Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

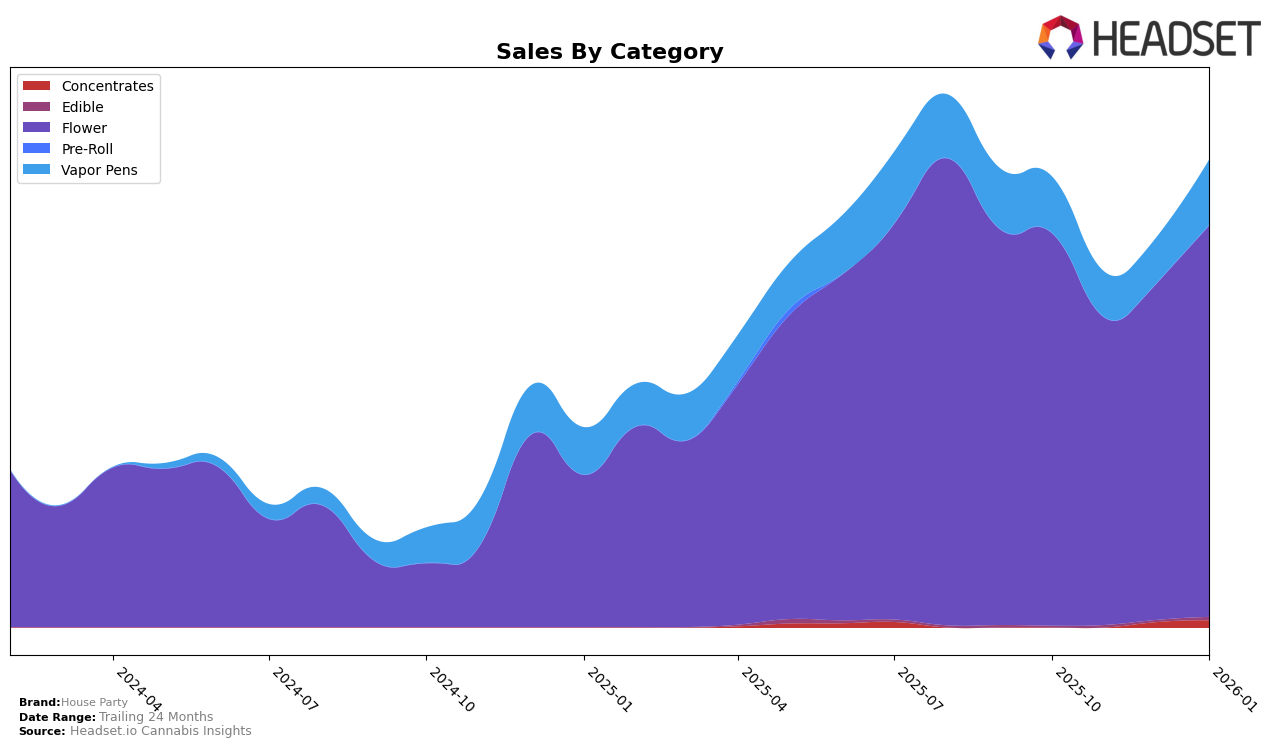

In the state of Oregon, House Party has demonstrated notable fluctuations in its performance across different product categories. Specifically, within the Flower category, House Party saw a significant improvement in its rankings from October 2025 to January 2026. Starting at 19th place, the brand experienced a dip to 30th in November, only to climb back up to 16th by January. This resurgence is indicative of a positive trend, reflecting a rebound in consumer interest or possibly successful strategic adjustments by the brand. However, the Vapor Pens category tells a different story, with House Party not breaking into the top 30 during this period, ranking 55th in October and improving slightly to 45th by January. This suggests that while there is some progress, the brand faces challenges in gaining a stronger foothold in this category.

House Party's sales data further underscores these trends. In the Flower category, despite a dip in November, sales rebounded in January, surpassing October's figures, which aligns with their improved ranking. This suggests a robust recovery and potential growth in market share. Conversely, the Vapor Pens category, while showing incremental sales growth, remains a challenging area for House Party, as it hasn't yet achieved a top-tier ranking. The brand's ability to navigate these dynamics across categories will be crucial for its future positioning in the competitive landscape of Oregon.

Competitive Landscape

In the competitive landscape of the Oregon flower category, House Party has demonstrated notable resilience and adaptability over recent months. While its rank fluctuated from 19th in October 2025 to 30th in November, it rebounded to 16th by January 2026. This recovery is significant, especially when compared to competitors like Mother Magnolia Medicinals, which saw a steady climb from 67th to 15th, and Millerville Farms, which entered the top 20 in January 2026. Despite a dip in sales in November, House Party's sales figures rebounded by January, aligning closely with Herbal Dynamics, which also saw a significant rank improvement. Meanwhile, Hecate Gardens emerged as a strong competitor, climbing to 14th place by January 2026, surpassing House Party in both rank and sales. These dynamics highlight the competitive pressure in the market and the importance for House Party to continue innovating and strategizing to maintain and improve its market position.

Notable Products

In January 2026, House Party's top-performing product was Frosty Gelato (28g) in the Flower category, maintaining its consistent first-place ranking from previous months with sales of 1602 units. The Kush Mintz Liquid Diamonds Cartridge (1g) in the Vapor Pens category rose to the second position from fifth in December 2025, showing a significant increase in popularity. Slurty 3 Liquid Diamonds Cartridge (1g) debuted at the third rank, indicating strong initial sales figures. Sugar Runtz (28g) entered the rankings at fourth place, marking its presence in the Flower category. Trop Cherry (28g) saw a drop to the fifth position from its last recorded third position in November 2025, reflecting a decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.