Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

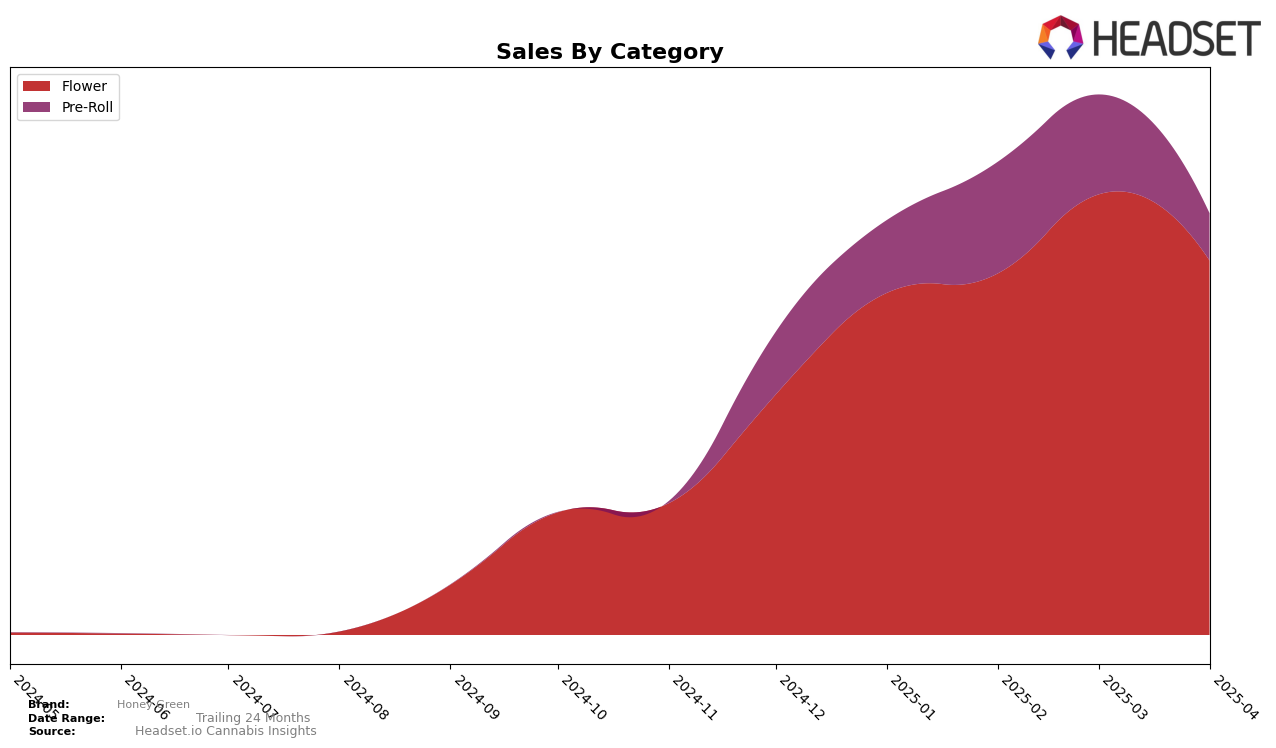

In the state of Missouri, Honey Green has shown notable performance in the Flower category. Starting the year at rank 29, the brand improved its position to 27 in February and further climbed to 26 by March. However, by April, Honey Green's rank slipped back to 30. This fluctuation in ranking is accompanied by an interesting sales trend, where the brand saw a peak in March with sales reaching $544,985, before experiencing a decline in April. This suggests that while Honey Green has managed to maintain a presence in the top 30, sustaining higher ranks remains a challenge in the competitive Missouri market.

The Pre-Roll category tells a different story for Honey Green in Missouri. The brand started at rank 32 in January and impressively jumped to 23 by February, indicating a strong upward momentum. However, the subsequent months saw a decline, with the brand falling to rank 33 in March and further dropping out of the top 30 by April, landing at rank 50. This sharp decline in ranking is mirrored by a significant drop in sales from February to April, highlighting potential challenges in maintaining their market position in this category. The contrasting performances in these categories underscore the dynamic nature of Honey Green's market strategy and its varying success across product lines.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Honey Green has experienced fluctuating rankings from January to April 2025, reflecting a dynamic market environment. Notably, Honey Green's rank improved from 29th in January to 26th in March, before slipping to 30th in April. This suggests a competitive pressure from brands like Sublime, which saw a significant jump from 34th in February to 28th in March, potentially impacting Honey Green's position. Meanwhile, Elevate Cannabis Co maintained a consistent presence, hovering around the 28th and 30th positions, indicating stable performance. Interestingly, Cookies re-entered the top 30 in February and March, which may have contributed to the competitive shifts. Despite these challenges, Honey Green's sales peaked in March, suggesting strong consumer demand, although the subsequent decline in rank indicates that maintaining momentum against these competitors is crucial for sustained growth.

Notable Products

In April 2025, the top-performing product for Honey Green was Dulce de Fresca (3.5g) in the Flower category, securing the number one rank with sales of 1608 units. Gabana (3.5g), also in the Flower category, followed closely at the second position, marking its first appearance in the rankings. Runtz on Runtz (3.5g) experienced a drop from second in March to third in April, indicating a slight decline in its popularity. Permanent Marker Pre-Roll (1g) maintained a steady performance, moving up from fifth in March to fourth in April. Lollipop (3.5g) made its debut in the rankings at the fifth position, showcasing its potential in the competitive Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.