Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

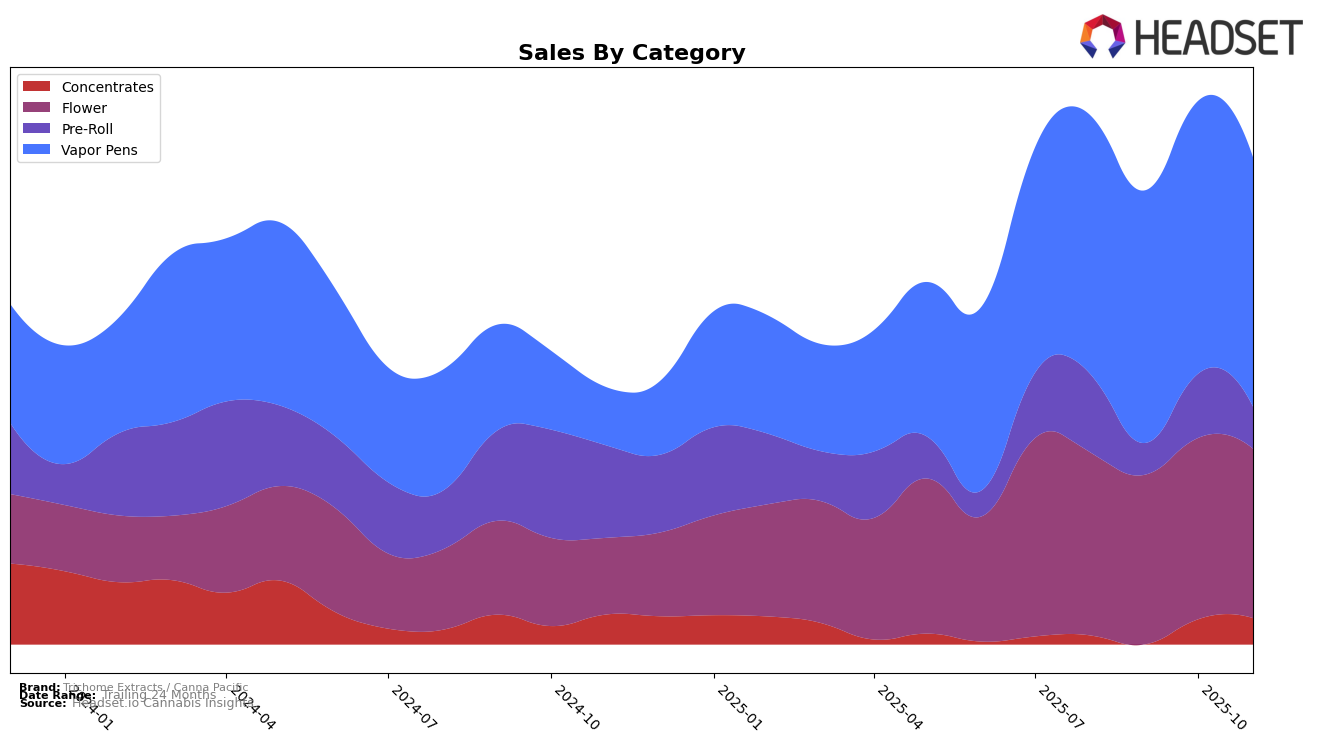

Trichome Extracts / Canna Pacific has shown notable performance variations across different product categories in Washington. In the Concentrates category, the brand experienced a significant upward trajectory, improving its rank from 78 in September 2025 to 49 by November 2025. This upward movement reflects a strong sales growth, as evidenced by a jump from $22,770 in September to $38,195 in November. Conversely, the Pre-Roll category exhibited more volatility, with rankings fluctuating from 86 in September to 75 in November, indicating a less consistent performance. Despite these fluctuations, the brand's ability to remain within the top 100 across these categories suggests a robust market presence.

In contrast, the Flower category in Washington has shown a more stable but less dynamic performance. The brand maintained a consistent rank around 56 throughout the months from August to November 2025, with sales figures reflecting minor fluctuations. This stability could be indicative of a loyal customer base or consistent product quality. Meanwhile, in the Vapor Pens category, Trichome Extracts / Canna Pacific has consistently held a strong position, maintaining ranks around 30, though there was a slight dip in sales from October to November. The brand's ability to stay within the top 30 in this category highlights its competitive edge and potential leadership in the vapor pen market within the state.

Competitive Landscape

In the competitive landscape of Vapor Pens in Washington, Trichome Extracts / Canna Pacific has maintained a consistent presence, ranking 30th in August, September, and November 2025, with a slight improvement to 29th in October. Despite this stability, the brand faces stiff competition from brands like Honey Tree Extracts, which consistently ranked higher, maintaining a position around 26th and experiencing a notable sales increase in October. Meanwhile, Herb's Oil showed a strong upward trend, climbing from 31st in August to 28th in November, with a significant sales boost in the same period. While Cookies and Passion Flower Cannabis experienced fluctuations and declines in sales, Trichome Extracts / Canna Pacific's stable ranking suggests a resilient market position, though there is room for growth to compete with the upward momentum of its rivals.

Notable Products

In November 2025, the top-performing product for Trichome Extracts / Canna Pacific was the Honey Bananas Applesauce Cartridge (1g) from the Vapor Pens category, achieving the number one rank with sales of 605 units. Following closely was the StrawGuava Applesauce Cartridge (1g), also from the Vapor Pens category, which secured the second position. The OBS Isolate Infused Pre-Roll 2-Pack (1g) maintained a strong presence, ranking third, a slight drop from its second position in October 2025. Studio 54 Applesauce Cartridge (1g) entered the rankings at fourth place, while Black Soap Isolate Infused Pre-Roll 2-Pack (1g) rounded out the top five. Notably, the Vapor Pens category dominated the top spots, indicating a shift in consumer preference from previous months where Pre-Rolls were more prominent.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.