Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

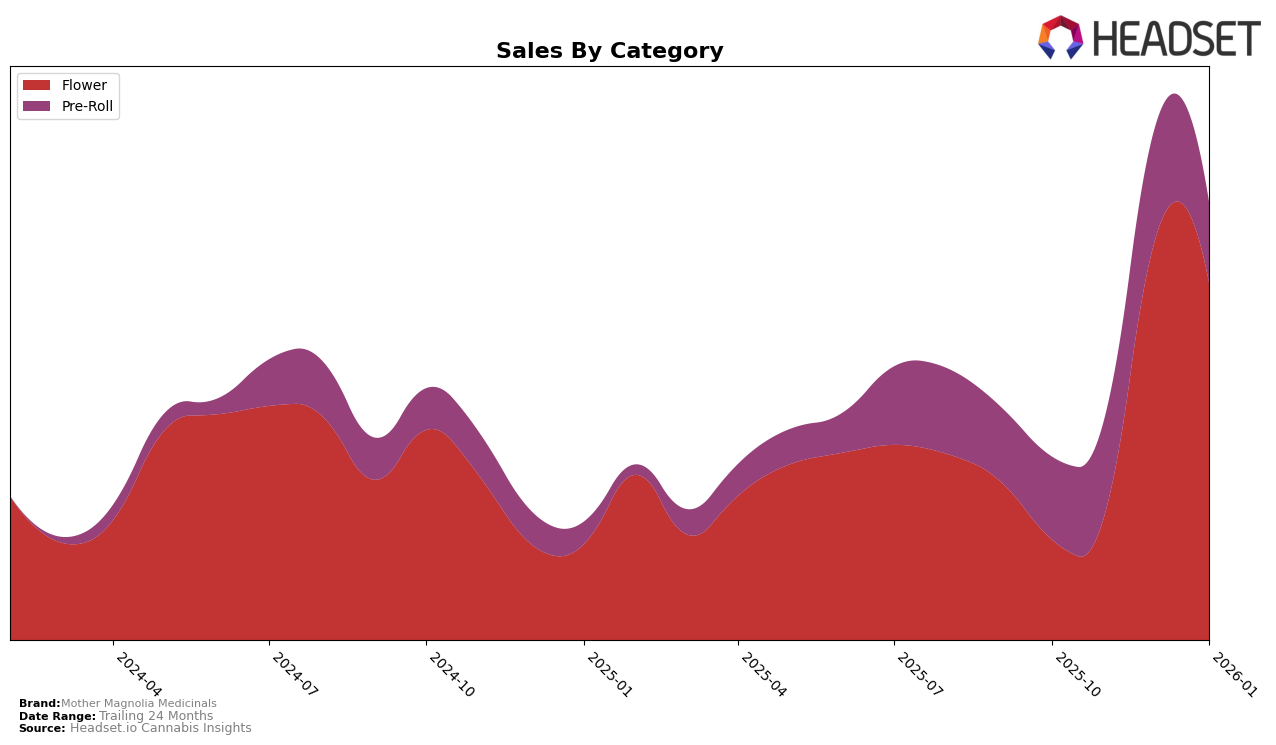

Mother Magnolia Medicinals has demonstrated a notable upward trajectory in the Oregon market, particularly within the Flower category. The brand has climbed significantly in the rankings, moving from 67th place in October 2025 to an impressive 15th by January 2026. This rise indicates a strong consumer response and possibly effective marketing strategies or product improvements. The sharp increase in sales from approximately $90,686 in October to $273,164 in January further underscores the brand's growing prominence in this category.

In contrast, the performance of Mother Magnolia Medicinals in the Pre-Roll category in Oregon has been relatively stable, with rankings hovering in the mid-30s throughout the observed period. Despite a slight dip to 36th position in January 2026, the brand has maintained a consistent presence within the top 40. This stability might suggest a steady customer base or market saturation in this category. The absence from the top 30 could indicate areas for potential growth or a need for strategic adjustments to enhance brand visibility and market share in the Pre-Roll sector.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Mother Magnolia Medicinals has shown a remarkable upward trajectory in rankings, moving from 67th place in October 2025 to an impressive 15th by January 2026. This significant climb indicates a strong increase in market presence and consumer preference. In comparison, Focus North consistently maintained a higher rank, peaking at 13th in January 2026, suggesting a robust market position. Meanwhile, Herbal Dynamics experienced a similar upward trend, reaching 17th place by January 2026, but with less dramatic sales growth compared to Mother Magnolia Medicinals. House Party and Hecate Gardens also showed competitive performances, with House Party ranking 16th and Hecate Gardens 14th in January 2026. The data suggests that while Mother Magnolia Medicinals has made significant strides in improving its market rank, it still faces stiff competition from these established brands, which may influence its strategic decisions moving forward.

Notable Products

In January 2026, Tahoe Brunch (1g) emerged as the top-performing product for Mother Magnolia Medicinals, climbing from the second position in December 2025. Strawberries and Cream (Bulk) followed closely, securing the second spot, improving from its third-place ranking in December. Omega Red (1g) maintained a consistent presence in the rankings, holding the third position, despite a sales dip from 1379 units in December to 1180 units in January. Lilac Diesel (Bulk) re-entered the top rankings at fourth place, after not being ranked in December. Alpha Blue (1g) experienced a significant drop, falling from first place in December to fifth in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.