Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

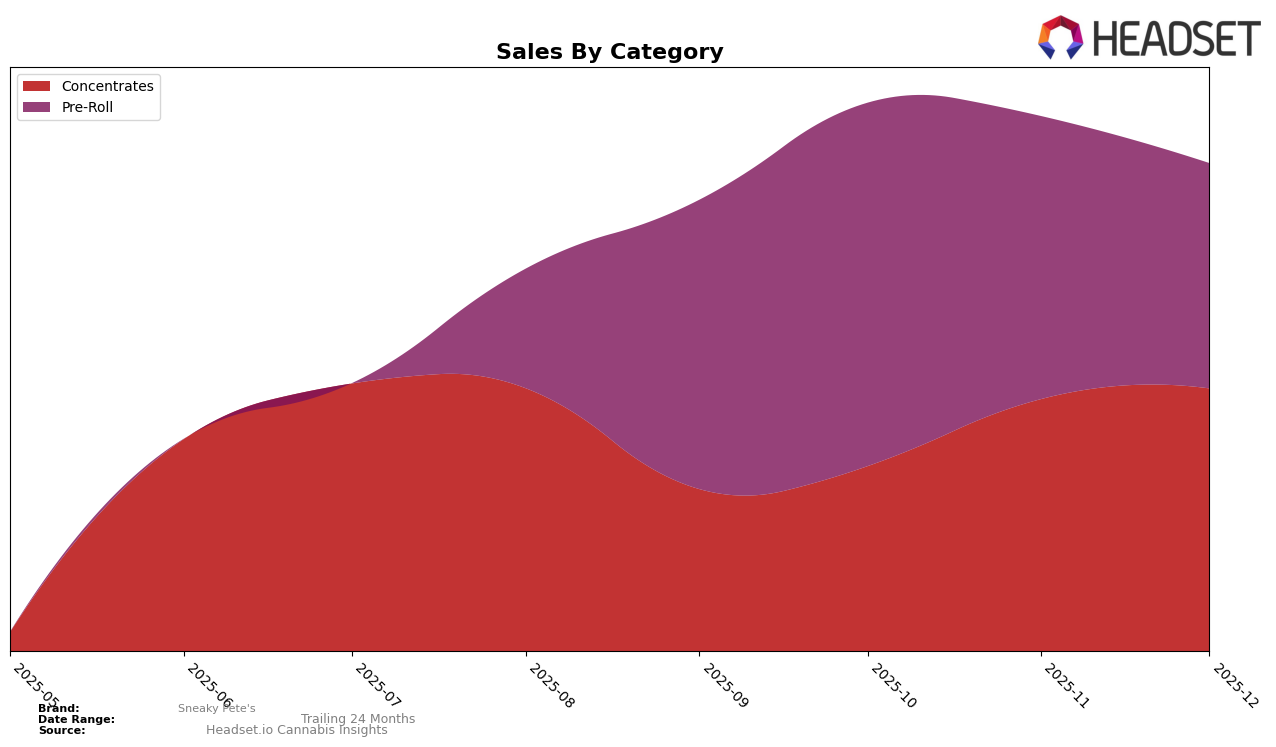

Sneaky Pete's has shown notable performance variations across different categories and states. In the Concentrates category in New Jersey, the brand has experienced a positive trajectory, improving its rank from 19th in September 2025 to 16th by December 2025. This upward movement is indicative of a strengthening market presence in this category, with sales showing a consistent increase over the months. The brand's ability to climb the rankings in a competitive market suggests a strategic focus on enhancing product offerings or market engagement in this state.

Conversely, the performance of Sneaky Pete's in the Pre-Roll category in New Jersey tells a different story. The brand did not manage to break into the top 30 by December 2025, with its rank declining from 39th in October to 50th by the year's end. This decline in rank, coupled with a decrease in sales from October to December, highlights potential challenges or shifts in consumer preferences within this category. It could suggest the need for a reassessment of marketing strategies or product offerings to regain a competitive edge in the Pre-Roll market.

Competitive Landscape

In the competitive landscape of the concentrates category in New Jersey, Sneaky Pete's has shown a notable improvement in its market position over the last few months of 2025. Starting from a rank of 19th in September, Sneaky Pete's climbed to 14th in November before settling at 16th in December. This upward trajectory in rank is mirrored by a consistent increase in sales, indicating a positive reception from consumers. In comparison, Avexia maintained a relatively stable position, fluctuating slightly but remaining in the top 15, while Breakwater made a significant leap from being outside the top 20 in September to 14th by December. Meanwhile, SUN and New Earth experienced more volatility, with SUN peaking at 13th in November and New Earth dropping out of the top 20 in November before recovering slightly. These dynamics suggest that while Sneaky Pete's is gaining traction, it faces stiff competition from brands like Breakwater, which have shown rapid improvements in both rank and sales.

Notable Products

In December 2025, Cold Sweatz Infused Pre-Roll (1g) emerged as the top-performing product for Sneaky Pete's, securing the number one rank with impressive sales figures, reaching 886 units. Under the Z Infused Pre-Roll (1g) made a notable entry into the rankings, achieving the second position. Kirkland Kush Infused Pre-Roll (1g), which previously held the top spot in November, slipped to third place, indicating a decrease in sales momentum. Cat Nap Infused Pre-Roll (1g) maintained a stable presence in the rankings, moving from fourth position in October to fourth again in December. Pete's Medley Infused Pre-Roll (1g) entered the rankings for the first time, capturing the fifth spot, showcasing its potential in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.