Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

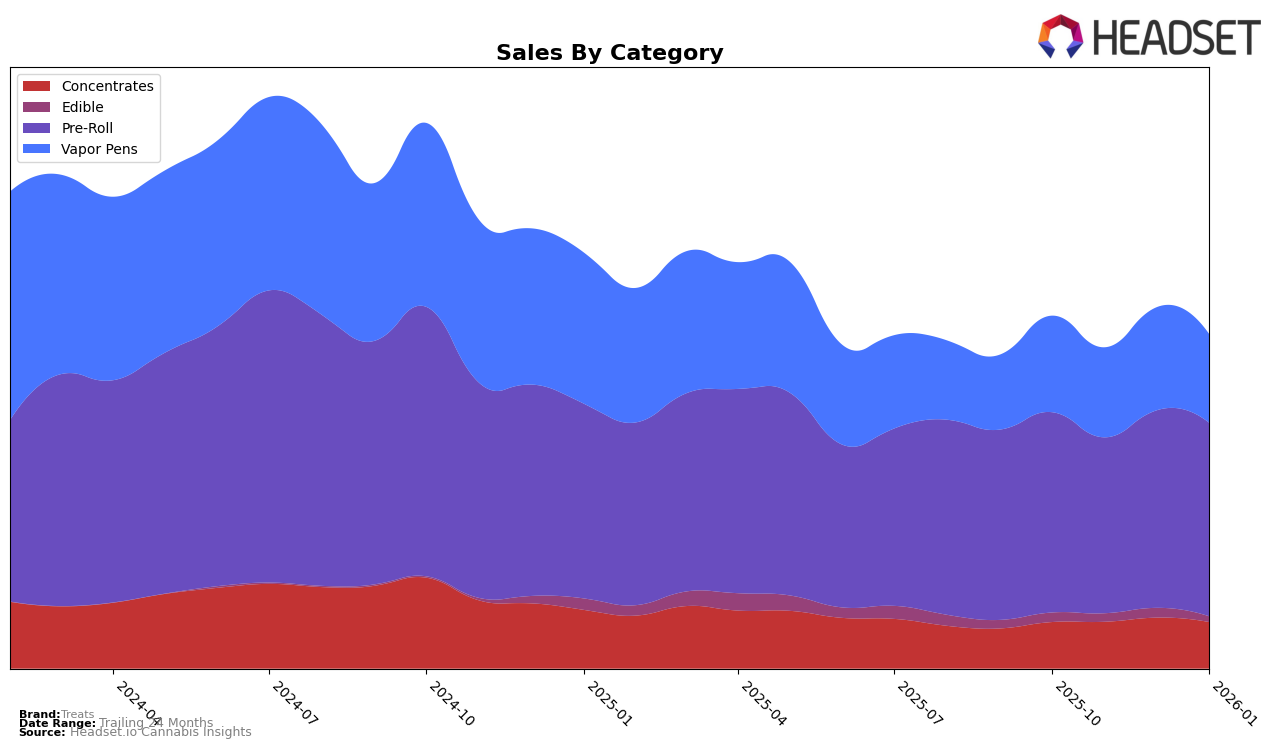

In the state of Washington, Treats has shown varying performance across different product categories. Concentrates have maintained a relatively stable presence, with rankings hovering around the low 60s. Despite not breaking into the top 30, there was a noticeable uptick in sales in December 2025, suggesting a potential for future growth. On the other hand, the Vapor Pens category saw some fluctuations, with a notable improvement in December 2025, moving from 72nd to 65th position, before stabilizing in January 2026. This indicates a positive reception during the holiday season, although it did not translate into a sustained upward trend.

Treats' Pre-Roll category in Washington presents a more promising picture. The brand managed to climb back into the top 30 by January 2026, having previously fallen to 35th in November 2025. This recovery may reflect effective marketing strategies or seasonal demand, as the sales figures remained relatively robust through the end of the year. While the brand's absence from the top 30 in other categories might be concerning, the strong performance in Pre-Rolls could indicate a strategic focus or consumer preference that Treats may capitalize on in the future.

Competitive Landscape

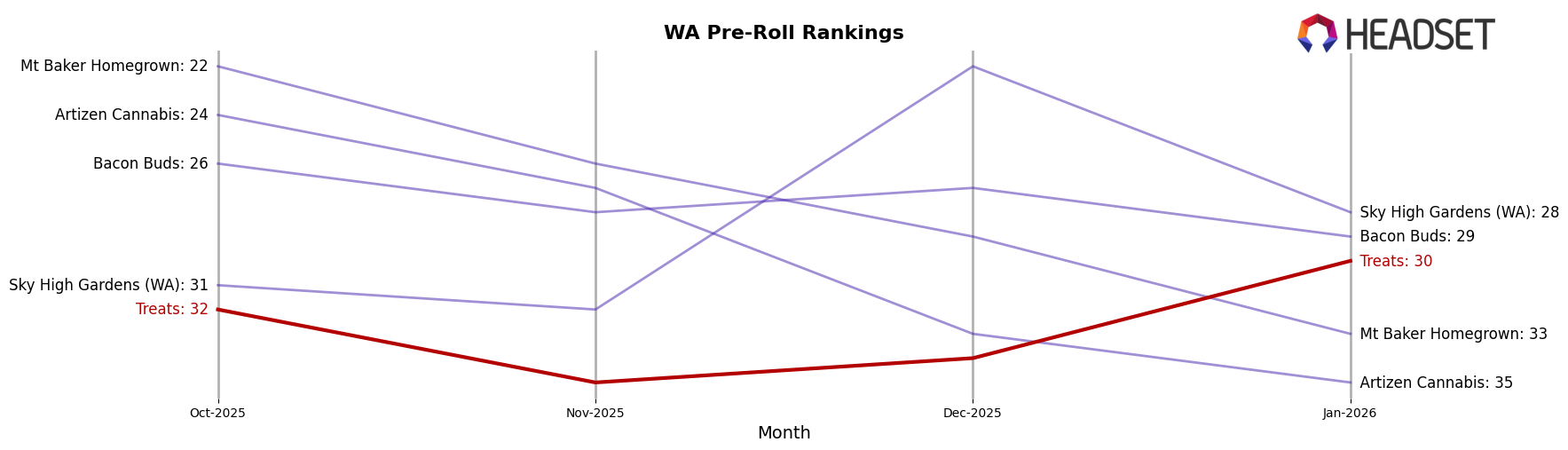

In the competitive landscape of the Washington Pre-Roll category, Treats has shown a fluctuating performance in terms of rank and sales over the past few months. Despite a challenging market, Treats improved its rank from 35th in November 2025 to 30th by January 2026, indicating a positive trend in market positioning. This upward movement is noteworthy, especially when compared to competitors such as Artizen Cannabis, which saw a decline from 24th to 35th, and Mt Baker Homegrown, which dropped from 22nd to 33rd. Meanwhile, Sky High Gardens (WA) experienced a rise and fall, ending at 28th, while Bacon Buds maintained a relatively stable position, ending at 29th. These dynamics suggest that Treats is gaining traction against some of its competitors, potentially due to strategic marketing efforts or product innovations that resonate with consumers. As Treats continues to climb the ranks, it will be crucial to monitor whether this trend persists and how it impacts overall sales growth in the coming months.

Notable Products

In January 2026, Candy Cone Infused Pre-Roll (1g) emerged as the top-performing product for Treats, reclaiming its number one position from October 2025 with a notable sales figure of 5202 units. Birthday Cake Infused Pre-Roll (1g) followed closely in second place, maintaining its steady performance from December 2025. Blueberry Pie Infused Pre-Roll (1g), which led the rankings in December, slipped to third place in January. Iced Watermelon Infused Pre-Roll (1g) made its debut in the rankings at fourth place, indicating strong initial sales. Bubble Gum Infused Pre-Roll (1g) moved up to fifth place from its previous position in November, showing a positive trend in sales growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.