Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

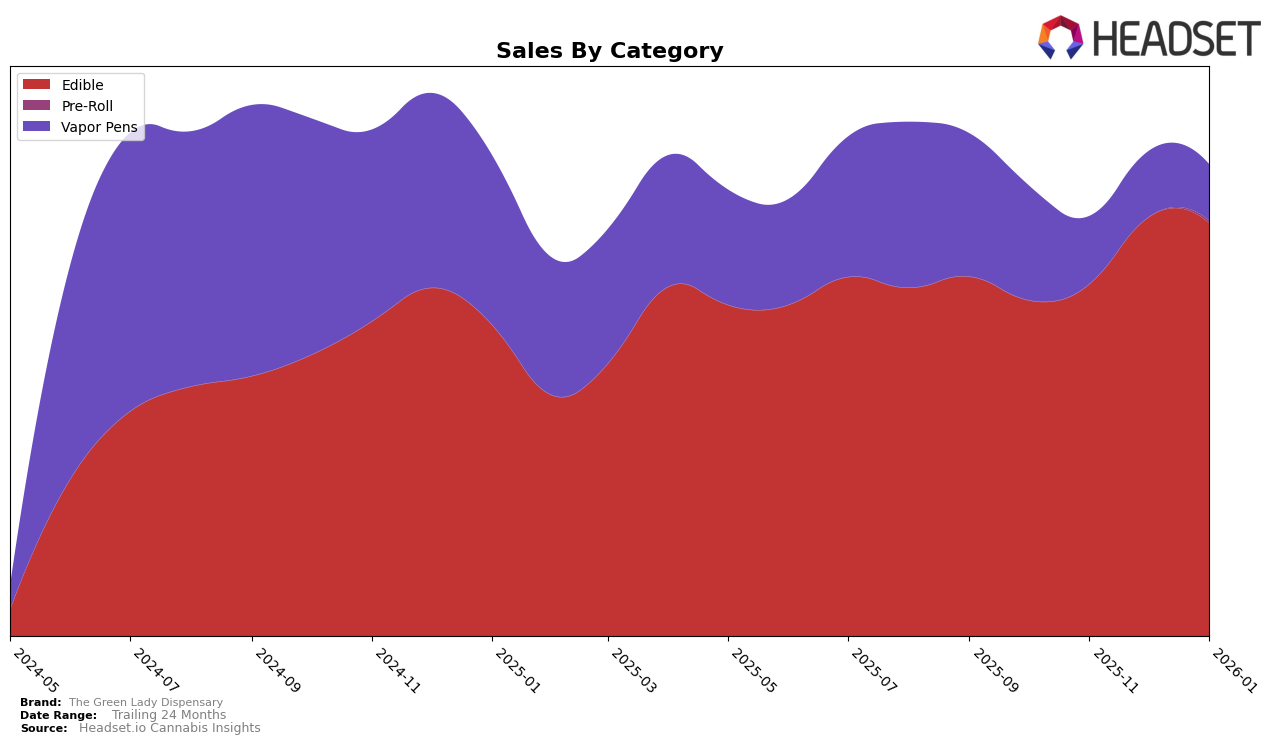

The Green Lady Dispensary has shown a consistent presence in the New York market, particularly in the Edible category. Over the four-month period from October 2025 to January 2026, the brand maintained its position within the top 30, fluctuating slightly but remaining steady between ranks 28 and 30. This stability is underscored by a notable increase in sales, peaking in December 2025 with a sales figure of $107,820. Such performance indicates a growing consumer preference for their edible products, suggesting that The Green Lady Dispensary is successfully capturing market share in this category.

In contrast, the brand's performance in the Vapor Pens category in New York has not been as strong, with a rank of 87 in October 2025 and no subsequent top 30 rankings in the following months. This absence from the top 30 list indicates a potential area for improvement or a strategic reevaluation in this category. The initial sales figure in October was $29,583, which might suggest that while there is some market presence, it is not as competitive compared to their edible offerings. This disparity between categories highlights the importance for The Green Lady Dispensary to possibly invest in product development or marketing strategies to enhance their standings in the vapor pens market.

Competitive Landscape

In the competitive landscape of the Edible category in New York, The Green Lady Dispensary has shown a steady performance, maintaining a consistent presence within the top 30 brands from October 2025 to January 2026. Despite this stability, it faces stiff competition from brands like Ruby Farms and Nyce, both of which have shown stronger upward trends in sales. Notably, Ruby Farms consistently ranked higher than The Green Lady Dispensary, peaking at rank 26 in December 2025 with a significant sales boost. Meanwhile, Nyce demonstrated a notable improvement, climbing from rank 32 in October 2025 to 27 by January 2026, with sales surpassing The Green Lady Dispensary in the latter months. The Green Lady Dispensary's sales saw a gradual increase, but to enhance its competitive edge, it may need to strategize on differentiating its offerings or amplifying its marketing efforts to capture a larger market share.

Notable Products

In January 2026, The Green Lady Dispensary's top-performing product was the CBC/CBG/THC 1:1:2 Painkiller Pina Colada Gummies 10-Pack, maintaining its number one rank for four consecutive months with sales reaching 1184 units. The THC/CBN 1:1 Nightcap Sleep Blueberry, Spiced Cinnamon & Chamomile Gummies 10-Pack also retained its second-place position consistently over the same period. The THC/THCV 2:1 Spicy Peach Margarita Gummies 10-Pack held steady at third place for two months after improving from fourth place in October 2025. Mango Mojito Live Resin Gummies made a notable rise, moving from fifth place in December to fourth place in January. Conversely, the CBD/THC 1:1 Summer Sangria Chill Gummies saw a decline, dropping from third in October to fifth by January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.