Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

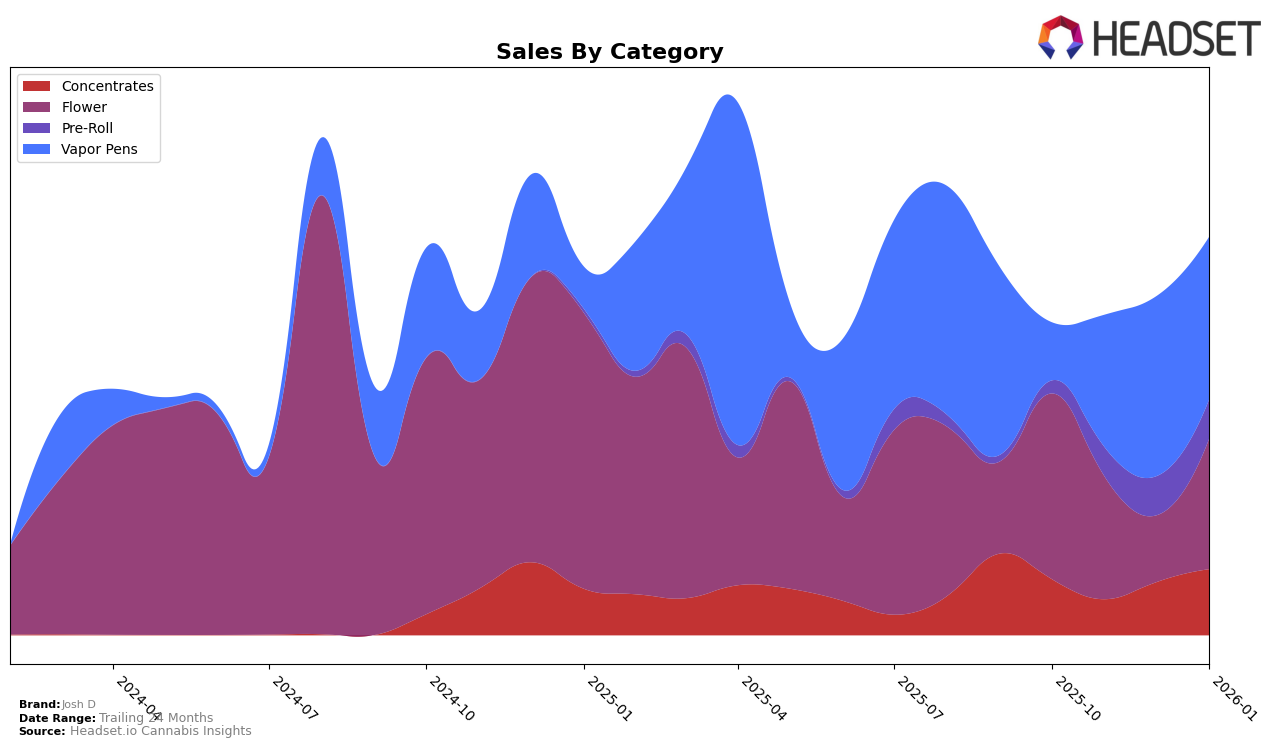

The performance of Josh D in the New Jersey market, particularly in the Flower category, has seen a downward trend from October 2025 to December 2025, with rankings slipping from 82nd to 97th. This decline in rank is reflected in the sales figures, which decreased significantly over the same period. By January 2026, Josh D did not rank in the top 30 brands, indicating a need for strategic adjustments to regain market presence. This absence from the top 30 could be a concern for the brand, as it suggests a loss of competitive edge in a key market category.

In contrast, Josh D's performance in Ohio presents a mixed picture across different categories. The brand showed resilience in the Concentrates category, where it improved from 31st to 23rd place by January 2026, accompanied by a notable increase in sales. However, in the Flower category, while sales rebounded in January 2026 after a dip, the brand remained outside the top 50, highlighting room for improvement. The Pre-Roll category saw an entry into the rankings at 35th in December 2025, which could signal potential for growth. Meanwhile, the Vapor Pens category demonstrated stability, maintaining its position at 47th from December 2025 to January 2026, suggesting a steady consumer base in this product line.

Competitive Landscape

In the Ohio Vapor Pens category, Josh D has demonstrated a notable upward trajectory in brand ranking, moving from 72nd place in October 2025 to 47th by December 2025, where it maintained its position into January 2026. This improvement signifies a robust growth in market presence, contrasting with competitors like Moxie, which saw a decline from 35th to 45th over the same period. Meanwhile, Galenas experienced fluctuations, peaking at 43rd in November before dropping to 51st by January. The Standard held a relatively stable position around the mid-40s, while Bold appeared in the rankings only in January at 44th. Josh D's consistent climb in rank suggests a successful strategy in capturing market share, despite the competitive landscape marked by fluctuating performances of other brands.

Notable Products

In January 2026, the top-performing product from Josh D was the Bobby Shaloha Pre-Roll (1g) in the Pre-Roll category, maintaining its top rank from December with impressive sales of 2437 units. Wyld Lyfe Pre-Roll (1g) secured the second position, showing a significant improvement from its absence in December rankings to a strong comeback with 1089 units sold. The Ojos Rojos Pre-Roll (1g) consistently held the third position across the months, with sales of 976 units in January. A new entry in the rankings, the Ojos Rojos Full Spectrum Cartridge (1g) in the Vapor Pens category, debuted at fourth place. Josh D OG (2.83g) in the Flower category entered the rankings at fifth, indicating a growing interest in this product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.