Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

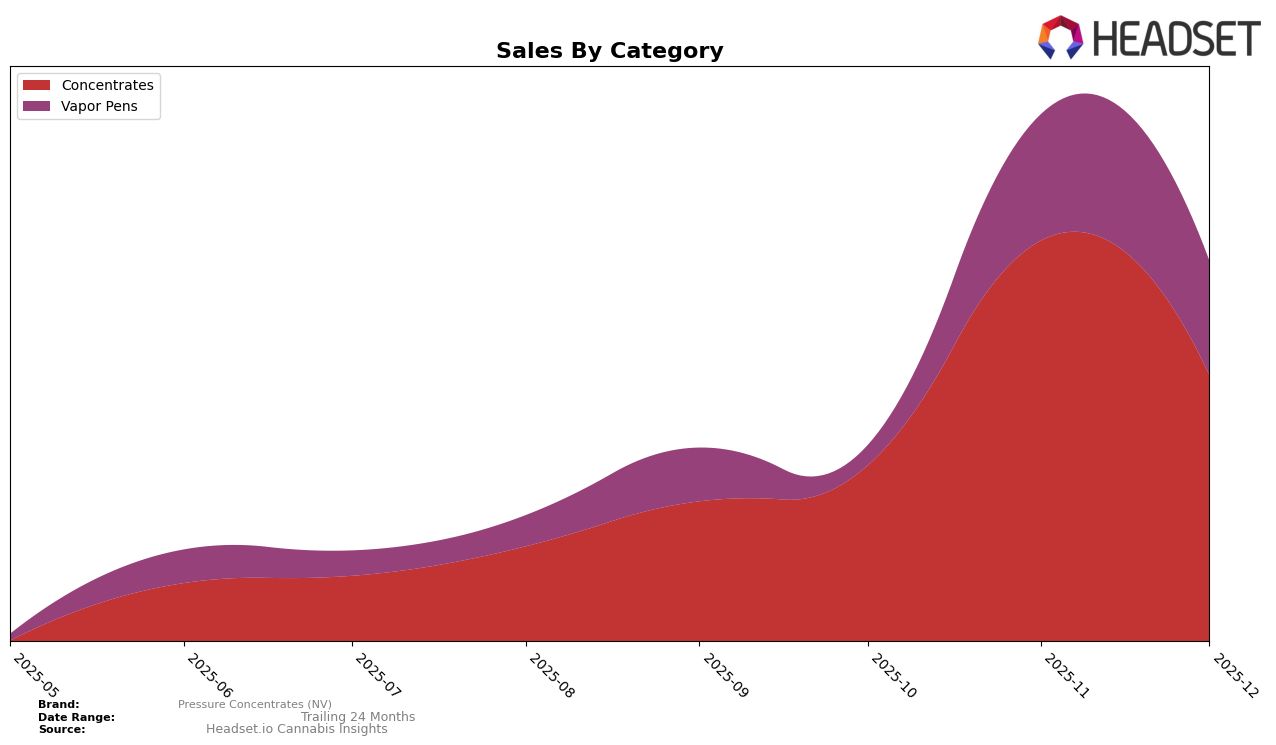

Pressure Concentrates (NV) has shown notable performance in the Concentrates category within Nevada. Over the last four months of 2025, the brand has experienced a positive trajectory, moving from a rank of 23 in September to as high as 13 in November, before settling at 15 in December. This upward movement is indicative of their growing market presence and consumer preference in the state. The brand's sales figures reflect this trend, with a significant increase in sales from September to November, before a slight decrease in December. Such movements suggest a strong competitive edge in the Concentrates category, though maintaining this momentum will be crucial as they continue to navigate the state's market dynamics.

In contrast, Pressure Concentrates (NV) faced challenges in the Vapor Pens category in Nevada. The brand was not ranked in the top 30 in October, which highlights a potential area for improvement. Despite this, they managed to regain a position in the rankings by November, moving up to 49 and then slightly improving to 48 by December. This fluctuation suggests that while there is some consumer interest in their Vapor Pens, the brand may need to strategize better to secure a stable and higher position in this competitive category. The absence from the October rankings could serve as a critical learning point for the brand to enhance its market strategies and product offerings in the Vapor Pens category.

Competitive Landscape

In the Nevada concentrates market, Pressure Concentrates (NV) has demonstrated a notable upward trajectory in its rankings from September to December 2025, moving from 23rd to 15th place. This positive trend suggests a strengthening position in the market, likely driven by strategic initiatives or product innovations. In comparison, Khalifa Kush experienced fluctuations, ending December at 13th, slightly ahead of Pressure Concentrates (NV), but with a downward sales trend. Meanwhile, CAMP (NV) showed a significant leap from 30th in September to 10th in November, although it settled at 16th in December, indicating potential volatility. Fuze Extracts made a notable jump to 14th in December, suggesting increased competitiveness. Spiked Flamingo maintained a relatively stable position around the 18th rank. Overall, Pressure Concentrates (NV) seems to be on a promising path, with its improved rank reflecting potential gains in market share amidst a dynamic competitive landscape.

Notable Products

In December 2025, the top-performing product from Pressure Concentrates (NV) was Michigan Grasshopper Live Resin Badder (0.05g) in the Concentrates category, maintaining its first-place rank from November. Diamond Bar Live Resin Disposable (1g) debuted in second place within the Vapor Pens category. Grape Cadillac Live Rosin Disposable (0.5g) held steady at third place in Vapor Pens, showing consistent performance since November. Cran Zee 89 Live Rosin Disposable (0.5g) entered the rankings at fourth place, while Shady Apples Live Rosin Badder (1g) was fifth in Concentrates. Notably, Michigan Grasshopper Live Resin Badder achieved sales of $127 in December, reflecting a slight decrease from prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.