Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

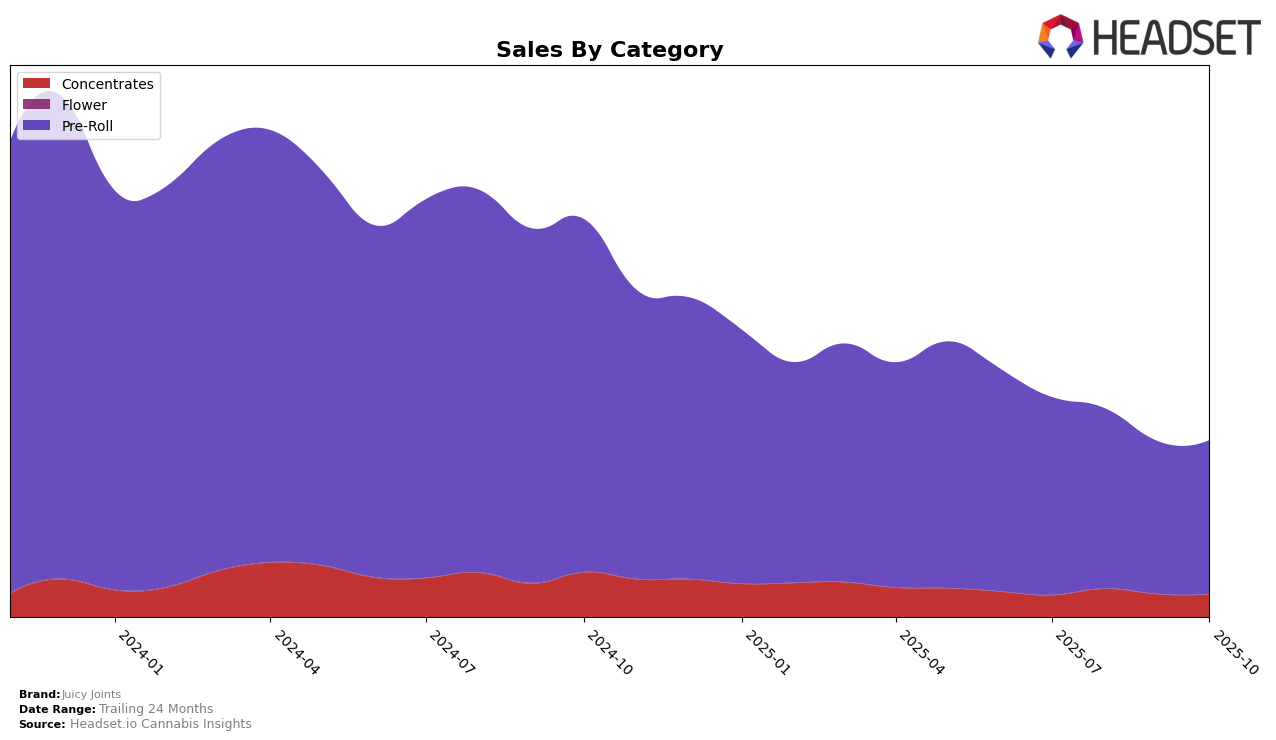

In the state of Washington, Juicy Joints has shown a consistent presence in the Pre-Roll category, maintaining a rank within the top 30 brands from July to October 2025. Despite a slight dip in sales from July to August, the brand stabilized its position at rank 29 through September and October. This consistency suggests a solid customer base and a steady demand for Juicy Joints' Pre-Roll products in Washington. In contrast, their performance in the Concentrates category has seen them outside the top 30, with rankings fluctuating between 81 and 88, indicating a more challenging market position in this category.

While Juicy Joints has managed to maintain a foothold in the Pre-Roll category in Washington, the absence of their ranking in the top 30 for Concentrates highlights potential areas for growth or reevaluation. The Concentrates category saw Juicy Joints' rank hover in the 80s, suggesting that while there is some presence, it is not as robust as their Pre-Roll offerings. This disparity between categories might suggest a need for strategic adjustments to enhance their visibility and competitiveness in the Concentrates market. The brand's ability to sustain its Pre-Roll rankings amidst fluctuating sales figures, however, is a testament to its resilience and brand loyalty among consumers in Washington.

Competitive Landscape

In the competitive landscape of the Washington pre-roll market, Juicy Joints has maintained a consistent rank of 29th from August to October 2025, despite experiencing a decline in sales from July to September, with a slight recovery in October. This stability in rank suggests resilience amidst fluctuating sales figures. Notably, Falcanna has seen a decline in rank from 22nd in July to 27th in October, accompanied by a consistent decrease in sales, which could indicate a potential opportunity for Juicy Joints to capture market share. Meanwhile, Treats has shown an upward trajectory, improving its rank from 37th in July to 28th in October, with increasing sales, posing a competitive challenge. Saints and Momma Chan Farms have not been in the top 20, but their fluctuating ranks and sales highlight a dynamic market environment where Juicy Joints must strategically position itself to maintain and enhance its market presence.

Notable Products

In October 2025, the Seattle Berry Infused Pre-Roll (0.8g) maintained its position as the top-performing product for Juicy Joints, despite a decrease in sales to 2628 units. The Mango Infused Pre-Roll (0.8g) climbed to the second position, improving from third place in September, showcasing its rising popularity. CBD Blueberry Creamsicle Infused Pre-Roll (0.8g) re-entered the rankings at the third spot, indicating a renewed interest among consumers. The Black Cherry Infused Pre-Roll (0.8g) moved up to fourth place from fifth, while the Blue Raspberry Flavored Infused Pre-Roll (0.8g) secured the fifth position, marking its return to the rankings. Overall, the top products showed some reshuffling in their rankings, reflecting changing consumer preferences within the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.