Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

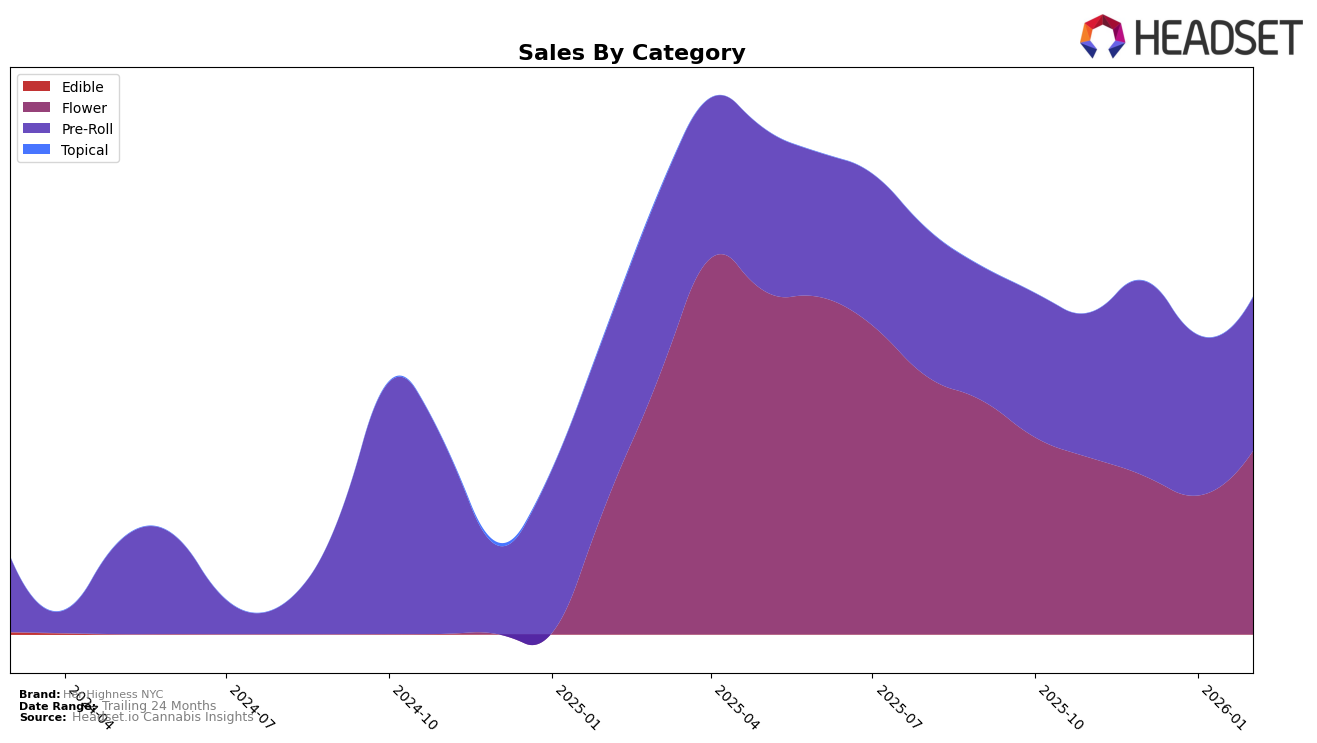

Her Highness NYC has shown varied performance across different categories and states. In the New York market, the Flower category has seen some fluctuations. Although the brand did not make it into the top 30 rankings for Flower from November 2025 through February 2026, there was a notable improvement in February, moving from 81st in January to 71st place. This indicates a positive trend despite the overall lower rankings. The sales figures reflect this movement, with a dip in January but a recovery in February, suggesting that the brand might be regaining traction in this category.

In contrast, Her Highness NYC's performance in the Pre-Roll category in New York has been relatively stable. The brand maintained a position within the top 50 from November 2025 to February 2026, with a slight drop from 45th in December to 47th in February. Despite this minor decline, the brand's sales in this category were robust, particularly in December, indicating strong consumer interest. This stability in the Pre-Roll segment suggests that Her Highness NYC has a solid foothold in this category, which could be a strategic advantage in the competitive New York market.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Her Highness NYC has experienced fluctuations in its market position, with rankings ranging from 63rd in November 2025 to 71st in February 2026. Despite a slight improvement from January to February, Her Highness NYC remains outside the top 60, indicating challenges in maintaining a competitive edge. In contrast, High Peaks consistently outperformed Her Highness NYC, maintaining a rank between 55th and 66th, suggesting stronger market traction. Similarly, Golden Garden and ghost. have shown more stable performances, with ranks consistently higher than Her Highness NYC. Notably, Pot & Head also faced a decline, but still managed to stay close to Her Highness NYC's rank, indicating a competitive peer group. These dynamics highlight the need for Her Highness NYC to strategize effectively to improve its market standing and sales trajectory in the New York Flower category.

Notable Products

In February 2026, the top-performing product for Her Highness NYC was Giggle Puffs Infused With Appetite-Suppressant Terpenes Pre-Roll 5-Pack (2.5g), reclaiming the number one rank with sales of 666 units. Following closely was Sex Pot Infused Pre-Roll 5-Pack (2.5g), which fell to second place after leading in January. Hoe Hoe Hoe Infused Pre-Roll 5-Pack (2.5g) maintained its third-place position from January, showing consistent performance. Sleepy Puffs Kief Infused Pre-Roll 5-Pack (2.5g) also held steady at third place, indicating a stable demand. Notably, Rainbow Sprinkles Infused Pre-Ground (7g) entered the rankings for the first time in February, securing the fourth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.