Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

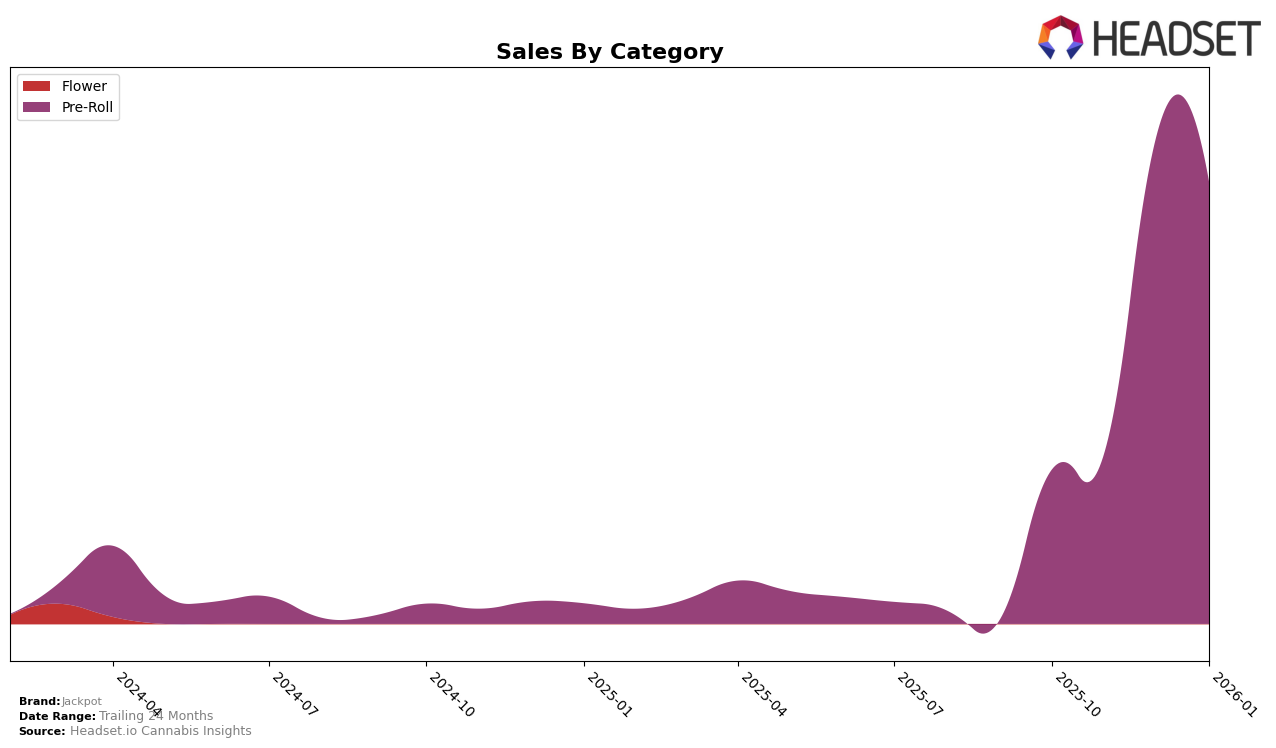

In the province of Saskatchewan, Jackpot has shown a notable upward trend in the Pre-Roll category. Starting from a rank of 32 in October 2025, the brand climbed to rank 11 by January 2026. This significant improvement indicates a growing consumer preference for Jackpot's pre-roll offerings. The leap from rank 28 in November to 13 in December is particularly impressive, suggesting a successful strategy or product launch during this period. The absence of a top 30 ranking in October highlights how quickly Jackpot has gained traction, marking a positive trajectory for the brand in this market.

Jackpot's performance in Saskatchewan is complemented by a steady increase in sales, with a notable spike in December 2025, where sales more than doubled compared to the previous month. This surge could be attributed to seasonal demand or effective marketing campaigns. Despite not being in the top 30 in October, the brand's rapid ascent by January suggests a well-received product lineup or enhanced distribution efforts. Observing these movements can provide insights into Jackpot's strategies and consumer responses, although further details on their approach remain to be explored.

```Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Jackpot has demonstrated a remarkable upward trajectory in brand ranking and sales. Starting from a rank of 32 in October 2025, Jackpot climbed to 11 by January 2026, showcasing a significant improvement in market presence. This rise is particularly notable when compared to competitors like MTL Cannabis, which fluctuated between ranks 11 and 15 during the same period, and Divvy, which only appeared in the top 20 in January 2026 at rank 14. Meanwhile, Rogue Botanicals and Elevator maintained relatively stable positions, with Rogue Botanicals consistently in the top 13 and Elevator experiencing a slight dip in December. Jackpot's sales growth aligns with its rank improvement, indicating a successful strategy in capturing market share from established brands. This trend suggests that Jackpot is becoming a formidable player in the Saskatchewan Pre-Roll market, potentially enticing customers to explore its offerings further.

Notable Products

In January 2026, the top-performing product from Jackpot was the Orange Tangie Pre-Roll 28-Pack (14g), maintaining its first-place rank from previous months with impressive sales of 1614 units. The Purple Drank Pre-Roll 3-Pack (1.5g) rose to second place, showing a notable increase from its third position in December 2025. Meanwhile, the Purple Drank Pre-Roll 28-Pack (14g) slipped to third place after being second in December 2025. The Orange Tangie Pre-Roll 3-Pack (1.5g) held steady at fourth place across the assessed months. Overall, the pre-roll category continues to dominate sales for Jackpot, with minimal fluctuation in product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.