Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

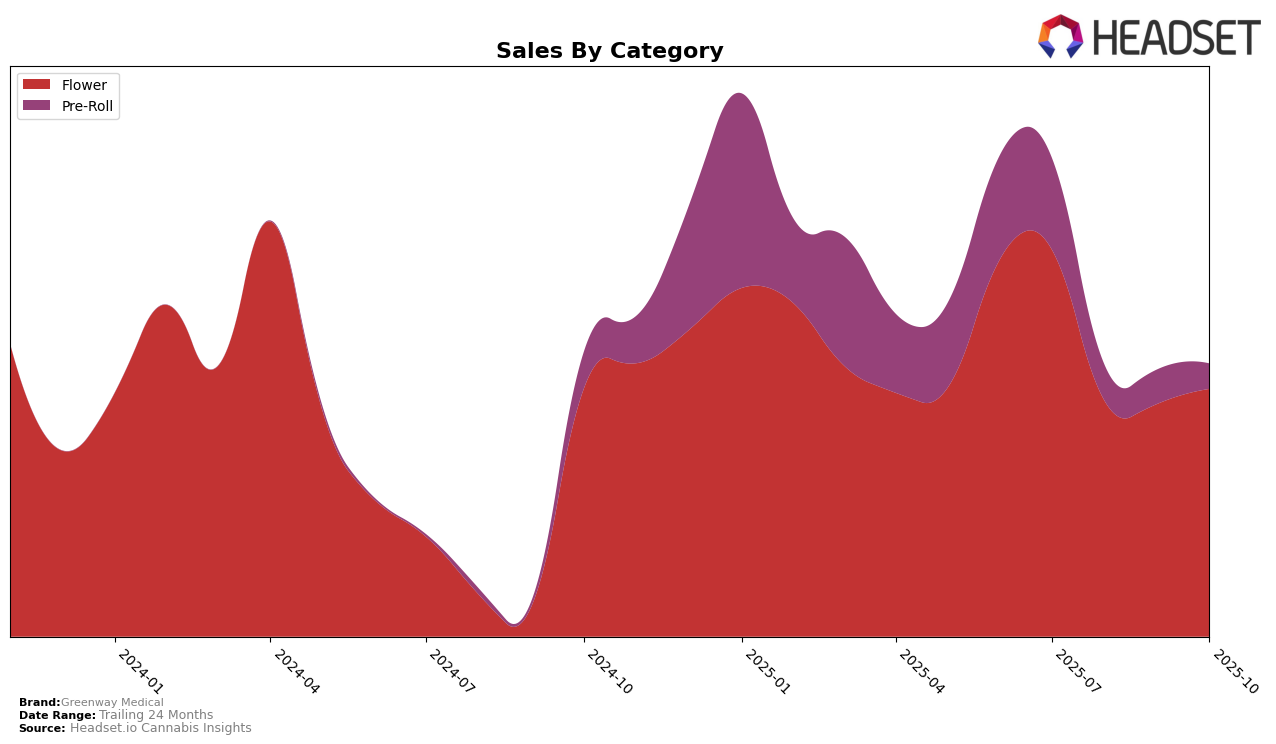

Greenway Medical has shown varied performance across different categories and states. In the Nevada market, the brand's presence in the Flower category has seen some fluctuations. Starting from a rank of 20 in July 2025, they dropped out of the top 30 in August but managed to climb back to 29 by September and improved slightly to 28 in October. This indicates a potential recovery or stabilization in their Flower category sales in Nevada, despite a noticeable dip in sales from July to August. Such movements suggest that while Greenway Medical faced challenges, there might be underlying efforts to regain market traction.

Conversely, the performance in the Pre-Roll category in Nevada paints a different picture. The brand started at rank 25 in July but fell out of the top 30 by August, and even further by October, indicating a downward trend. The decline in sales from July to October further underscores this challenging period for their Pre-Roll offerings. The absence from the top 30 in consecutive months might reflect increasing competition or shifting consumer preferences in this category. This data highlights the importance of market adaptability and strategic adjustments for Greenway Medical to maintain or improve its standings.

Competitive Landscape

In the competitive landscape of the Nevada flower market, Greenway Medical has experienced fluctuating rankings over the past few months, indicating a dynamic market position. In July 2025, Greenway Medical held a strong 20th rank, but by August, it had slipped to 32nd, before recovering slightly to 28th by October. This volatility suggests a competitive environment where brands like Trichome and GB Sciences have shown significant movements, with Trichome notably climbing from 59th to 29th, indicating a robust growth trajectory. Meanwhile, BLVD and Super Good have also demonstrated competitive sales figures, with Super Good achieving a higher rank than Greenway Medical in October. These shifts highlight the need for Greenway Medical to strategize effectively to maintain and improve its market position amidst aggressive competitors.

Notable Products

In October 2025, the top-performing product for Greenway Medical was Electrolime (3.5g) in the Flower category, maintaining its consistent number 1 ranking since July. Cap Junky (3.5g) also performed well, ranking second in October, showing a strong resurgence from its absence in September. Jungle Pie (3.5g) held steady at the third position across the months, indicating stable demand despite fluctuations in sales figures. New to the top ranks, Divorce Cake (3.5g) entered at the fourth position, while Gas Line Pre-Roll (1g) made its debut in fifth place. Notably, Electrolime (3.5g) achieved sales of 2,566 units in October, highlighting its continued popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.