Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

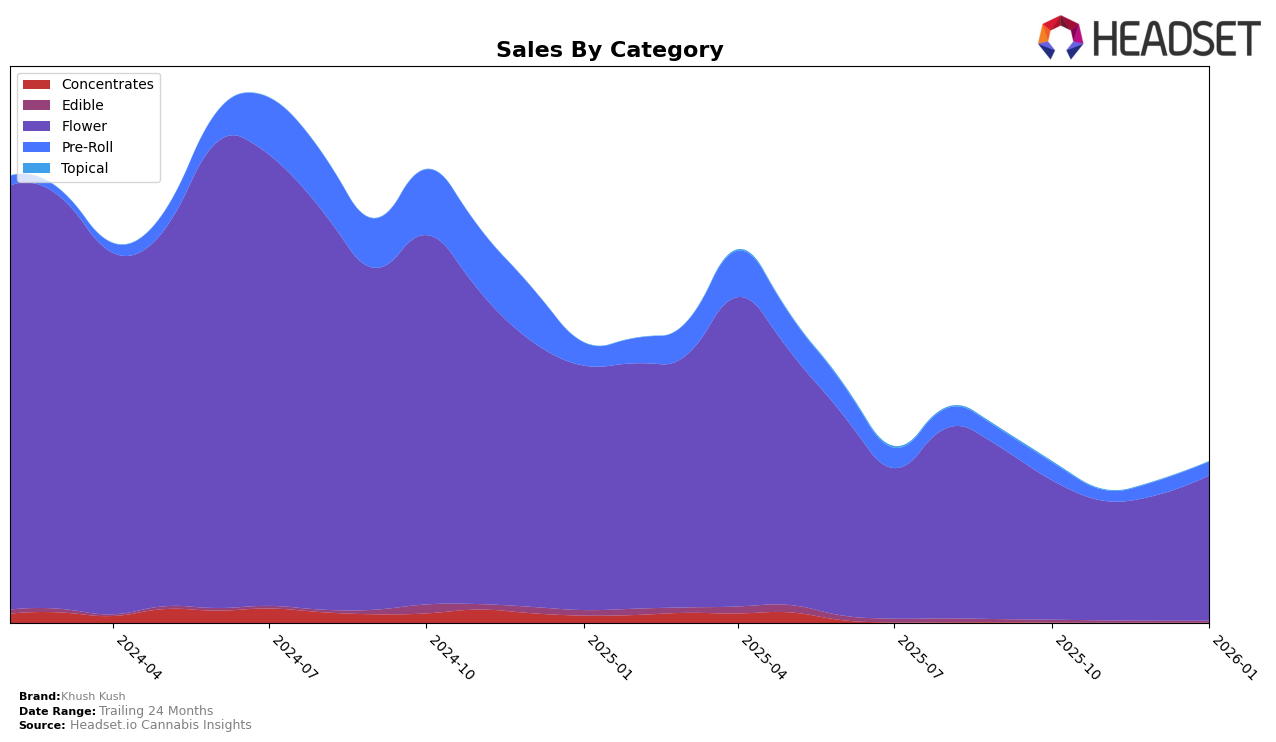

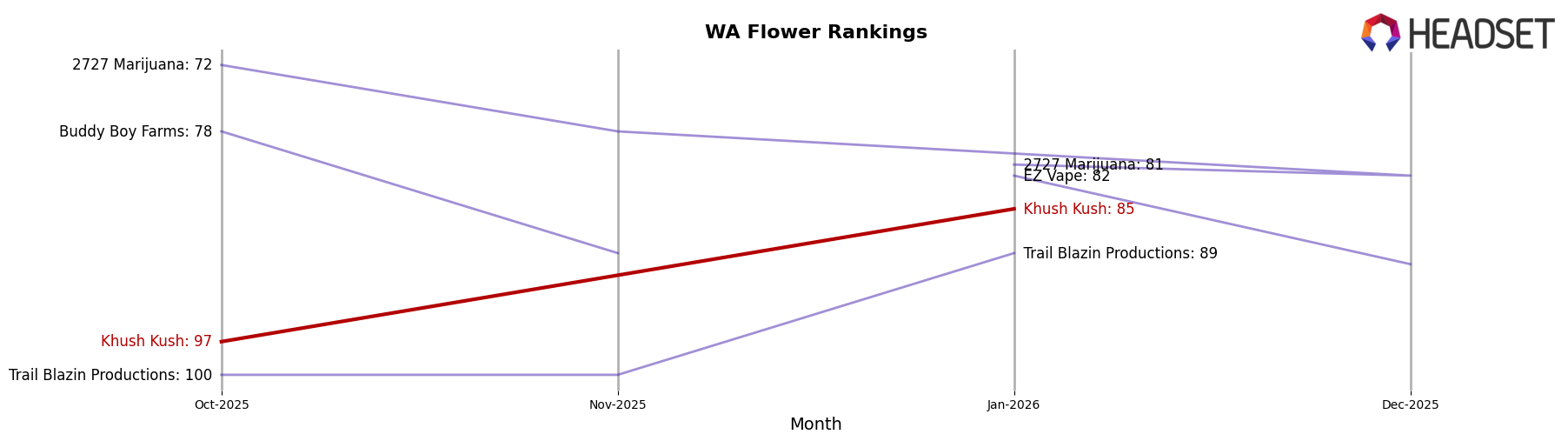

Khush Kush has been active in the Washington market, particularly in the Flower category. In October 2025, the brand ranked 97th, but by January 2026, it had climbed to 85th place. This upward movement indicates a positive trend, suggesting that Khush Kush is gaining traction among consumers in Washington. However, the absence of a ranking in November and December 2025 implies that the brand was not among the top 30 during those months, which could suggest a temporary dip in performance or increased competition during the holiday season.

Despite the fluctuations in monthly rankings, Khush Kush's sales figures show some resilience. The sales in January 2026 were slightly higher than those in October 2025, reflecting a recovery or growth phase. This trend is noteworthy as it highlights the brand's potential to improve its market position over time. However, the lack of ranking data for November and December 2025 also raises questions about the consistency of their performance, which could be a point of interest for further analysis or strategic adjustments by the brand.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Khush Kush has shown a promising upward trend in rankings, moving from being unranked in November 2025 to securing the 85th position by January 2026. This improvement highlights a positive trajectory in sales performance, contrasting with brands like Buddy Boy Farms, which saw a decline in rank from 78th in October 2025 to being unranked by December 2025. Similarly, Trail Blazin Productions maintained a consistent but lower presence, with a slight improvement to 89th in January 2026. Meanwhile, EZ Vape demonstrated a steady rise, reaching 82nd in January 2026, indicating a competitive edge in sales. The performance of 2727 Marijuana, although fluctuating, remained relatively strong, consistently ranking in the top 100. These dynamics suggest that Khush Kush is gaining momentum and market share, positioning itself as a formidable competitor in the Washington flower market.

Notable Products

In January 2026, the top-performing product for Khush Kush was Sticky Gorilla #4 (3.5g) in the Flower category, maintaining its number one rank from November 2025 with sales reaching 575 units. Sticky Gorilla #4 Pre-Roll 2-Pack (1g) experienced a slight drop to second place, despite strong sales of 537 units. Brandywine (3.5g) remained consistent at the third position, showing a slight decrease in sales compared to December 2025. Sticky Gorilla #4 (1g) entered the rankings for the first time, securing the fourth spot. Chocolate Covered Marsh Mellow Squares 3-Pack (30mg) dropped to fifth place, indicating a decline in popularity within the Edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.