Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

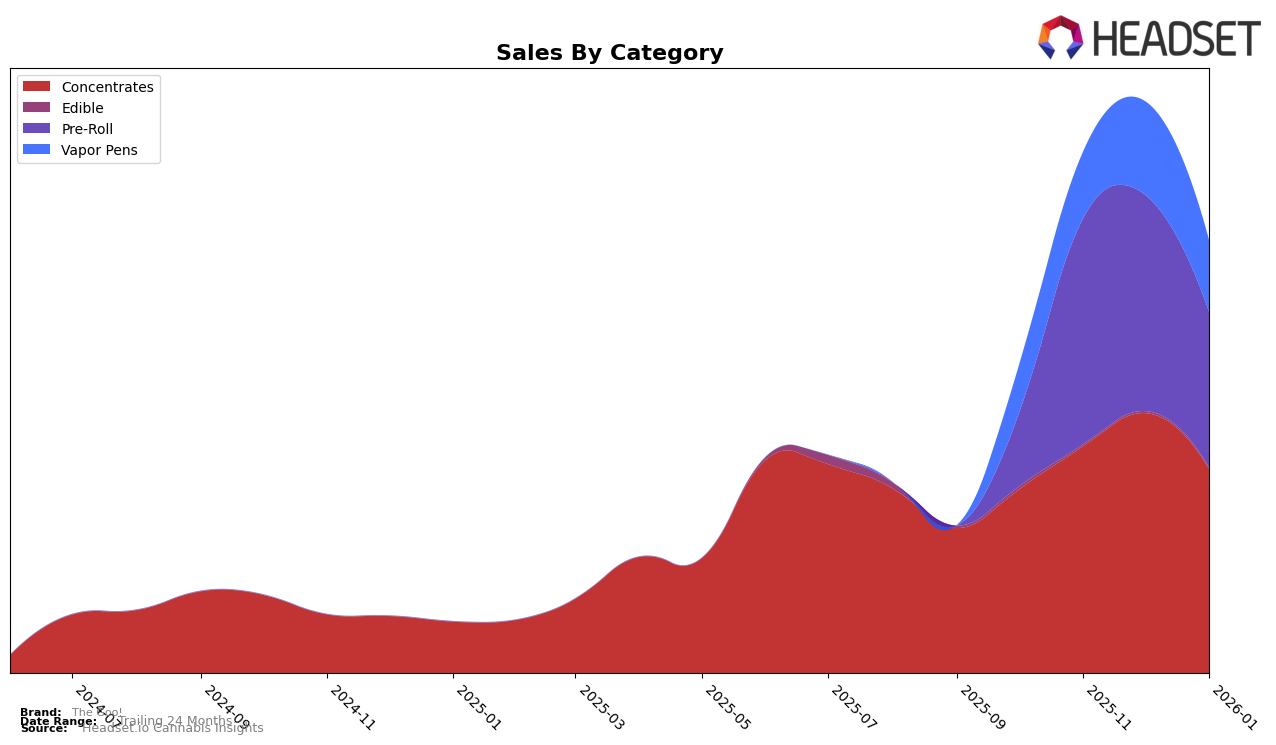

The Goo! has demonstrated notable performance in the Alberta market, particularly within the Concentrates category. Over the past few months, the brand has maintained a strong presence, starting at a rank of 10 in October 2025 and improving to the 7th position in both November and December, before slightly dropping to 9th in January 2026. This movement indicates a generally positive trajectory, although the dip in January suggests potential challenges or increased competition. In the Vapor Pens category, The Goo! showed a steady improvement, climbing from 56th in October to 44th by December, before a slight decline to 46th in January. Notably, The Goo! did not make it into the top 30 for Pre-Rolls, despite a significant boost in sales during November and December, highlighting an area for potential growth.

In Ontario, The Goo! has seen a promising upward trend in the Concentrates category, moving from a rank of 39 in October 2025 to breaking into the top 30 by January 2026. This advancement reflects a positive reception in the Ontario market, with sales figures supporting this upward momentum. The brand's consistent presence in the top rankings in Alberta and its emerging performance in Ontario suggest a strategic focus on these markets. However, the absence from the top 30 in other categories across these provinces could imply a concentrated effort in specific niches or a need to diversify their product appeal to capture a broader audience.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, The Goo! has demonstrated notable fluctuations in its rank over the recent months, which could be indicative of strategic shifts or market dynamics. From October 2025 to January 2026, The Goo! made a significant leap from being outside the top 50 to securing the 45th position by November 2025, maintaining this rank in December before slightly dropping to 48th in January 2026. This upward movement in rank coincided with a substantial increase in sales from October to November, suggesting a successful marketing or distribution strategy. In comparison, Hiway and Partake experienced a downward trend in both rank and sales, with Hiway dropping from 38th to 49th and Partake from 45th to 50th over the same period. Meanwhile, Vox maintained a relatively stable position, slightly declining from 37th to 47th, while Trippy Sips showed an upward trajectory, moving from 61st to 45th. These dynamics suggest that The Goo! is gaining traction in a competitive market, potentially capturing market share from some of its competitors.

Notable Products

In January 2026, the top-performing product from The Goo! was the Brain Fruit Live Rosin Infused Pre-Roll 3-Pack (1.5g), maintaining its first-place rank from the previous month with sales of 2,284 units. The It Came From The Kush Live Rosin Infused Pre-Roll 3-Pack (1.5g) remained steady in second place, although its sales saw a decline compared to December. The Goo-Cart Live Rosin Cartridge (0.5g) held onto the third position in the Vapor Pens category, showing consistency since its introduction. Brain Fruit Live Rosin (1g) climbed to fourth place in the Concentrates category, indicating a resurgence in popularity. Funkalicious Live Rosin (1g) rounded out the top five, maintaining its position from December despite a drop in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.