Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

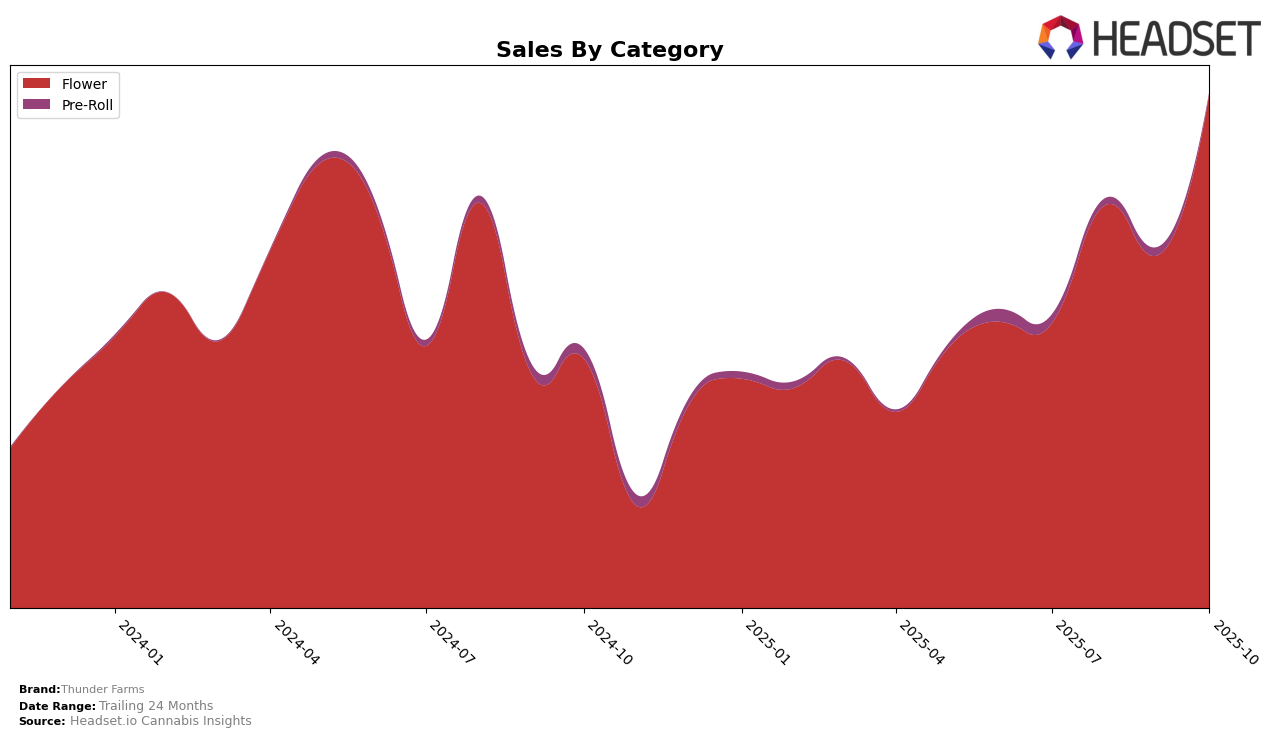

Thunder Farms has shown a notable upward trajectory in the Oregon market, particularly in the Flower category. Starting from a rank of 54 in July 2025, the brand has climbed to 28 by October 2025. This steady ascent highlights a growing consumer preference or strategic improvements in the brand's offerings. The movement into the top 30 is a significant milestone, indicating that Thunder Farms is gaining traction and visibility in a competitive market. The brand's sales in Oregon have also seen a considerable increase, with October sales figures showing a marked improvement over the previous months, suggesting effective market penetration and possibly an expanding customer base.

While Thunder Farms has made impressive strides in Oregon, their absence from the top 30 rankings in other states or provinces could be indicative of either a strategic focus on the Oregon market or challenges in expanding their footprint elsewhere. This lack of presence in other regions might be seen as a limitation in their current market strategy, or it could highlight the brand's prioritization of strengthening its position in Oregon before broader expansion. Understanding these dynamics can offer valuable insights into Thunder Farms' market approach and future potential for growth across different geographies.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Thunder Farms has demonstrated a noteworthy upward trajectory in brand ranking from July to October 2025. Initially positioned at 54th place in July, Thunder Farms improved its rank to 28th by October, indicating a positive trend in market presence. This ascent is particularly significant when compared to competitors like Self Made Farm, which experienced a decline from 15th to 27th place over the same period. Meanwhile, High Noon Cultivation and Focus North showed fluctuating rankings, with High Noon Cultivation moving from 50th to 29th and Focus North dropping from 26th to 30th. Notably, Drewby Doobie / Epic Flower also saw a significant rise, ending at 26th place in October. Thunder Farms' consistent improvement in rank is mirrored by a steady increase in sales, suggesting effective strategies in capturing market share and consumer interest amidst a dynamic competitive environment.

Notable Products

In October 2025, Thunder Farms' top-performing product was Astronaut Status Bulk in the Flower category, securing the number one rank with sales of 2963 units. Following closely, Astronaut B-Buds Bulk achieved the second position, improving from the first rank in September. Alaskan Thunder Fuck Bulk maintained a steady presence, ranking third, a drop from its top position in August. Sherb Crasher Bulk and Alaskan Thunder Fuck 1g made notable entries into the top five, ranking fourth and fifth, respectively. The rankings indicate a dynamic shift, with Astronaut Status Bulk emerging as the new leader in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.