Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

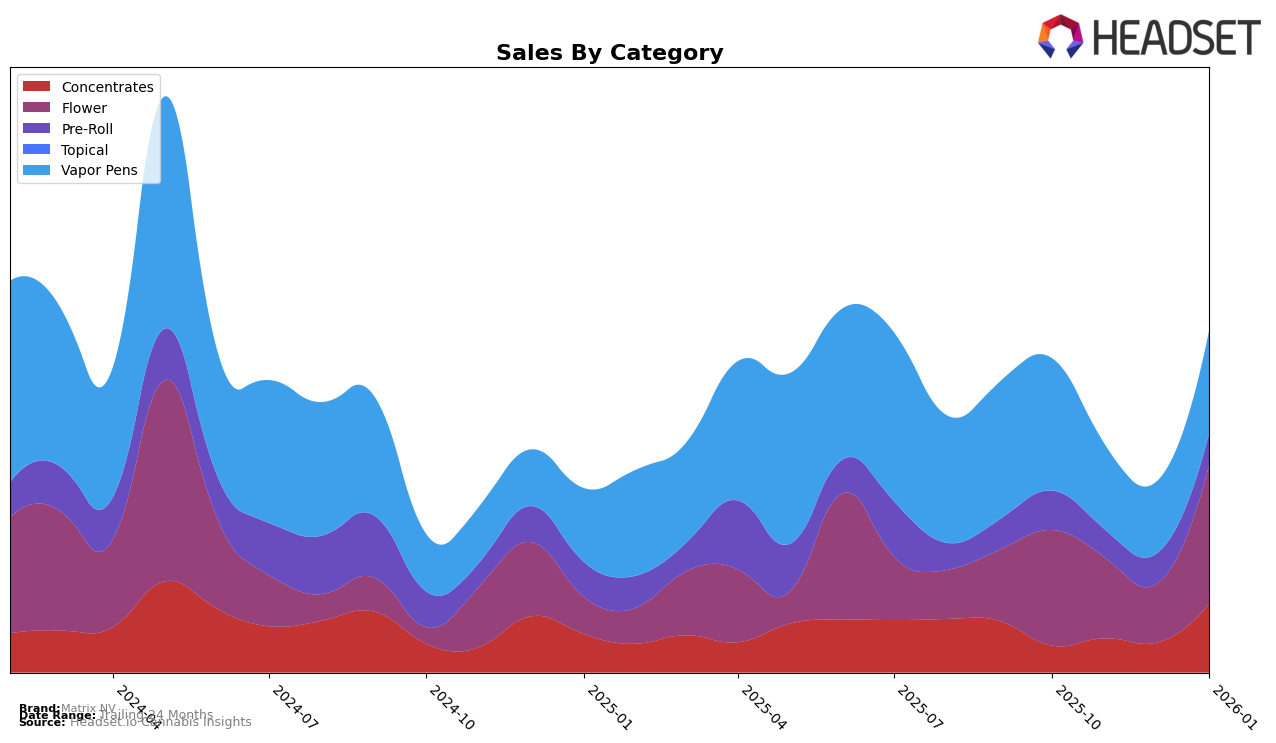

Matrix NV has demonstrated notable performance shifts across various product categories in the state of Nevada. In the Concentrates category, the brand showed a significant upward trend, climbing from the 21st position in October 2025 to break into the top 10 by January 2026. This improvement is underscored by a substantial increase in sales during this period. Conversely, their performance in the Flower category has been more volatile. Starting outside the top 30 in October 2025, Matrix NV managed to reach the 35th position by January 2026, indicating a recovery but still not within the top tier of brands. This suggests potential growth opportunities, yet also highlights the competitive nature of the Flower market in Nevada.

In the Pre-Roll category, Matrix NV maintained a relatively stable presence, fluctuating slightly but remaining close to the 40th position over the observed months. Although not within the top rankings, this consistency might suggest a loyal customer base or steady demand. The Vapor Pens category, however, presented a mixed picture. The brand experienced a dip in rankings from October to December 2025, descending to the 27th position, before rebounding to 22nd in January 2026. This recovery, coupled with the sales data, indicates a resilient market strategy that may have capitalized on seasonal trends or promotional efforts. Overall, while Matrix NV shows strong potential in certain categories, their performance across others suggests areas for strategic focus and improvement.

Competitive Landscape

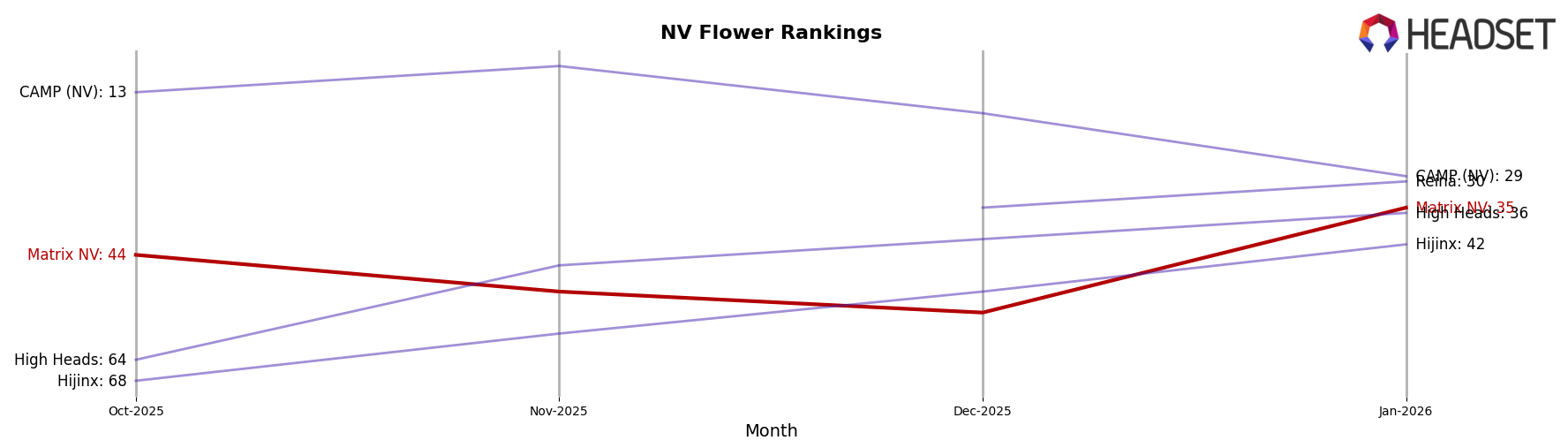

In the competitive landscape of the Flower category in Nevada, Matrix NV has experienced notable fluctuations in its market position over recent months. Despite a dip in rank from October to December 2025, where it fell from 44th to 55th, Matrix NV made a significant recovery by January 2026, climbing to 35th place. This rebound in rank coincides with a substantial increase in sales, suggesting a successful strategic adjustment or market response. In contrast, competitors like Hijinx and High Heads have shown a more consistent upward trajectory, with Hijinx improving its rank from 68th in October to 42nd in January, and High Heads moving from 64th to 36th in the same period. Meanwhile, Reina emerged strongly in December with a 35th rank, maintaining a stable position into January. CAMP (NV), although experiencing a drop from 8th to 29th, still maintains a significantly higher sales volume than Matrix NV. These dynamics highlight the competitive pressures Matrix NV faces, emphasizing the importance of strategic agility in maintaining and enhancing its market position.

Notable Products

In January 2026, Heir Heads Pre-Roll (1g) from Matrix NV reclaimed its top position in the Pre-Roll category, with sales reaching 609 units, after experiencing a dip to third place in November 2025. Johnny Bravo Budder (1g) emerged as the second top-selling product in the Concentrates category, marking its debut in the rankings. GP x AB Pre-Roll (1g) climbed to the third spot in the Pre-Roll category, up from fifth place in November 2025. Nimbus Snacks (3.5g) secured the fourth position in the Flower category, making its first appearance in the rankings. Blue Andeze Pre-Roll (1g) rounded out the top five, maintaining its position from December 2025 in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.