Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

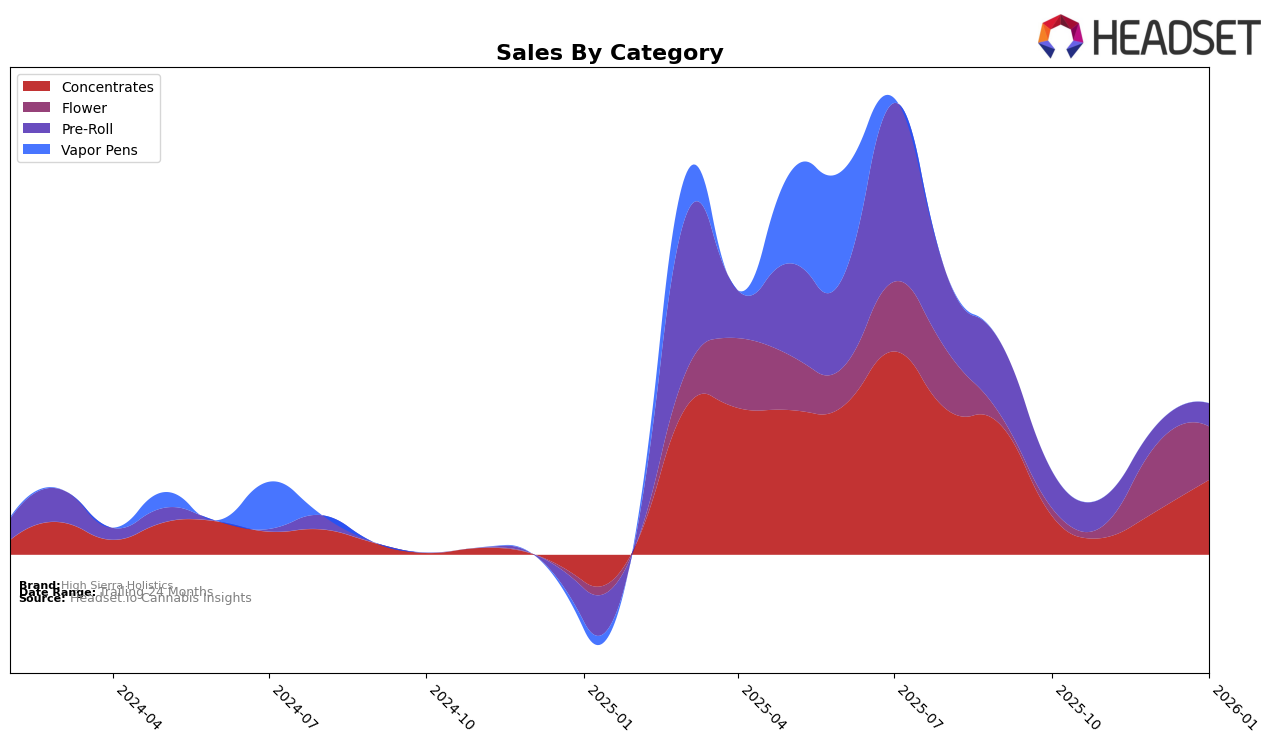

High Sierra Holistics has shown some notable movements in the cannabis market across different categories and states. In Nevada, the brand made a significant entry into the Concentrates category, achieving a rank of 26 in January 2026. This indicates a promising performance considering they were absent from the top 30 in the preceding months. However, their presence in the Flower category has been less consistent. They were not ranked in the top 30 in October and November 2025, but managed to secure the 89th spot in December 2025 and slightly declined to 93rd in January 2026. This movement suggests a fluctuating yet persistent presence in the Flower market.

While High Sierra Holistics has made strides in the Concentrates category, their performance in the Flower category in Nevada reflects a need for strategic improvements to maintain and enhance their market position. The brand's sales in the Flower category saw a decrease from December 2025 to January 2026, which could indicate challenges in sustaining consumer interest or competitive pressures. Moreover, the absence of rankings in the Concentrates category prior to January 2026 could suggest either a recent entry into this segment or previous underperformance. These dynamics highlight the importance of continuous adaptation and market analysis to capitalize on growth opportunities in the competitive cannabis landscape.

Competitive Landscape

In the Nevada concentrates category, High Sierra Holistics has shown a notable entry into the competitive landscape by securing the 26th rank in January 2026, marking its first appearance in the top 30. This entry is significant as it indicates a positive shift in market presence, especially when compared to competitors like The Grower Circle, which fluctuated around the 26th and 27th positions in the same period. Meanwhile, Panna Extracts has consistently improved its rank, moving from 25th in October 2025 to 23rd by January 2026, suggesting a stronger market hold. On the other hand, ODYSSEY experienced a decline, dropping from 16th to 28th, which could potentially open up opportunities for High Sierra Holistics to capture more market share. Additionally, Pressure Concentrates (NV) showed volatility, peaking at 12th in November 2025 but dropping to 24th by January 2026, indicating a competitive but fluctuating market environment that High Sierra Holistics can leverage to improve its standing further.

Notable Products

In January 2026, High Sierra Holistics saw Twisted Citrus Live Resin (1g) take the top spot in sales, highlighting its strong performance in the Concentrates category with sales of 152 units. Berry Gelato Live Resin Sugar (1g) followed closely as the second best-selling product, while Orange Cream Pop Live Sugar (1g) secured the third position. Notably, Skywalker Live Resin (1g) climbed to the third rank from fifth in December 2025, showing a significant improvement in its market performance. Grimmdica Smalls (7g), a Flower product, ranked fourth, maintaining a stable position in the top five for the month. The shifts in rankings from previous months indicate a growing consumer preference for live resin products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.