Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

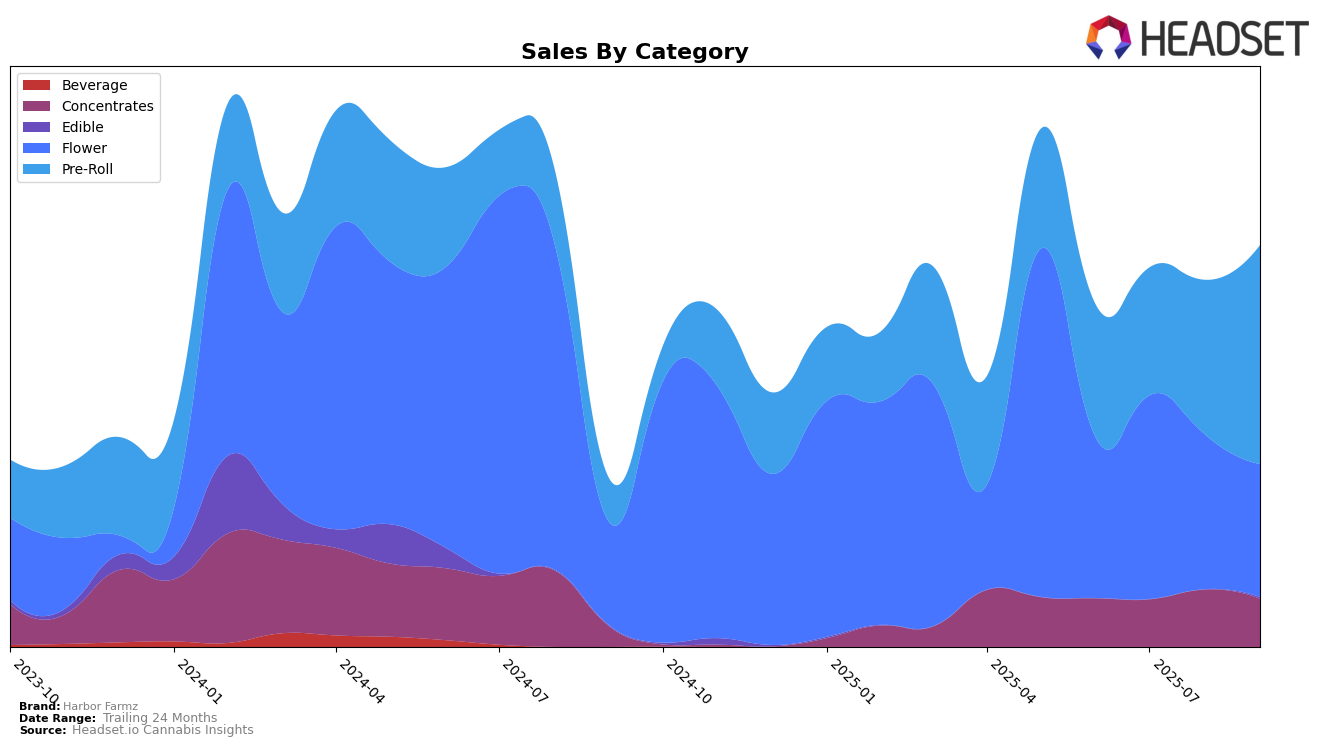

Harbor Farmz has shown notable performance variations across different product categories in Michigan, with particular movements in their rankings that merit attention. In the Concentrates category, Harbor Farmz has not yet secured a place in the top 30, as evidenced by their rankings fluctuating between 39th and 45th from June to September 2025. This suggests a consistent struggle to break into the higher echelons of this competitive category. Meanwhile, the Flower category has seen a similar challenge; the brand has not been able to climb into the top 30, with rankings hovering in the 70s and 90s. This indicates that while there is some interest in their Flower products, it is not enough to compete with the leading brands in the market.

Conversely, Harbor Farmz has demonstrated significant progress in the Pre-Roll category in Michigan. Notably, they moved up from a 44th place ranking in June and July to an impressive 24th place by September 2025. This upward trajectory is supported by a substantial increase in sales, particularly from August to September, where they saw a leap from 273,123 to 387,565 in sales. This indicates a growing consumer preference for their Pre-Roll offerings, positioning Harbor Farmz as a brand to watch within this category. However, despite these gains, the brand still faces challenges in achieving similar success across all product categories.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll market, Harbor Farmz has demonstrated a notable upward trajectory in recent months. Despite starting at a lower rank of 44 in June 2025, Harbor Farmz has made significant strides, climbing to the 24th position by September 2025. This improvement is particularly impressive when compared to competitors like Element, which fluctuated in rank and ended at 25th, and Amnesia, which improved from 42nd to 26th. Meanwhile, My Friend also showed a positive trend, moving from 46th to 23rd. Harbor Farmz's sales have seen a consistent increase, culminating in a substantial boost in September, surpassing Amnesia and closely rivaling My Friend. This upward momentum suggests that Harbor Farmz is effectively capturing market share and enhancing its brand presence in the competitive Michigan pre-roll sector.

Notable Products

In September 2025, the top-performing product from Harbor Farmz was Grapeful Dead Infused Pre-Roll (1g) in the Pre-Roll category, which climbed to the number one spot with notable sales of 10,481 units. Neon Luau Infused Pre-Roll (1g) also saw significant improvement, moving from fifth place in August to second in September. Apples & Bananas (3.5g) in the Flower category secured the third position, up from fourth in August. Willie's Kush Cake x LA Kush Cake Infused Pre-Roll (1g) entered the rankings at fourth place, while Hyperpop Infused Pre-Roll (1g) debuted in fifth place. These shifts highlight a strong performance in the Pre-Roll category for Harbor Farmz this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.