Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

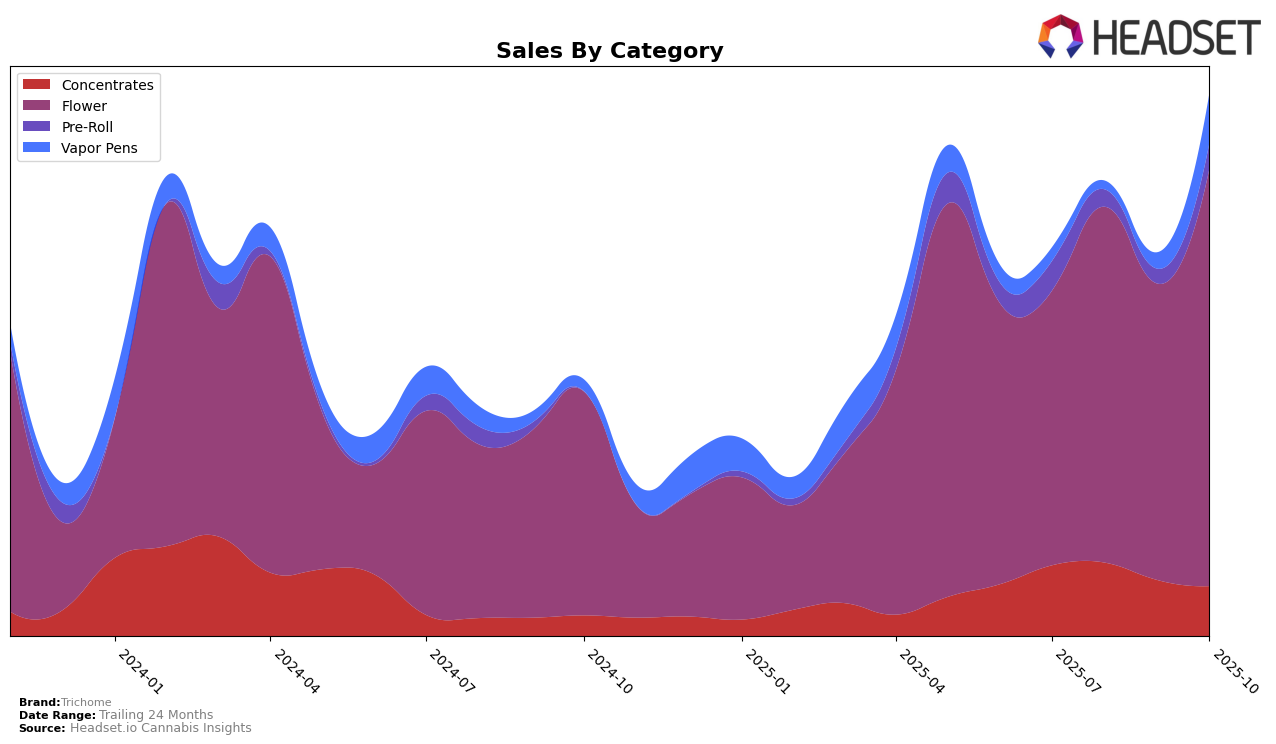

Trichome has demonstrated varied performance across different categories and states in recent months, showcasing both opportunities and challenges. In Nevada, the brand has made notable strides in the Flower category, climbing from the 59th position in July to break into the top 30 by October. This upward trajectory is reflective of a significant increase in sales, suggesting successful strategies or product offerings in this category. However, Trichome's performance in the Pre-Roll category in Nevada has been inconsistent, as it was not ranked in the top 30 for two months, indicating potential areas for improvement. Meanwhile, their entry into the Vapor Pens category in Nevada in September at rank 51, and subsequent rise to 37 by October, signals a promising potential for growth in this segment.

In Oregon, Trichome's presence in the Concentrates category has been relatively stable, maintaining a position just outside the top 30 throughout the months. This consistency might suggest a loyal customer base, though the slight dip in ranking to 35 in October could warrant attention. Conversely, the brand's performance in the Flower category in Oregon has seen a decline, moving from 44th in July to 61st in October. This downward trend might reflect increased competition or shifts in consumer preferences, and could be an area for strategic reassessment. Overall, Trichome's varied performance across these states and categories highlights both their successes and the challenges they face in maintaining and expanding their market presence.

Competitive Landscape

In the Nevada flower category, Trichome has demonstrated a notable upward trajectory in rank and sales over the past few months. Starting from a rank of 59 in July 2025, Trichome climbed to 29 by October 2025, showcasing a significant improvement in market presence. This rise is accompanied by a substantial increase in sales, indicating a growing consumer preference for Trichome products. In contrast, Greenway Medical, while maintaining a relatively stable rank around the 20s, experienced fluctuating sales, suggesting potential volatility in its customer base. Similarly, The Grower Circle and BLVD have shown less dynamic shifts in rank, with The Grower Circle consistently ranking in the low 30s and BLVD experiencing a slight decline from 24 to 30. Meanwhile, Super Good has managed to maintain a competitive edge, closely trailing Trichome with a stable rank around the high 20s and consistent sales growth. These insights suggest that Trichome's strategic initiatives are effectively enhancing its competitive position in the Nevada flower market.

Notable Products

In October 2025, the top-performing product from Trichome was Wedding Crashers Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one rank with sales reaching 1691 units. Rainbow Beltz (14g) in the Flower category emerged as a new contender, securing the second position with no prior ranking data. Ice Cream Cake (Bulk) also showed a strong performance in the Flower category, moving up from fourth to third place since September. OG Glue (14g) and Sunset Sherbet (Bulk) rounded out the top five, maintaining their fourth and fifth positions, respectively. Notably, the rise of Wedding Crashers Pre-Roll to the top spot represents a significant improvement from its third-place rank in July and August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.