Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

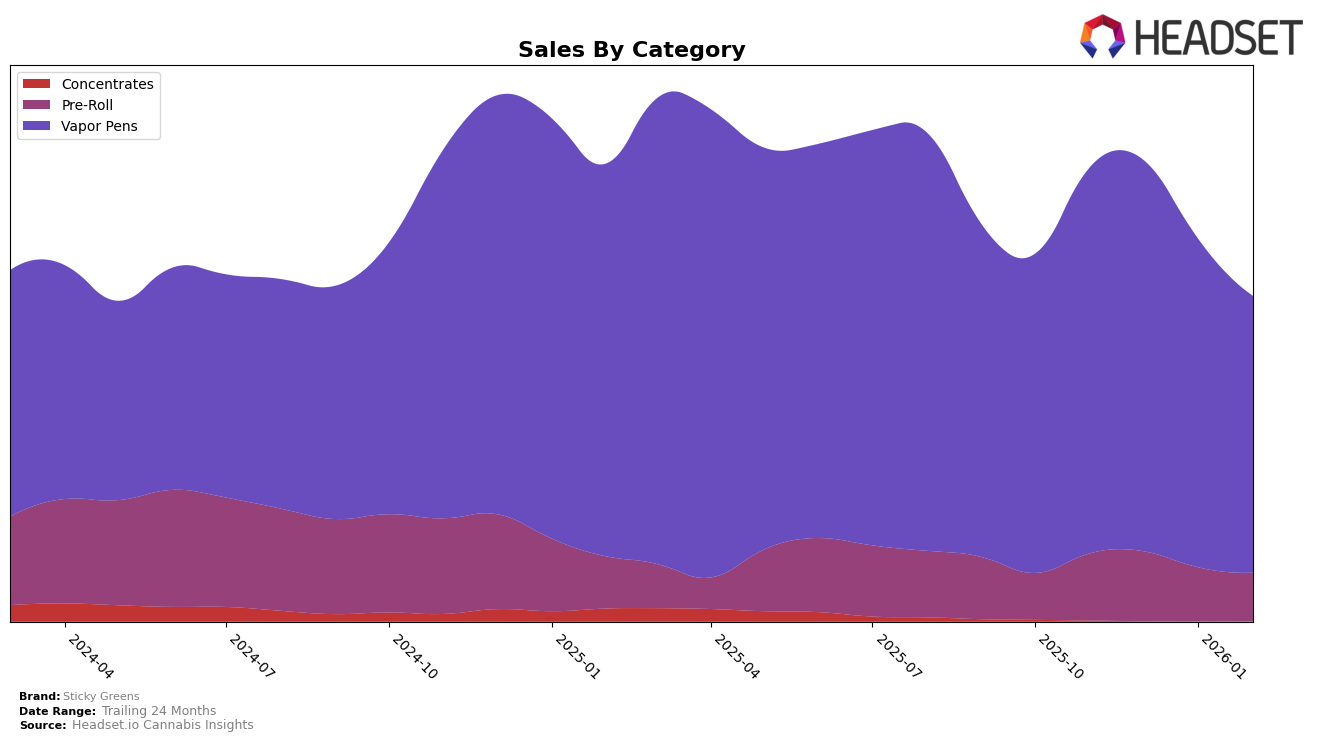

Sticky Greens has shown varied performance across different categories and provinces. In Alberta, the brand's presence in the Pre-Roll category has been somewhat volatile, with rankings fluctuating from 37th in November 2025 to 33rd by February 2026. This movement suggests a slow but positive trend upwards, although they have not consistently maintained a top 30 position, indicating room for improvement. In contrast, their performance in the Vapor Pens category in Alberta has been more stable, consistently ranking within the top 6, demonstrating a strong foothold in this segment despite a decline in sales over the months.

In British Columbia, Sticky Greens has faced challenges in the Pre-Roll category, with rankings slipping from 52nd in November 2025 to 69th by February 2026, highlighting a need for strategic adjustments to regain market share. However, the brand has shown resilience in the Vapor Pens category, improving its rank from 10th to 6th over the same period, indicating strong consumer demand and effective market strategies. Interestingly, in Illinois, Sticky Greens made an entry into the Vapor Pens market in February 2026, debuting at 57th, which could signal potential growth opportunities if the brand can leverage its strengths from other markets.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Sticky Greens has experienced some notable shifts in its market position. Over the months from November 2025 to February 2026, Sticky Greens maintained a steady rank, starting at 5th place in November and December, before slipping to 6th place in January and February. This change in rank reflects a broader trend of declining sales, with a significant drop from November's figures to February's. Meanwhile, competitors such as General Admission consistently held the 4th position, despite a decrease in sales, indicating a strong brand presence. XPLOR managed to surpass Sticky Greens in January, moving from 6th to 5th place, showcasing a positive sales trajectory. Additionally, Kolab made a notable leap from 11th to 7th place by February, suggesting a significant increase in market share. These dynamics highlight the competitive pressures Sticky Greens faces, emphasizing the need for strategic adjustments to regain its previous standing.

Notable Products

In February 2026, the Red Razzleberry Liquid Diamond Cartridge (1g) emerged as the top-performing product for Sticky Greens, overtaking the previous leader with a rank of 1 and sales of 7,564 units. The Blue Shark Liquid Diamond Cartridge (1g) fell to the second position, despite maintaining the top rank in the previous three months. Baja Breeze Liquid Diamond Cartridge (1g) consistently held the third position, indicating stable performance. Just Greens Liquid Diamond Cartridge (1g) improved to the fourth position from fifth in December 2025. The newly introduced Melonballer Liquid Diamond Cartridge (1g) debuted in fifth place, marking its entry into the top rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.