Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

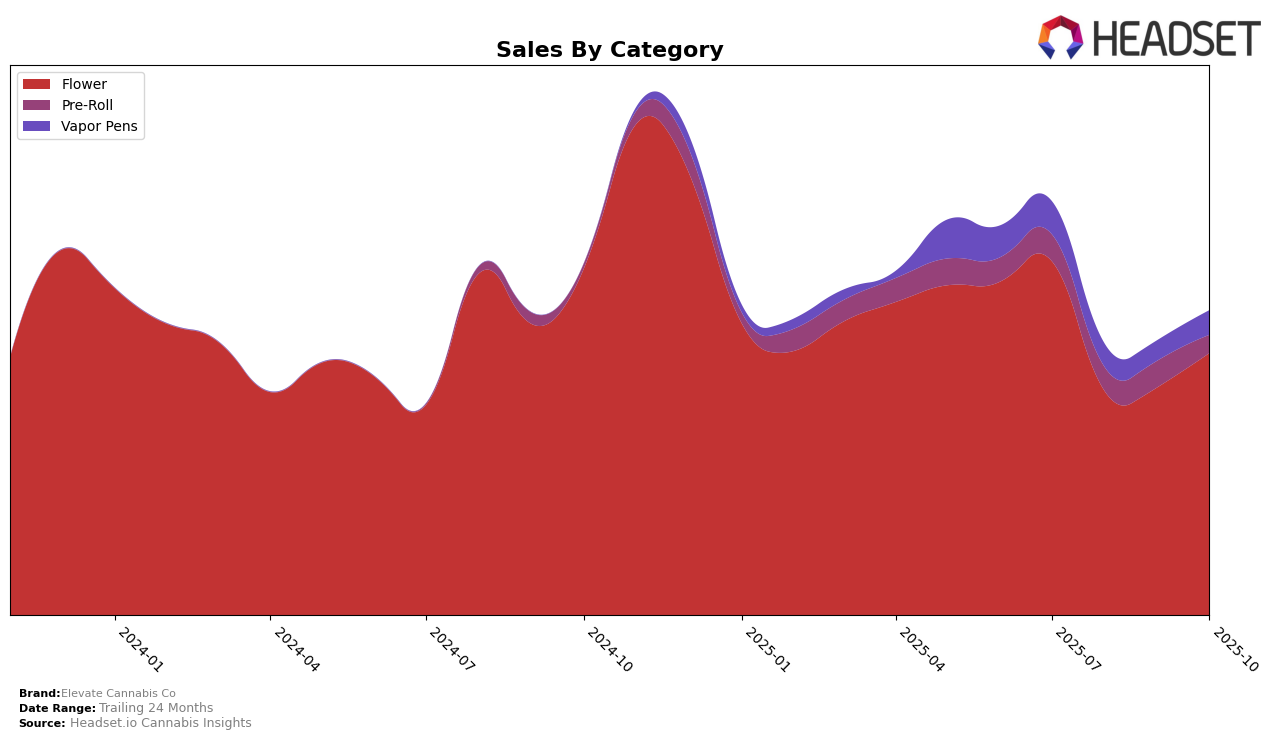

Elevate Cannabis Co has shown varied performance across different states and product categories over the past few months. In Arizona, the brand's Flower category has seen a resurgence, climbing back to a rank of 26th in October 2025 after dipping to 30th in September. This indicates a positive rebound in consumer interest or market dynamics favoring their product. However, the brand's performance in the Pre-Roll category appears to be less favorable, as they fell out of the top 30 rankings by October, landing at 46th. This drop could suggest increased competition or a shift in consumer preferences away from their offerings in this category.

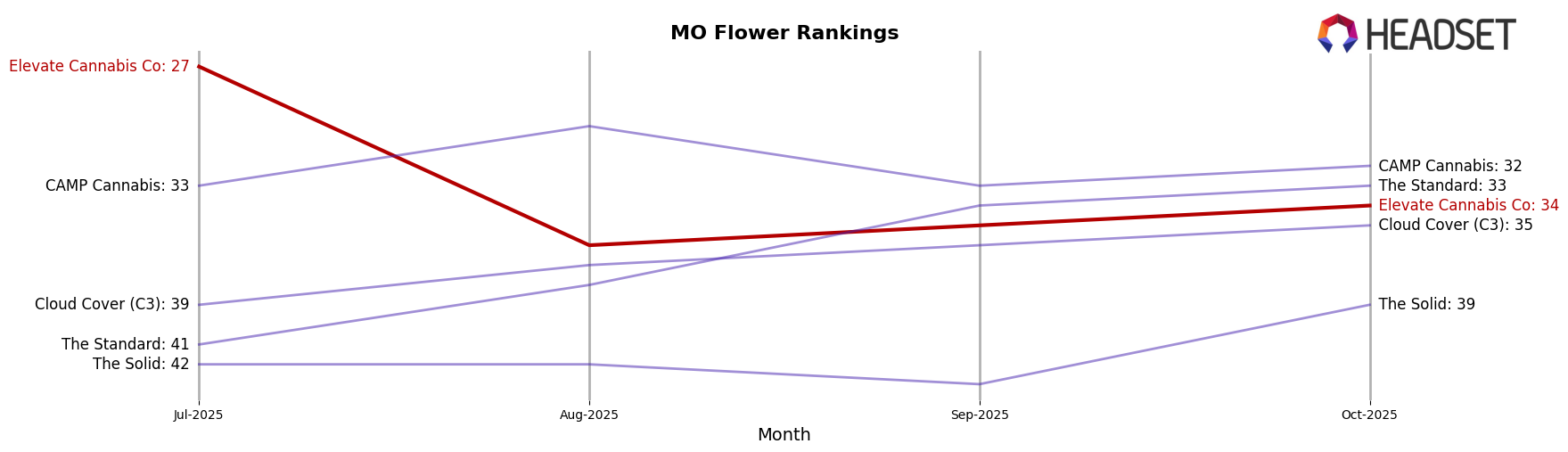

In Missouri, Elevate Cannabis Co's presence in the Flower category is noteworthy, although it experienced a decline from 27th in July to 34th by October. Despite this downward trend in rankings, the brand has managed to maintain a consistent sales volume, indicating that while they face stiff competition, their consumer base remains relatively stable. The brand's overall performance across these states and categories highlights the dynamic nature of the cannabis market, where consumer preferences and competitive pressures can significantly influence brand standings.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Elevate Cannabis Co has shown a gradual improvement in its ranking from 36th in August 2025 to 34th in October 2025, reflecting a positive trajectory in sales performance. Despite this upward trend, Elevate Cannabis Co remains behind competitors like CAMP Cannabis, which consistently ranks higher, reaching 32nd place in October 2025. Meanwhile, The Standard has also outperformed Elevate Cannabis Co, climbing to 33rd place in October 2025 with a notable increase in sales. Conversely, Cloud Cover (C3) and The Solid have maintained lower rankings, with Cloud Cover (C3) improving slightly to 35th and The Solid remaining outside the top 30. These dynamics suggest that while Elevate Cannabis Co is making strides, it faces stiff competition from brands like CAMP Cannabis and The Standard, which are capturing more market share in Missouri's Flower category.

Notable Products

In October 2025, Headband Cookies (3.5g) maintained its position as the top-performing product for Elevate Cannabis Co, consistent with its first-place ranking since July, with sales reaching 7316 units. Grapefruit Durban (3.5g) held steady in second place, showing resilience in its category despite fluctuating sales figures over the months. Star Killer Pre-Roll (1g) made a notable jump to third place, a significant improvement from being unranked in September. Grandpa's Stash (3.5g) entered the rankings for the first time in fourth place, indicating a strong debut. Hell's OG (3.5g) experienced a slight drop in ranking to fifth place, continuing its gradual decline from earlier in the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.