Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

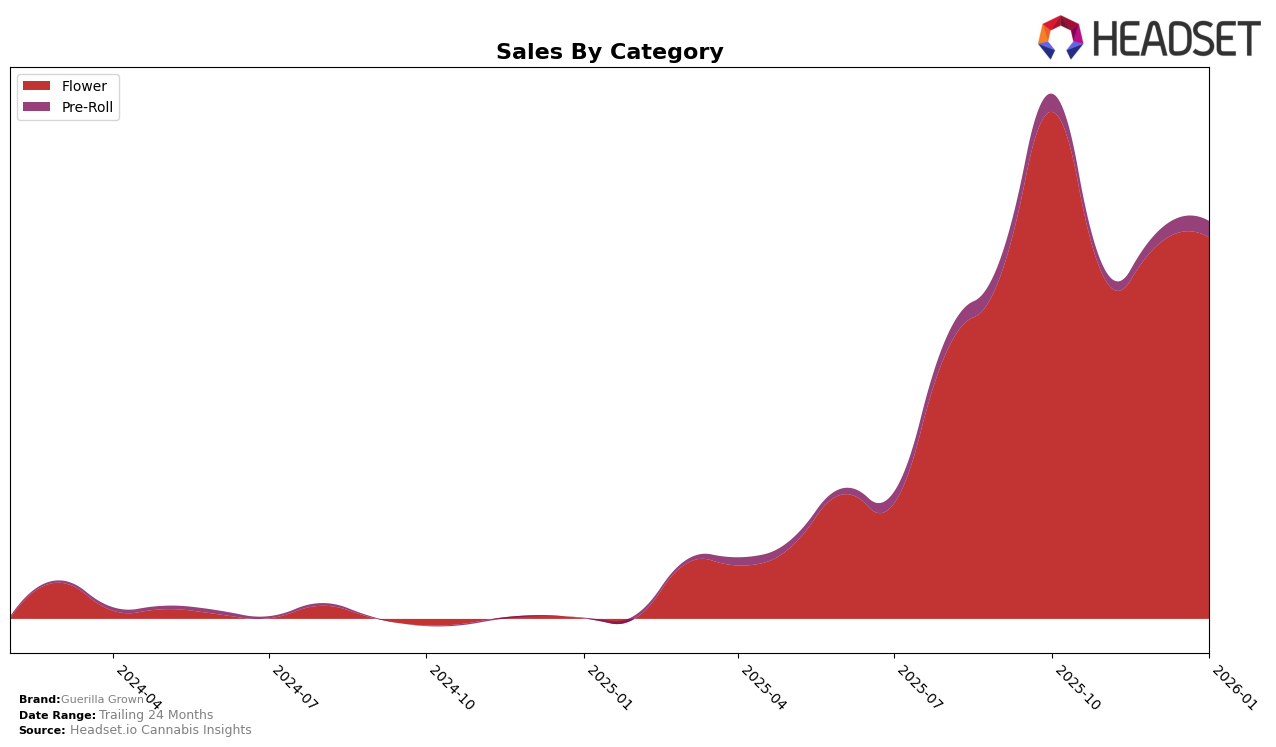

Guerilla Grown has demonstrated fluctuating performance across different states and categories, with notable activity in the Flower category in Michigan. In October 2025, the brand held a strong position at rank 16, but by November, its rank had dropped to 29. Despite this dip, Guerilla Grown managed a slight recovery by January 2026, climbing back to rank 22. This movement indicates a resilience in the Michigan market, although the brand's presence outside the top 30 in some months suggests challenges in maintaining consistent market share.

The sales trend for Guerilla Grown in Michigan also reflects a dynamic landscape. Starting with over $1.2 million in sales in October 2025, there was a noticeable decline in November, followed by a gradual recovery in the subsequent months. The ability to rebound in sales and improve their ranking in January 2026 highlights the brand's potential to adapt and compete effectively within the Flower category. However, the absence of rankings in other states or provinces indicates potential areas for growth and expansion that the brand may need to address to enhance its market presence further.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Guerilla Grown has experienced notable fluctuations in its ranking over the past few months. Starting at 16th place in October 2025, the brand saw a decline to 29th in November and 30th in December, before recovering to 22nd in January 2026. This volatility contrasts with competitors like Heavyweight Heads, which maintained a more stable ranking, peaking at 20th in January. Meanwhile, Everyday Cannabis (MI) demonstrated a strong performance, reaching as high as 8th place in December before dropping to 24th in January. Despite these fluctuations, Guerilla Grown's sales have shown resilience, with a recovery in January, suggesting potential for regaining market share. Brands like Skymint and Tru Smoke also highlight the competitive pressure in this market, with Skymint experiencing a similar recovery trend in January. These dynamics underscore the importance for Guerilla Grown to strategize effectively to stabilize its rank and capitalize on sales opportunities in the Michigan flower market.

Notable Products

In January 2026, Noriega OG Pre-Roll (1g) emerged as the top-performing product for Guerilla Grown, climbing from a rank of 3 in December 2025 to rank 1, with impressive sales reaching 21,065 units. Ripped Off Runtz Smalls (3.5g) also showed significant improvement, moving from rank 5 to 2, with sales increasing to 12,225 units. Slap N Tickle (Bulk) entered the rankings at position 3, while Say Less (Bulk) and Gary Poppins (Bulk) secured the 4th and 5th spots respectively. Compared to previous months, the January rankings highlight a strong performance in the Pre-Roll and Flower categories. This shift suggests a growing consumer preference for these specific product types from Guerilla Grown.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.