Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

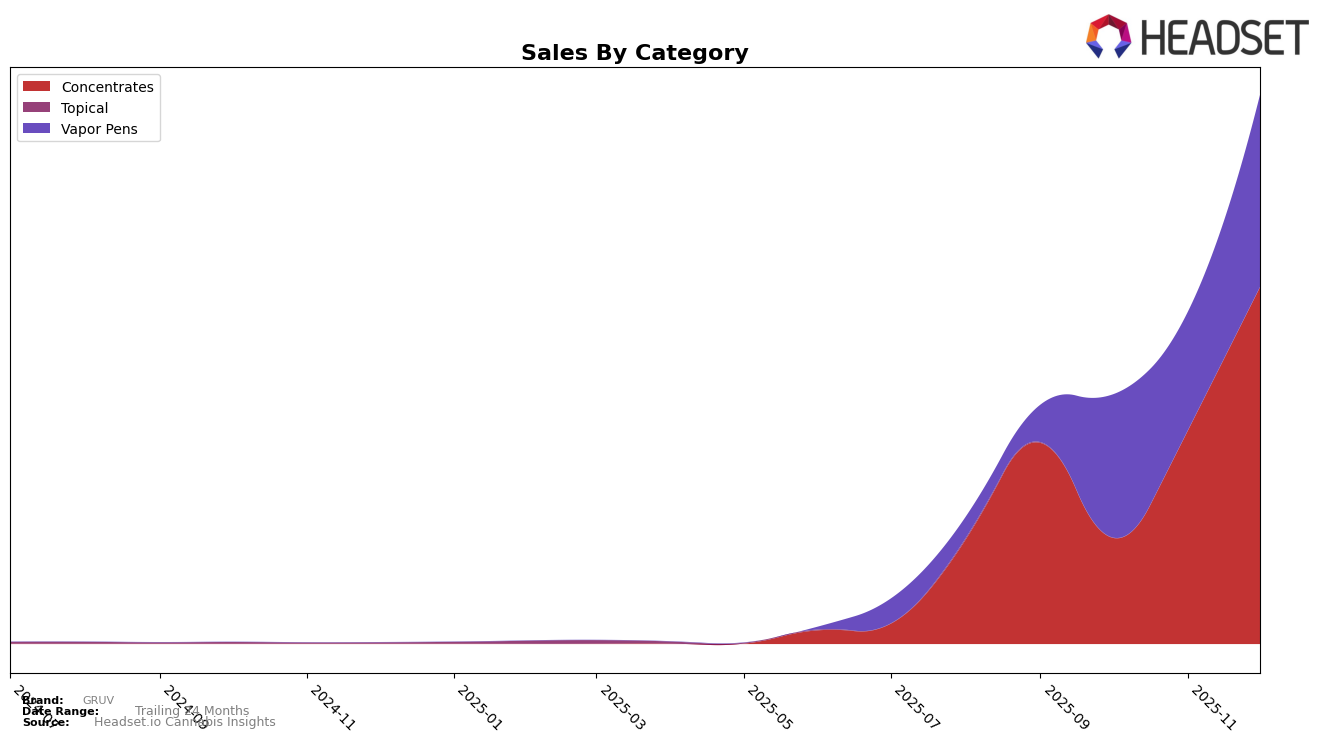

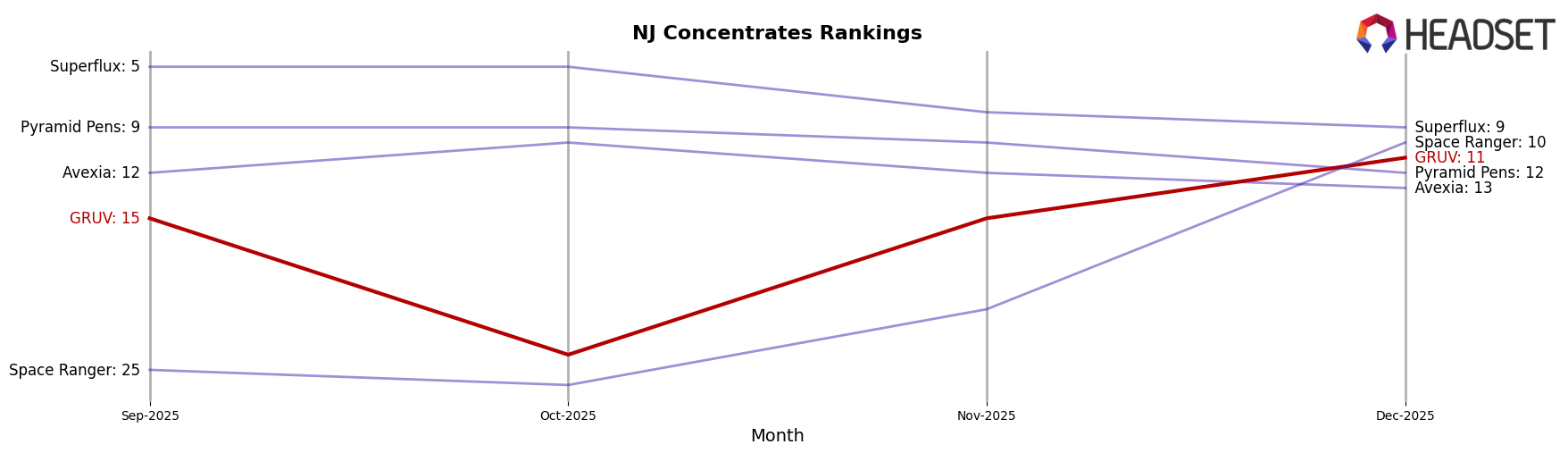

In the state of New Jersey, GRUV has shown notable performance in the Concentrates category. Starting at the 15th position in September 2025, the brand experienced a dip in October, falling to 24th place. However, it quickly rebounded to 15th in November and climbed further to 11th by December. This upward trajectory suggests a strong recovery and growing preference for GRUV's concentrates among consumers in New Jersey. The sales figures reflect this trend, with a significant increase from October to December, indicating successful strategies or product offerings that resonated well with the market.

Conversely, GRUV's performance in the Vapor Pens category in New Jersey presents a different narrative. The brand did not make it into the top 30 in September, highlighting a challenging start in this category. Although it entered the rankings in October at the 62nd position and slightly improved to 58th by December, the brand's position remained relatively low. This could suggest either a highly competitive landscape or potential areas for improvement in GRUV's vapor pen offerings. Despite these challenges, the sales figures indicate a positive movement from November to December, suggesting some level of consumer acceptance or seasonal demand.

Competitive Landscape

In the New Jersey concentrates category, GRUV demonstrated a notable recovery in rank from October to December 2025, climbing from 24th to 11th position. This resurgence is particularly significant given the competitive landscape, where brands like Superflux and Pyramid Pens consistently maintained higher ranks, with Superflux holding steady in the top 10 throughout the period. GRUV's sales trajectory showed a promising upward trend in December, surpassing Space Ranger, which also made a significant leap from 21st to 10th place. This suggests that while GRUV faces stiff competition, its strategic efforts in the latter months of 2025 have positioned it for potential growth, highlighting the dynamic nature of the market and the importance of continuous adaptation to consumer preferences.

Notable Products

In December 2025, the top-performing product from GRUV was the Sour Strawberry Live Rosin (1g), which reached the number one rank in the Concentrates category with notable sales of 359 units. The Orange Sunshine Live Rosin Cartridge (0.5g) maintained its position at rank two in the Vapor Pens category, showing consistent popularity. Blueberry Live Rosin Disposable (0.5g) entered the rankings at third place, indicating a strong debut in the Vapor Pens category. Purple Diesel Live Rosin Cartridge (0.5g) held steady at fourth place, demonstrating stable demand over the months. Notably, Papaya Cake Live Rosin (1g) dropped from second to fifth place in the Concentrates category, reflecting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.