrates improved its rank significantly from 47th to 41st, reflecting a strong upward sales trend. Meanwhile, Native Sun experienced a sharp drop in rank from 31st to 45th, indicating a substantial decline in sales. These dynamics suggest that while Green Meadows faces challenges in maintaining its market position, competitors like Crispy Commission Concentrates are gaining ground, potentially impacting Green Meadows' market share and necessitating strategic adjustments to regain momentum.

Notable Products

In August 2025, the top-performing product for Green Meadows was Fanta Sea Pre-Roll (1g), which rose to the number one rank with notable sales of 2,623 units. Black Apple Pre-Roll (1g) maintained a strong presence, securing the second position with a slight increase in sales compared to July. Mango Madness Pre-Roll (1g) entered the rankings at number three, showcasing a significant impact on the market. Flavor Burst Pre-Roll (1g) reappeared in the rankings, securing the fourth spot despite a drop in sales from previous months. The Tank - Blue Dream Distillate Disposable (1g) remained consistent in its fifth position, indicating steady performance in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.