Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

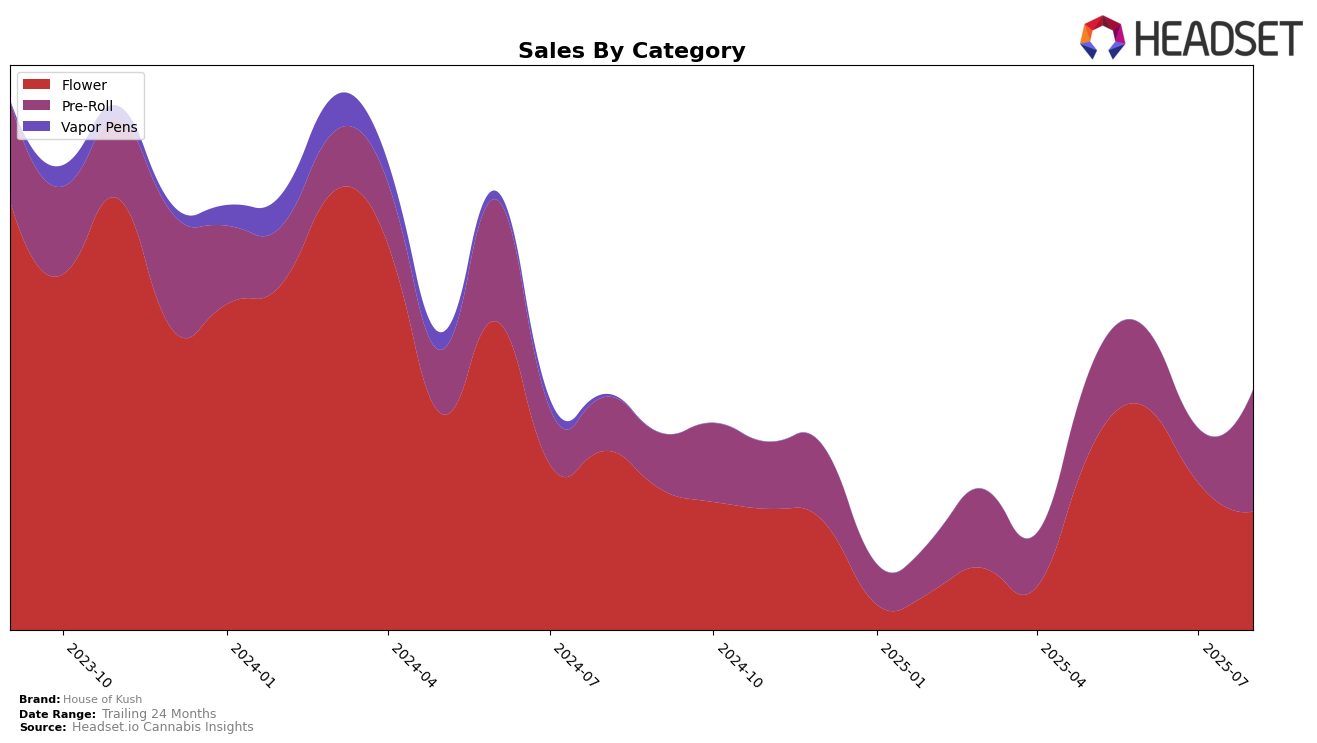

House of Kush's performance in the Maryland market has shown mixed results across different product categories. In the Flower category, the brand has consistently remained outside the top 30, with rankings fluctuating between 43rd and 46th place from May to August 2025. This suggests that while there is some presence, the brand is struggling to gain a more competitive foothold in this category within the state. Conversely, the Pre-Roll category presents a more positive picture, with House of Kush climbing from 36th place in May and June to 26th in August, indicating a significant improvement in market penetration and consumer preference for their pre-roll products.

In Missouri, House of Kush's Flower category performance has been relatively stable, although it remains outside the top 30 rankings, hovering around the low 60s. This stability suggests a consistent but limited presence in the market. The Pre-Roll category, however, tells a different story. The brand's ranking dropped from 70th in May to 78th in June, and it did not appear in the top 30 for July and August, indicating a potential decline in consumer interest or increased competition. This absence in the top 30 highlights a challenge for House of Kush in maintaining visibility and competitiveness in Missouri's pre-roll market.

Competitive Landscape

In the competitive landscape of the Maryland pre-roll category, House of Kush has demonstrated a notable upward trajectory in recent months. After starting at rank 36 in May 2025, House of Kush climbed to rank 26 by August 2025, showcasing a significant improvement in its market position. This rise in rank is accompanied by a substantial increase in sales, particularly in August, where sales nearly doubled compared to May. In contrast, Khalifa Kush and Cultivar Collection have also improved their ranks, but their sales growth has been more gradual. Meanwhile, Roll One / R.O. experienced fluctuations, missing the top 20 in June, yet maintaining a competitive edge in other months. Interestingly, Phas3 saw a dramatic leap in sales in July, although its rank slightly declined in August. These dynamics suggest that while House of Kush is gaining momentum, it faces stiff competition from brands like Khalifa Kush and Phas3, which are also making strategic moves to capture market share.

Notable Products

In August 2025, House of Kush's top-performing product was the Red Velvet Kush Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its first-place ranking from previous months with a significant increase in sales to 5841 units. The AK-47 Pre-Roll 2-Pack (1g) rose to the second position from third in July, showing a consistent improvement in its ranking. Katsu Bubba Pre-Roll 2-Pack (1g) re-entered the top ranks, securing the third position after not being ranked in July. GMO BK Pre-Roll 2-Pack (1g) maintained its fourth position, consistent with its previous performance. Lastly, Apples & Bananas Pre-Roll (1g) held steady in fifth place, showing steady sales but a slight decline from July's sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.