Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

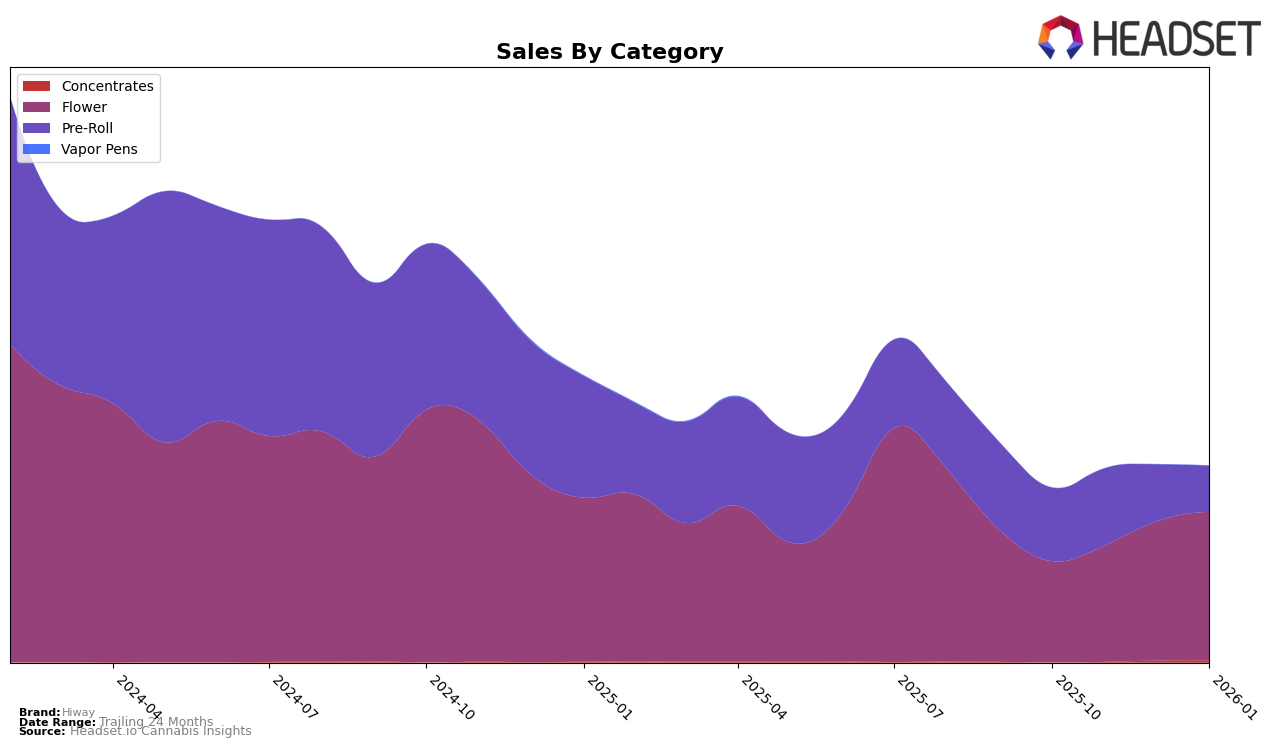

Hiway's performance in the Alberta market has shown significant improvement in the Flower category, where it climbed from a rank of 54 in October 2025 to an impressive rank of 17 by January 2026. This upward trajectory is noteworthy, especially considering the sales increase from 84,745 in October to 336,678 in January. However, the Pre-Roll category in Alberta tells a different story, as Hiway remained outside the top 30, peaking at rank 38 in October and dropping to rank 49 by January. This suggests a potential area for growth or strategic adjustment. Meanwhile, in British Columbia, Hiway's Flower category saw some fluctuations, with a notable improvement from rank 79 in October to 52 in both November and January, indicating a more stable performance.

In Ontario, Hiway's Flower category experienced a slight decline in rankings, moving from 69 in October to 76 by January, which could point to increased competition or shifting consumer preferences. Despite this, sales figures remained relatively stable, suggesting a loyal customer base. In Saskatchewan, Hiway's Flower category performance was more volatile, with rankings swinging from 16 in October to 41 in January, highlighting potential challenges or market dynamics at play. The absence of Hiway from the top 30 rankings in the Pre-Roll category in British Columbia is a notable gap, suggesting a missed opportunity or market entry strategy that could be revisited.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Hiway has shown a remarkable upward trajectory in recent months. From October 2025 to January 2026, Hiway's rank improved significantly from 54th to 17th, indicating a strategic shift or successful marketing efforts that have bolstered its market presence. This surge is particularly notable when compared to competitors like QWEST, which saw fluctuating ranks between 11th and 16th, and Simply Bare, which even dropped out of the top 20 in November before recovering to 16th by January. Meanwhile, Nugz (Canada) and Space Race Cannabis maintained relatively stable positions, with ranks hovering around the mid-teens. Hiway's dramatic rise in rank is mirrored by its sales growth, particularly in January 2026, where it nearly matched the sales figures of its higher-ranked competitors, suggesting a closing gap in market share and consumer preference.

Notable Products

In January 2026, the top-performing product for Hiway was the Sativa Pre-Roll 2-Pack (2g), maintaining its first-place rank consistently from October 2025 to January 2026, with sales of 8,823 units. The Indica Pre-Roll 2-Pack (2g) also held steady in second place throughout the same period, despite a decrease in sales. Slow Lane Indica (28g) remained in third place, showing a slight decline in sales from the previous month. Fast Lane Sativa (28g) made a notable leap to the fourth position in January, up from its fifth place in October, with a significant increase in sales. Slow Lane Indica (3.5g) experienced a drop in rank from fourth to fifth place, as its sales figures fell over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.