Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

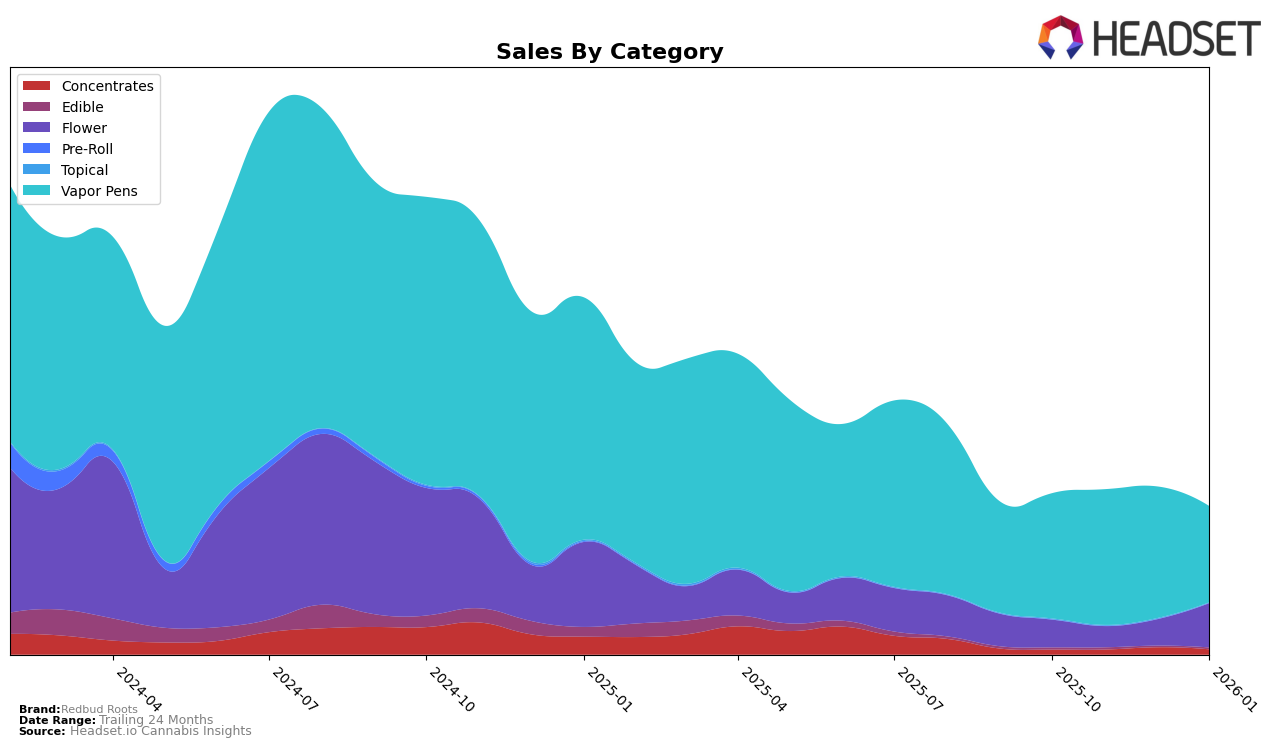

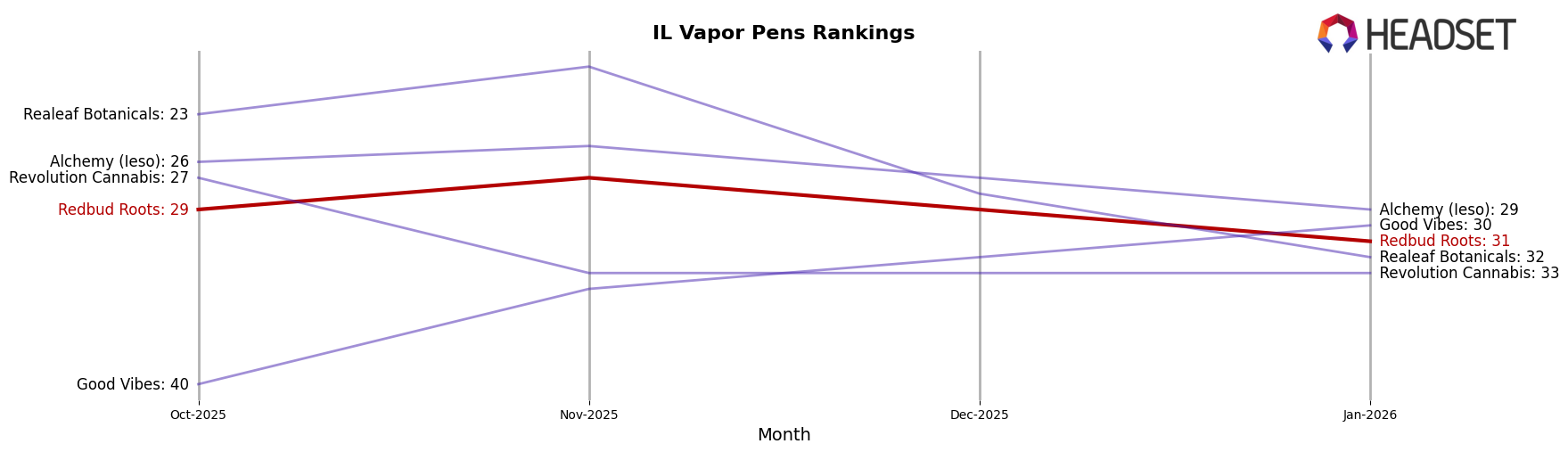

Redbud Roots has shown varied performance across different states and product categories. In Illinois, the brand's presence in the Vapor Pens category has seen a slight decline, slipping from a ranking of 29 in October 2025 to 31 by January 2026. Despite this downward trend, the brand experienced a peak in sales during November 2025, indicating a potential seasonal demand or successful promotional efforts during that period. Meanwhile, in Michigan, Redbud Roots has not ranked in the top 30 for the Flower category, which might suggest a need for strategic adjustments or increased competition in that segment.

In the Concentrates category in Michigan, Redbud Roots has shown an upward trajectory, moving from a rank of 100 in November 2025 to 82 in December 2025, before slightly slipping to 88 in January 2026. This indicates a growing acceptance or preference for their concentrates, albeit with some fluctuations. Additionally, the brand has entered the Vapor Pens market in Ohio with a rank of 73 in January 2026, marking a new presence in that state. This entry could signify potential growth opportunities if they can leverage their brand strength and market strategies effectively. However, the absence of top 30 rankings in other categories and states highlights areas where Redbud Roots may need to bolster their market presence and product offerings.

Competitive Landscape

In the Illinois Vapor Pens category, Redbud Roots experienced a fluctuating performance from October 2025 to January 2026, with its rank oscillating between 27th and 31st place. Despite a slight improvement in November 2025, Redbud Roots' rank dipped again by January 2026, indicating a competitive market environment. Notably, Revolution Cannabis also saw a decline, dropping from 27th to 33rd, which suggests a broader market challenge rather than an isolated issue for Redbud Roots. Meanwhile, Alchemy (Ieso) maintained a relatively stable position, peaking at 25th in November before settling at 29th by January, indicating stronger resilience. Good Vibes showed a positive trend, improving from 40th to 30th, potentially capturing market share from others. Realeaf Botanicals experienced a significant drop from 20th to 32nd, highlighting volatility in the rankings. These dynamics suggest that while Redbud Roots faces challenges, there is potential for gaining ground if market conditions shift or strategic adjustments are made.

Notable Products

In January 2026, Sherbanger Bulk from Redbud Roots led the sales rankings, securing the top position with sales of 5713 units. Following closely was Glitter Bomb Bulk, ranked second, and Whompz Bulk, which took the third spot. Oops All Berries Bulk came in fourth, while Rocket Fuel Full Spectrum Distillate Cartridge 1g rounded out the top five. These products showed a strong performance, especially considering their absence from the top ranks in previous months. The notable leap to the forefront indicates a significant shift in consumer preference towards these flower products and vapor pens in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.