Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

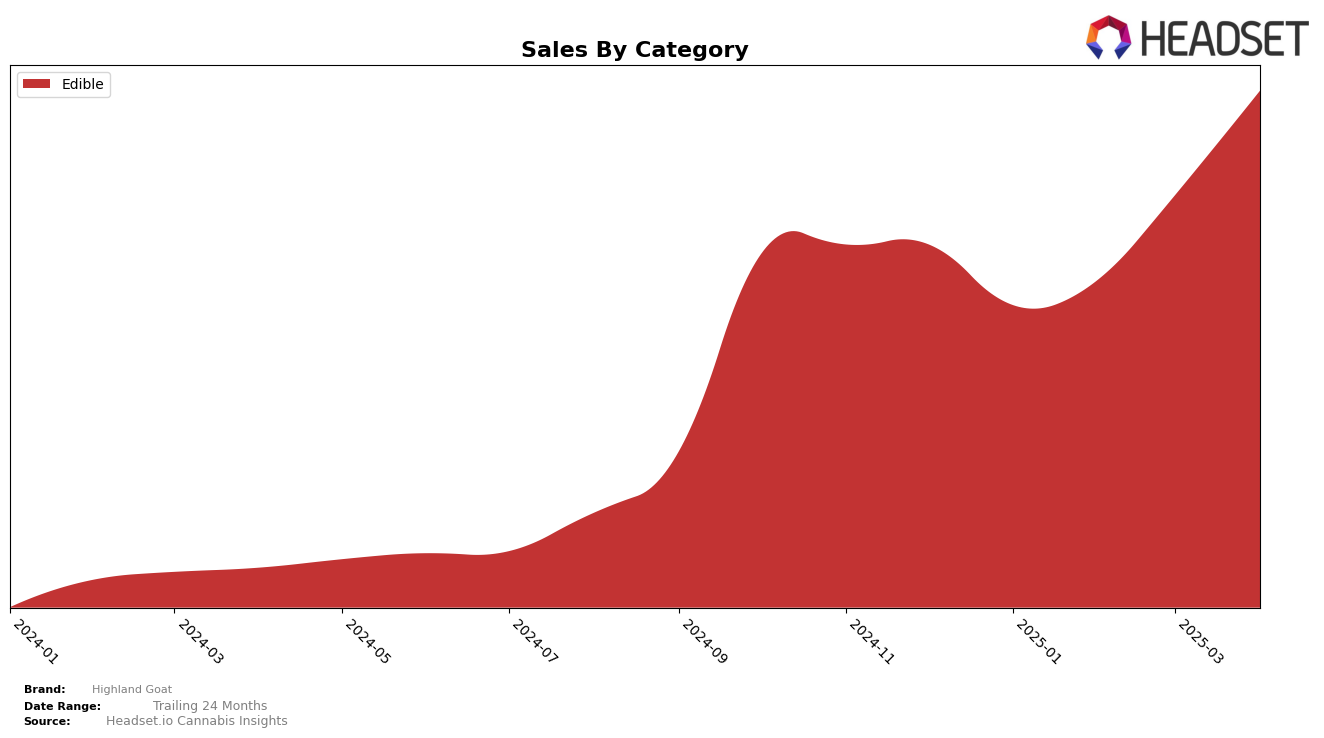

Highland Goat has shown notable progress in the Edible category within the state of New York. Starting from January 2025, the brand was ranked 35th, but by April, it had improved its position to 27th. This upward trajectory indicates a consistent increase in popularity and consumer preference over a few months. The sales figures for April, which reached 70,640, underline this positive trend, suggesting a growing consumer base and effective market strategies. However, it's important to note that Highland Goat was not initially in the top 30, which implies there was significant room for growth at the start of the year.

While Highland Goat's performance in New York is promising, the absence of rankings in other states or provinces indicates potential areas where the brand is either not present or not performing as strongly. This could be seen as a challenge or an opportunity for expansion and increased market penetration. The steady climb in New York's rankings suggests that similar strategies could be employed in other regions to replicate this success. However, the lack of data from other locations leaves room for speculation on whether Highland Goat can sustain or improve its performance across different markets.

Competitive Landscape

In the competitive landscape of the edible category in New York, Highland Goat has demonstrated a notable upward trajectory in rankings and sales from January to April 2025. Starting at rank 35 in January, Highland Goat climbed to rank 27 by April, showcasing a consistent improvement in its market position. This positive trend is indicative of a robust growth strategy, as evidenced by the increase in sales from $42,117 in January to $70,640 in April. In comparison, 1906 maintained a relatively stable position, hovering around rank 23 to 24, with sales consistently higher than Highland Goat, suggesting a strong foothold in the market. Meanwhile, The Green Lady Dispensary experienced a slight decline in rank from 25 to 29, with fluctuating sales figures. Olio and Pure Vibe both showed varied performance, with Olio not ranking in the top 20 until March, indicating potential volatility. Highland Goat's steady rise in rank and sales positions it as a growing contender in the New York edible market, potentially poised to challenge more established brands.

Notable Products

In April 2025, the top-performing product for Highland Goat was the Strawberry Lemonade Hash Rosin Gummies 20-Pack (100mg) in the Edible category, maintaining its leading position from March with a notable sales figure of 1271 units. The Hibiscus Lime Hash Rosin Gummies 20-Pack (100mg), also in the Edible category, held steady at the second position, despite a slight decrease in sales compared to March. This marks a consistent top-two ranking for these products over the past four months. The Strawberry Lemonade variant regained its top spot in March after briefly dropping to second place in February. The consistent performance of these products highlights their strong market appeal and customer preference within the Highland Goat lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.